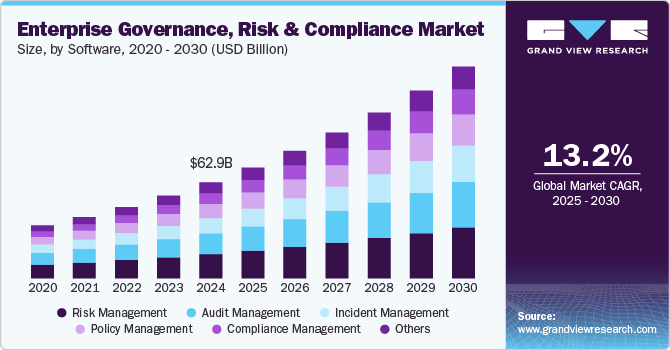

Enterprise Governance, Risk And Compliance Market Size, Share & Trends Analysis growing at a CAGR of 13.2% from 2025 to 2030

The global enterprise governance, risk and compliance market size was estimated at USD 62.92 billion in 2024 and is projected to reach USD 134.96 billion by 2030, growing at a CAGR of 13.2% from 2025 to 2030. The growth of this market can be attributed to the benefits of implementing enterprise governance, risk and compliance (eGRC), which include stability, optimization, transparency, reduced costs, and consistency, among others.

Key Market Trends & Insights

- In 2024, North America dominated the market with a revenue share of 34.0%.

- Europe is expected to witness fastest growth over the forecast period.

- Based on component, the software segment dominated the market and accounted for a revenue share of nearly 65.0% in 2024.

- Based on software, the risk management segment accounted for the largest revenue share of nearly 25.0% in 2024.

- Based on services, the consulting segment accounted for the largest revenue share of over 38.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 62.92 Billion

- 2030 Projected Market Size: USD 134.96 Billion

- CAGR (2025-2030): 13.2%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/enterprise-governance-risk-compliance-egrc-market/request/rs1

Additionally, the presence of companies such as Oracle, Microsoft, SAP SE, and Software AG, which offer unique solutions, has resulted in a wide range of products available in the market, driving its growth.

The integration of AI and ML technologies within eGRC platforms has revolutionized how companies manage risk and compliance. AI-powered tools can detect emerging risks by analyzing large datasets, identifying patterns, and providing predictive insights. For example, AI can be used to automatically assess credit risks, identify fraud, or highlight potential regulatory violations. Machine learning algorithms can also be used to improve compliance monitoring, continuously adapting to new regulations and evolving threats.

These technologies enhance the efficiency and accuracy of eGRC tools, helping businesses stay proactive in managing risks. For instance, in April 2024, LogicGate, a U.D.-based risk management platform, unveiled its AI Governance Solution, designed to help organizations effectively manage and govern AI technology across all levels. This solution enables enterprises to adopt AI while ensuring compliance, agility, and competitive edge swiftly. The offering aims to help businesses maximize AI benefits while maintaining security and governance.

As regulations become more stringent across industries globally, companies are investing heavily in eGRC solutions to ensure they meet the growing compliance demands. Laws such as the GDPR, Sarbanes-Oxley, and others require organizations to track, manage, and report on compliance metrics, prompting the adoption of eGRC tools to streamline processes and minimize the risk of non-compliance.

With the increasing frequency and sophistication of cyberattacks, businesses are prioritizing cybersecurity and data protection. eGRC solutions help organizations manage their security risks more effectively by identifying vulnerabilities, automating risk assessments, and ensuring policies and controls are in place to prevent breaches. This trend is particularly pronounced in industries such as finance, healthcare, and manufacturing, which handle sensitive data.

Component Insights

The software segment dominated the market and accounted for a revenue share of nearly 65.0% in 2024. Cloud adoption is a significant factor accelerating the growth of the eGRC software market. As organizations increasingly move to cloud-based infrastructure, they need scalable and flexible eGRC solutions that can integrate seamlessly with cloud environments. Cloud-based eGRC software offers cost-effective deployment, real-time collaboration, and continuous updates, making it an attractive choice for businesses seeking efficiency and scalability.

The services segment is expected to grow at a significant CAGR of 13.8% over the forecast period. Many businesses are outsourcing eGRC operations to managed service providers (MSPs) to reduce internal resource burdens and ensure that governance and compliance tasks are handled by experts. Managed services offer ongoing risk assessments, real-time compliance monitoring, and response strategies, which help organizations stay agile and compliant in a fast-changing regulatory landscape.