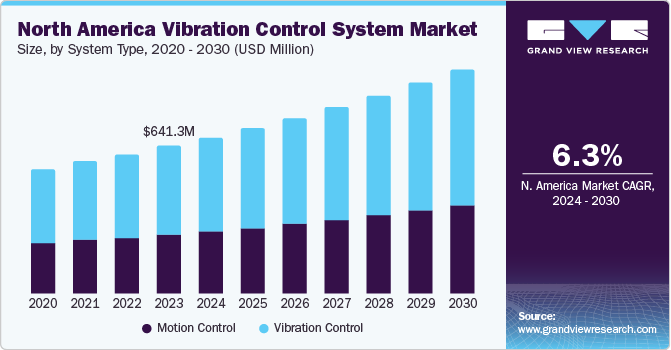

Vibration Control System Market Size, Share & Trends Analysis growing at a CAGR of 6.3% from 2024 to 2030

The global vibration control system market size was estimated at USD 5,182.0 million in 2023 and is projected to reach USD 7,933.9 million by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The market is witnessing increased global demand due to the rising focus on mechanical balancing and stability in automobiles and industrial machinery.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, Mexico is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, vibration control accounted for a revenue of USD 3,074.6 million in 2023.

- Vibration Control is the most lucrative system type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 5,182.0 Million

- 2030 Projected Market Size: USD 7,933.9 Million

- CAGR (2024-2030): 6.3%

- Europe: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/vibration-control-systems-market/request/rs1

Vibration control systems (VCS) are isolation systems that effectively address incoming vibrations. These systems control vibrations in stationary and moving machines, reducing friction and other disruptive factors. Also, these systems safeguard machine parts’ operation, heat generation, wear & tear, loss of energy, and cracks & breakage, among others. They are used in various industries such as automotive, aero & defense, electrical & electronics, oil & gas, and healthcare.

The rapidly growing automotive and aviation industries are expected to drive market growth over the forecast period. The rapid development of next-generation vibration control systems for aircraft to reduce vibration is a primary factor driving the market growth. Also, anti-vibration systems, such as mounting & bushing, reduce quivers in the automotive industry. These systems help in increasing vehicle efficiency as well as the life span of the components. VCSs were initially designed for use in automotive and electrical equipment. These systems are now used in aerospace & defense, oil & gas, and mining & quarrying, among others.

Furthermore, vibration monitoring systems are gaining ground in the healthcare sector as well pharmaceutical companies are using them to mitigate the impacts of trembles and quivers on sensitive equipment, such as DNA sequencing microarrays and Magnetic Resonance Imaging (MRIs), in healthcare and scientific institutions. On the other hand, factors, such as strict industry regulations, high costs of systems, and component reliability issues, are anticipated to hinder market growth over the coming years.