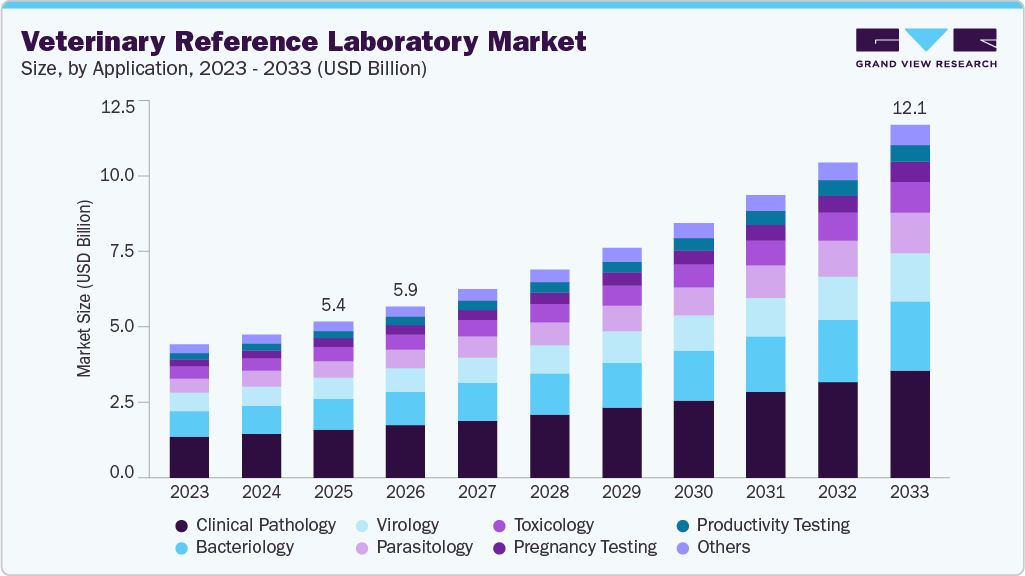

Veterinary Reference Laboratory Market growing at a CAGR of 10.87% from 2026 to 2033

The global veterinary reference laboratory market size was estimated at USD 5.35 billion in 2025 and is projected to reach USD 12.08 billion by 2033, growing at a CAGR of 10.87% from 2026 to 2033. The market is experiencing growth driven by factors such as growing awareness of early disease detection in companion animals, expansion of diagnostic capacity through laboratory acquisitions and network build-outs, increasing public investment in zoonotic disease surveillance and food safety, and rising demand for specialized and high-complexity testing.

Key Market Trends & Insights

- North America veterinary reference laboratory market held the largest revenue share of 42.57% in 2025.

- U.S. veterinary reference laboratory market dominated with the largest revenue share in 2025.

- By animal, the companion animal segment held the largest share of 64.19% in the market in 2025.

- By technology, clinical chemistry segment is the largest in the market in 2025.

- Based on the application, the clinical pathology segment held the largest market share in 2025.

- By end use, the veterinary hospitals and clinics segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.35 Billion

- 2033 Projected Market Size: USD 12.08 Billion

- CAGR (2026-2033): 10.87%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/veterinary-reference-laboratory-vrl-market/request/rs1

A major factor driving the market is that more people now understand the importance of early disease detection and monitoring in animals. Pet owners, livestock producers, and veterinarians are focusing more on catching health problems before they get worse. Because of this, there is greater demand for veterinary reference laboratories. These labs offer specialized tests that smaller clinics often cannot perform, including complex molecular tests, histopathology, and wide-ranging infectious disease panels. As a result, more samples are being sent to reference labs for accurate and timely diagnoses.

Demand is growing in the companion animal segment because owners want thorough health checks for older pets and those showing mild symptoms. Finding conditions like cancer, endocrine problems, and infections early helps improve treatment results. Reference labs meet this need by offering advanced tests and expert analysis, which leads to more referrals and greater use of centralized diagnostic services. In the livestock sector, producers are also sending more samples as they work to control outbreaks that threaten herd health and productivity. Reference labs help by providing confirmatory tests and surveillance tools to guide herd management.

Public health agencies are also supporting this trend by expanding programs to monitor zoonotic threats and food safety risks. These programs depend on standardized methods and reports from accredited reference labs. Private investment is helping labs grow, as diagnostic companies build new facilities and form partnerships. These steps help reduce turnaround times and expand service areas. As more clinicians and animal health managers see the value of early diagnosis, demand for reference lab services keeps rising. This ongoing trend is driving steady market growth and encouraging more investment in advanced diagnostic infrastructure.

Market Concentration & Characteristics

The veterinary reference laboratory market shows moderate to high industry concentration, with a small group of global players accounting for a large share of testing volumes. These companies benefit from broad test portfolios, integrated digital reporting systems, and established clinician networks. Ongoing acquisitions and laboratory expansions are reinforcing scale advantages, which raises entry barriers for smaller, independent laboratories.

The veterinary reference laboratory market shows a high level of innovation centered on advanced diagnostic depth and throughput. Reference labs are expanding use of real-time PCR, digital pathology, and next-generation sequencing to support early disease detection and confirmatory testing. Automation in sample processing and cloud-based reporting systems is improving turnaround times and result consistency across large test volumes. AI-supported image analysis is increasingly used in histopathology and cytology to support veterinary pathologists and reduce interpretation variability.

The market is experiencing a moderate level of M&A activities as large animal health and diagnostics groups strengthen reference laboratory networks. Acquisitions focus on expanding geographic coverage, adding specialty pathology capabilities, and increasing testing capacity. Recent deals by global players highlight a clear shift toward scale-driven models where centralized laboratories support regional clinics and hospitals. This trend is increasing market concentration and reinforcing barriers for smaller standalone laboratories.

Regulation plays a critical role in shaping laboratory operations, test validation, and accreditation standards. Reference laboratories must comply with strict quality systems, method validation protocols, and disease reporting requirements. Regulatory oversight increases operational costs but supports test reliability and clinician confidence. Compliance demands are particularly high for molecular and infectious disease testing used in surveillance and outbreak response.

Product substitutes include in-clinic diagnostic testing and empirical treatment without laboratory confirmation. In-house analyzers offer faster results for routine parameters but lack the depth and accuracy required for complex cases. Reference laboratories remain essential for confirmatory diagnostics, advanced pathology, and specialized assays that exceed clinic-level capabilities.

Regional expansion is accelerating as reference laboratory providers establish facilities in emerging markets with rising veterinary expenditure. Growth in pet ownership, livestock health programs, and zoonotic disease surveillance is increasing demand for centralized diagnostic services outside mature regions. This expansion supports long-term volume growth and network resilience.

Animal Insights

On the basis of animals, companion animals segment accounted for the highest market share in 2025, due to rising pet ownership and higher spending on veterinary diagnostics. Companion animals undergo frequent testing for chronic disease, oncology, and age-related conditions. Reference laboratories support this demand through advanced pathology and molecular panels. Strong referral dependence from clinics sustains high sample volumes. Preventive screening programs are gaining acceptance among pet owners. Growing insurance coverage for pets is further supporting diagnostic uptake.

Production animals segment is expected to register the fastest growth rate from 2026 to 2033 supported by expansion of commercial livestock farming. Producers are increasing testing frequency to improve herd productivity and reduce mortality risks. Reference laboratories support large-scale surveillance and confirmatory testing. Export-oriented livestock markets rely on certified diagnostic results. National disease control programs are increasing sample inflow. This trend is strengthening demand across poultry, swine, and cattle segments.

Veterinary Reference Laboratory Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 5.87 billion |

|

Revenue forecast in 2033 |

USD 12.08 billion |

|

Growth rate |

CAGR of 10.87% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal, application, technology, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia, Kuwait, Qatar, Oman |

|

Key companies profiled |

IDEXX, Mars, Incorporated, GD, Greencross Vets, Gribbles Veterinary Pathology. Zoetis, Neogen Corporation, ProtaTek International, Inc., Wisconsin Veterinary Diagnostic Laboratory, Ellie Diagnostics, & Merck & Co., Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |