Very Small Aperture Terminal (VSAT) Market Size, Share & Trends Analysis growing at a CAGR of 10.1% from 2024 to 2030

The global very small aperture terminal (VSAT) market size was estimated at USD 2,881.7 million in 2023 and is projected to reach USD 5,516.7 million by 2030, growing at a CAGR of 10.1% from 2024 to 2030. VSAT is a satellite communication (SATCOM) technology using small dish antennas to transmit and receive data through satellite networks.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, equipment accounted for a revenue of USD 1,627.3 million in 2023.

- Connectivity Services is the most lucrative solution segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,881.7 Million

- 2030 Projected Market Size: USD 5,516.7 Million

- CAGR (2024-2030): 10.1%

- North America: Largest market in 2023

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/very-small-aperture-terminal-vsat-market-report/request/rs1

The demand for very small aperture terminal is surging across various industries due to its ability to offer reliable, high-speed communication services to connect remote locations. Moreover, the growing demand for high-throughput satellite services and mobile VSAT solutions is expected to fuel market growth.

The convergence of IoT and M2M communication is anticipated to be a key driver propelling the growth of the very small aperture terminal market. The VSAT system is renowned for its robustness in satellite communication systems. It is crucial as organizations increasingly rely on IoT for automation and real-time data processing, thus stimulating market growth.

The growing demand for stable satellite communication solutions supports the market expansion. Companies heavily depend on VSAT to ensure dependable connectivity, particularly in underserved and rural areas. This ensures productivity and facilitates informed decision-making processes. Such widespread necessity is anticipated to fuel a gradual rise in the VSAT market.

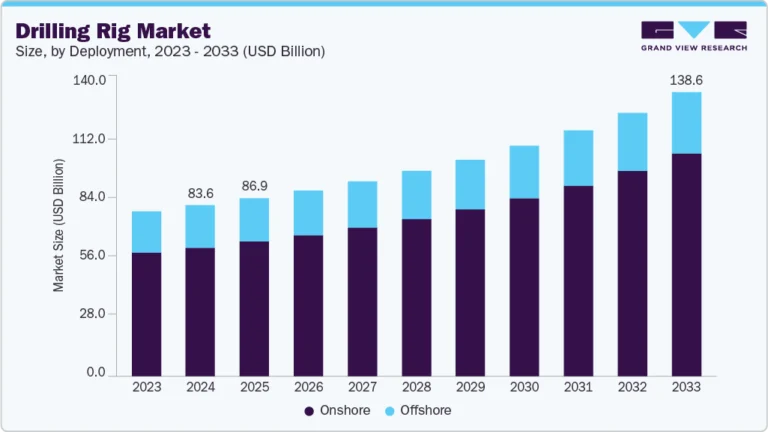

In addition, the growing demand for VSAT systems at remote locations, such as oil and gas rigs, to transfer data and communicate from offshore locations is expected to support the market’s growth. For instance, in January 2022, Nelco Ltd. secured a contract worth USD 400 million from Oil and Natural Gas Corporation (ONGC) to provide satellite communication services at offshore locations. The project involves supplying, commissioning, and maintaining ONGC’s dedicated VSAT-based network.

However, one of the primary barriers to entry into the very small aperture terminal market is the high initial investment. Deploying VSAT infrastructure may financially burden numerous firms, particularly smaller entities. This financial constraint hampers potential expansion efforts and dampens market adoption rates. Furthermore, regulatory issues represent another significant obstacle in the market landscape. Diverse locations may enforce distinct regulations, thereby complicating the deployment and operation of VSAT systems. The intricate nature of navigating these legal frameworks often entails substantial costs and time investments, leading several organizations to opt against investing in VSAT technology.

Solution Insights

The equipment segment dominated the market in 2023 and accounted for a global revenue share of 56.47%. The segment’s dominance can be attributed to the growing focus on digital transformation and the increasing adoption of cloud-based services that create opportunities for VSAT equipment vendors. VSAT systems enable organizations to access cloud resources, deploy software-defined networking (SDN) solutions, and support emerging technologies such as edge computing and 5G networks. The demand for advanced VSAT equipment is anticipated to grow as businesses focus on digitalization to enhance efficiency, flexibility, and competitiveness.

The connectivity services segment is anticipated to register the highest growth over the forecast period. The growth in this market segment can be attributed to the rising demand for VSAT technology that offers faster data transfer speeds for applications requiring real-time communication and large data transmission. Moreover, the expansion of VSAT connectivity services is driven by the globalization of businesses and the need for seamless communication across dispersed locations. VSAT networks provide reliable and secure communication links for multinational corporations, enabling them to connect remote offices, offshore sites, and mobile assets with headquarters and data centers.