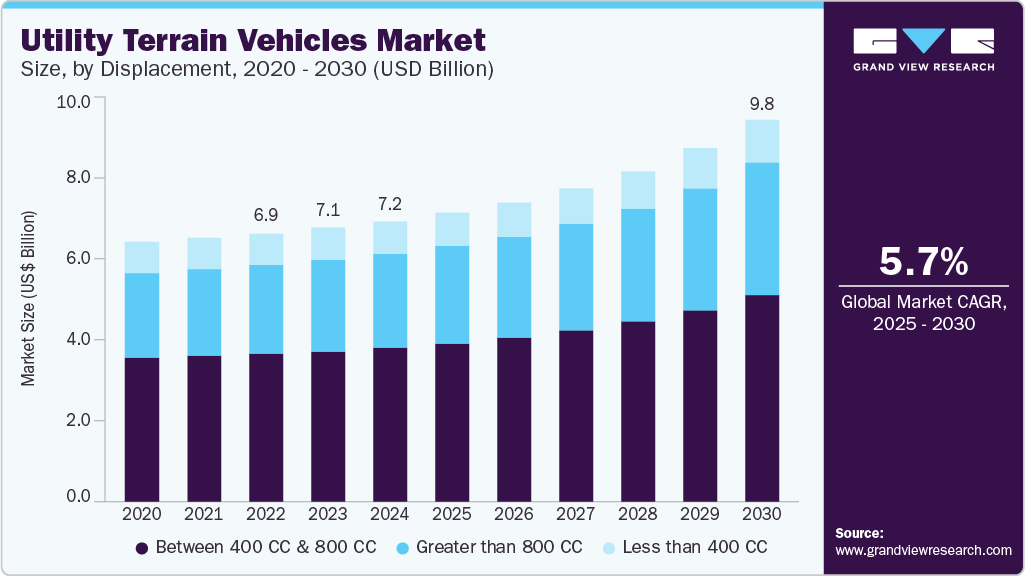

Utility Terrain Vehicles Market Size, Share & Trends Analysis growing at a CAGR of 5.7% from 2025 to 2030

The global utility terrain vehicles market size was estimated at USD 7.23 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. The increasing demand for versatile, off-road-capable vehicles across agriculture, construction, outdoor recreation, and defense sectors drives market growth.

Key Highlights:

- The North America utility terrain vehicles market held the largest share of 47.6% in 2024.

- The utility terrain vehicles market in the U.S. is expected grow at a significant CAGR over the forecast period.

- By displacement, between 400 CC & 800 CC segment accounted for the largest share of 54.8% in 2024.

- Based on propulsion, the gasoline segment held the largest market share of 68.9% in 2024.

- By application, the military segment is projected to grow at a significant CAGR of 7.3% over the forecast period.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/utility-terrain-vehicles-market-report/request/rs1

Greater utility in rugged terrain and improved load-carrying capacity and maneuverability have led to widespread adoption. Expanding recreational and sports activities in North America, Europe, and parts of Asia have also supported the market, where off-road tourism and outdoor motorsports have gained tractionRising demand from military applications for lightweight and high-mobility platforms has contributed to market momentum. Significant technological advancements have been observed across the UTV industry, particularly in areas such as electric propulsion, advanced suspension systems, GPS-based navigation, and autonomous driving capabilities. Battery-powered UTVs are being increasingly developed to meet environmental and regulatory standards, offering reduced emissions and lower operational costs. Integration of IoT features, telematics, and safety technologies such as rollover protection and terrain response systems has also been prioritized to improve vehicle performance and user experience. These innovations have been instrumental in enhancing both the functionality and appeal of UTVs across commercial and recreational use cases.

Robust investment activity has been witnessed in the sector, driven by growing demand and competitive pressures. Major manufacturers have supported expansion strategies through partnerships, acquisitions, and R&D investments. Electric UTV startups have attracted venture funding, while established OEMs have allocated capital towards developing hybrid and autonomous models. New production facilities are being established, especially in North America and Asia, to meet rising consumer demand and optimize distribution networks. These capital inflows have enabled product diversification and capacity scaling, allowing brands to tap into high-growth regions.

The regulatory landscape has been evolving to address safety, environmental, and usage standards associated with UTV operations. Emission regulations have been enforced in North America and Europe, pushing manufacturers toward electrification and cleaner combustion technologies. Safety regulations, including those related to occupant protection, speed limits, and usage zones (e.g., public roads vs. off-road trails), have also been tightened. In several regions, classification and licensing requirements are being clarified to distinguish UTVs from similar vehicle categories such as ATVs, influencing design and compliance strategies across manufacturers.