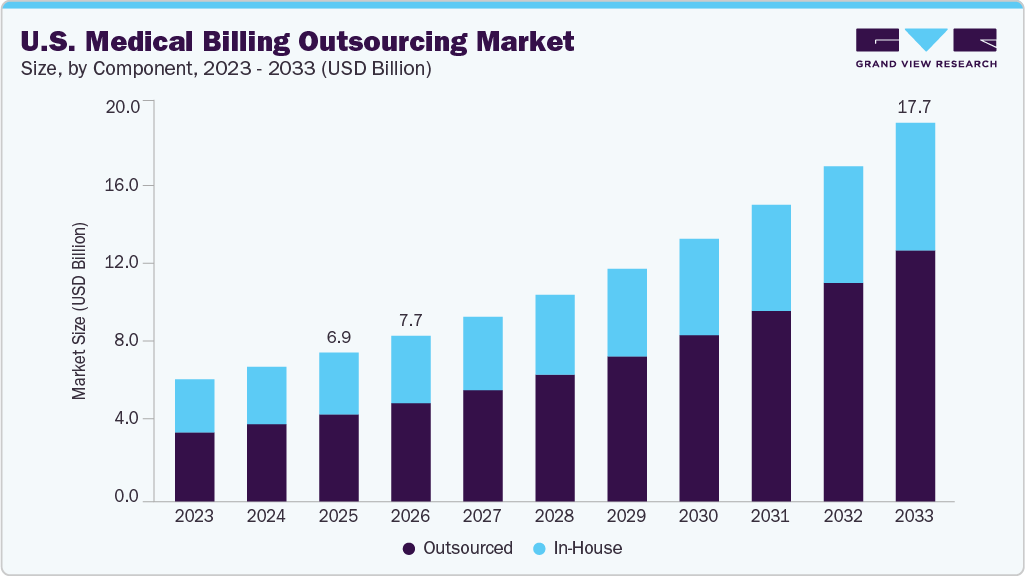

U.S. Medical Billing Outsourcing Market growing at a CAGR of 12.56% from 2026 to 2033

The U.S. medical billing outsourcing market size was estimated at USD 6.95 billion in 2025 and is projected to reach USD 17.69 billion by 2033, growing at a CAGR of 12.56% from 2026 to 2033. Increasing challenges faced by healthcare providers in managing a large volume of claims and reimbursements, resulting in significant revenue losses, are attributed to the rising demand for medical billing outsourcing services in the U.S.

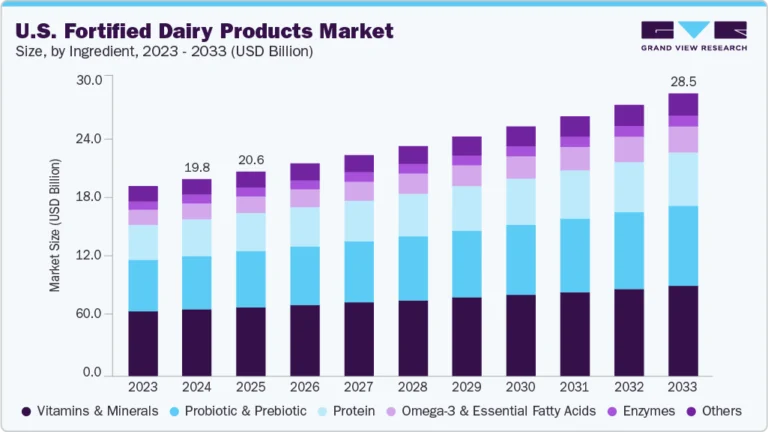

Key Market Trends & Insights

- By component, the outsourced segment accounted for the largest revenue share of 58.41% in 2025.

- By end use, hospitals held the largest revenue share of 46.97% in 2025.

- By service, the front-end segment held the largest revenue share of 38.69% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.95 Billion

- 2033 Projected Market Size: USD 17.69 Billion

- CAGR (2026-2033): 12.56%

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/us-medical-billing-outsourcing-market/request/rs1

Moreover, amplifying patient load and the need to address the growing records and bills burden medical practitioners. Hospitals are outsourcing the medical billing process to counter such a situation, thus anticipating market growth. Moreover, hospitals outsource medical billing to companies that have end-to-end knowledge of the Affordable Medical Care Act, Medicaid, and other healthcare and insurance programs. In addition, the healthcare industry is observing an increase in the outsourcing of billing activities by physicians and hospitals due to mandatory implementation of the intricate ICD-10 coding structure, growing care costs, and regulatory pressure to implement electronic medical records to sustain compensation levels. Medical services are facing complex challenges in billing and precise payment, which is anticipated to drive the demand for innovative RCM solutions. The availability of advanced innovative RCM solutions offered by renowned third-party service providers can help healthcare organizations leverage the economic value and efficacy of these RCM solutions while simultaneously focusing on improving patient care.

Furthermore, hassle-free claims settlement processes featuring accounts receivable management and claims management and the availability of professional coders acquainted with the latest medical codes are the primary reasons practices outsource their billing services. However, high threats of data breaches associated with medical billing are expected to hinder market growth during the forecast period. For instance, according to the 2024 Healthcare Data Breach Report published in January 2025 by the Department of Health and Human Services (HHS) Office for Civil Rights (OCR), more than 500 data breach records were reported in 2024.

Furthermore, billing service providers are increasingly deploying advanced technologies such as artificial intelligence (AI), robotic process automation, and predictive analytics to transform medical billing operations. AI-driven coding engines automatically extract and assign codes from clinical documentation, reducing human error and improving first-pass claim acceptance rates.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The X-axis represents the level of market concentration, ranging from low to high. The Y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, regulatory impact, and regional expansion. For instance, the U.S. medical billing outsourcing market is fragmented, with many small players entering the market and launching new innovative products.

Several industry players launch new products to enhance their product portfolio. For instance, in February 2023, Experian Health launched AI Advantage, a product specially designed to tackle the growing issue of healthcare insurance claims denials. This new system leverages artificial intelligence and Experian’s expertise in big data solutions to provide a seamless and comprehensive solution for claims management in the healthcare industry.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in September 2024, The Rawlings Group, Apixio Payment Integrity, and VARIS merged to create a leading platform focused on payment accuracy and integrity in healthcare. The impact of regulations on the U.S. revenue cycle management is high. The continuous policy changes and upgradation of regulations are expected to hinder market growth. RCM is relatively low due to changes in regulatory frameworks, specific demands of healthcare organizations, and varying reimbursement policies across the U.S. However, with the growing adoption of digital healthcare solutions and the increasing need for efficient RCM, the market is expected to witness significant growth in the coming years.

Component Insights

Based on components, the outsourced segment held the largest revenue share of 58.41% in 2025 and is expected to grow fastest over the forecast period. Outsourcing medical billing services is expected to significantly reduce costs, making it easier for small and medium-sized practices to manage their finances. Many hospitals and independent physicians prefer outsourcing these services to reduce healthcare costs, increase profit margins, and improve patient-physician relationships. Furthermore, doctors cannot provide the best possible care to patients if they are engaged in managing administrative processes, such as recovering claims and bills. Hence, to enhance their focus on medical care, large hospitals started outsourcing these services.

End-use Insights

Based on end-use, the hospital segment accounted for the largest revenue share of 46.97% in 2025. Hospitals are the key users of outsourcing services due to the high claim volume. Consolidations of hospitals further increase the complexity of billing and reimbursement procedures, thereby fueling segment growth. Most hospitals and healthcare facilities are shifting towards RCM services to minimize errors and find a cost-effective solution.They are focusing on implementing innovative RCM solutions by collaborating with vendors to transform the reimbursement scenario, which is anticipated to boost segment growth.

Furthermore, the industry is experiencing partnership and collaboration activities to enhance revenue cycle automation for hospitals and urgent care providers. For instance, in June 2025, Exdion Health and Inbox Health partnered to provide comprehensive revenue cycle management (RCM) and patient billing automation for hospitals, urgent care centers, and occupational health centers. This collaboration aims to enhance cash flow, reduce paper-based billing, and improve documentation quality, ultimately streamlining the billing process.

U.S. Medical Billing Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 7.73 billion |

|

Revenue forecast in 2033 |

USD 17.69 billion |

|

Growth rate |

CAGR of 12.56% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, service, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

R1RCM Inc.; Veradigm LLC (Allscripts Healthcare, LLC); Oracle (Cerner Corporation); eClinicalWorks; Kareo, Inc.; McKesson Corporation; Quest Diagnostics; Promantra Inc.; AdvancedMD, Inc.; eBilling Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |