U.S. Gut Health Supplements Market growing at a CAGR of 6.7% from 2025 to 2033

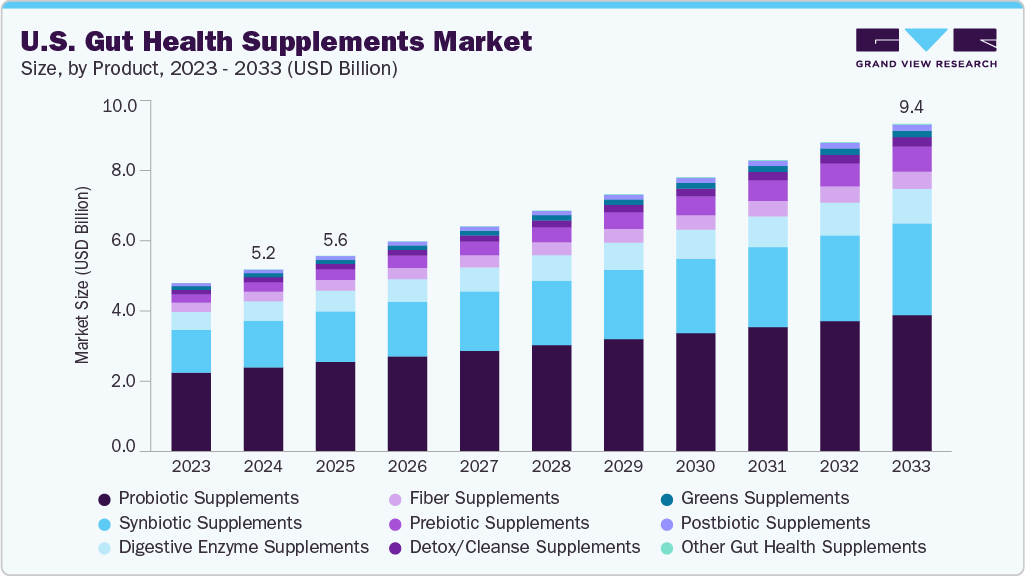

The U.S. gut health supplements market size was estimated at USD 5.19 billion in 2024 and is projected to reach USD 9.36 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033, as more people face chronic or recurring gut-related discomfort, demand for preventive and supportive solutions such as probiotics, prebiotics, and synbiotics, has surged. This trend is further reinforced by increasing clinical research linking gut health to overall wellness, including immunity, metabolism, and even mental health, which has boosted consumer trust in these supplements.

Key Market Trends & Insights

- By product, the probiotic supplements segment led the market with a share of 46.3% in 2024.

- By form, the capsuled gut health supplements segment led the market with a share of 42.6% in 2024.

- By distribution channel, the on-trade sales segment held the highest market share of 83.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.19 Billion

- 2033 Projected Market Size: USD 9.36 Billion

- CAGR (2025-2033): 6.7%

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/us-gut-health-supplements-market-report/request/rs1

Consumer awareness and lifestyle shifts are also fueling demand. Americans are becoming more conscious of the role the gut microbiome plays in maintaining long-term health, which has elevated gut health supplements from a niche product to a mainstream wellness choice. The aging U.S. population adds another layer of demand, as older adults often face digestive challenges and seek products that improve nutrient absorption and support immune function. Moreover, healthcare professionals are increasingly prescribing or recommending gut health supplements, particularly for high-risk groups, making the prescribed channel a key growth driver.

In addition, consumers are placing a strong emphasis on product efficacy and scientific validation. They are more likely to choose supplements backed by clinical research and endorsed by healthcare professionals. This shift reflects a desire for evidence-based solutions and a move away from marketing-driven claims. As a result, brands that invest in research and development and provide clear information on the science behind their products are gaining a competitive edge.

The convenience and versatility of available products also support the demand for gut health supplements. Consumers now have access to a wide variety of delivery formats, including capsules, powders, gummies, beverages, and functional foods like yogurts and snack bars infused with probiotics or prebiotics. This variety makes it easier for individuals to incorporate gut-friendly supplements into their daily diets without disrupting their routines.

Product Insights

Probiotic supplements held the largest share of the U.S. gut health supplements market, accounting for a share of 46.3% in 2024.The U.S. probiotic supplements market is rising because digestive issues, antibiotic use, and lifestyle-related gut imbalances are becoming more common, driving consumers to seek easy, preventive solutions. Growing awareness of the gut-immune-brain connection, along with endorsements from doctors and influencers, as well as the shift toward self-care and preventive health, are further boosting demand. Additionally, brands are launching more appealing, convenient formats (gummies, stick packs, women’s/probiotic blends), making probiotics more mainstream and driving higher adoption across various age groups.

For instance, in July 2024, Bayer’s One A Day brand introduced a new kids’ multivitamin gummy with iron, the first among leading brands to offer 12 mg of iron in gummy form, to help fill nutrient gaps in picky eaters. The launch is part of a new One A Day Kids line (with iron, probiotics, and a core multi) focused on supporting growth, immunity, and overall development, with clean-label, great-tasting gummies that parents find easier to give to kids.

Form Insights

The capsuled gut health supplements segment led the U.S. gut health supplements market, accounting for a revenue share of 42.6% in 2024, as capsules offer a convenient, precise, and clean way to consume probiotics, prebiotics, and fiber without added sugars or flavors often found in gummies. Rising digestive issues, increased awareness of the gut-immune-brain link, and growing recommendations from healthcare professionals are prompting consumers to seek more “clinical” and science-backed formats. Capsules also allow for targeted delivery (e.g., delayed-release) and higher-potency strains, making them attractive to health-conscious and older consumers looking for efficacy and ease of daily use.

Gummies/chews gut health supplements are anticipated to witness a CAGR of 8.6% from 2025 to 2033. The U.S. market for gummies and chews in gut health supplements is growing because consumers want products that are easy to take, taste good, and fit into daily routines without feeling like “medicine.” Gummies help brands target kids, older adults, and pill-fatigued consumers, while still delivering probiotics, prebiotics, or synbiotics in science-backed formulas. Added factors, such as clean-label ingredients, sugar-controlled formulations, and wider retail availability (including online, mass, and club channels), are further boosting adoption, making gummies/chews one of the fastest-rising delivery formats in digestive health.

Distribution Channel Insights

The sale of gut health supplements in the U.S. through OTC accounted for an 83.8% share of the U.S. gut health supplements industry. OTC gut health supplements are often positioned as safe and effective options for daily use, which enhances consumer confidence and encourages consistent purchasing behavior. The widespread availability of these products across mainstream retail outlets, pharmacies, convenience stores, and online platforms further enhances their accessibility and popularity. The supplements are primarily sold through drugstores and pharmacies, valued for their trusted brands, professional guidance, and wide variety of products.

Convenience stores are gaining traction in urban areas by offering quick, on-the-go formats, such as gummies and shots for busy consumers. Online platforms are rapidly expanding due to the convenience of e-commerce, competitive pricing, and detailed product information. Additionally, supermarkets, health food stores, and wellness boutiques contribute by offering a diverse range of natural and organic options for gut health to health-conscious consumers.

U.S. Gut Health Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.59 billion |

|

Revenue forecast in 2033 |

USD 9.36 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, form, product-form, distribution channel |

|

Key companies profiled |

Nestlé Health Science; Bayer AG; Amway Corp.; Herbalife International, Inc.; NOW Foods; Nature’s Sunshine Products, Inc.; BioGaia; Seed Health, Inc.; Ritual; RenewLife |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |