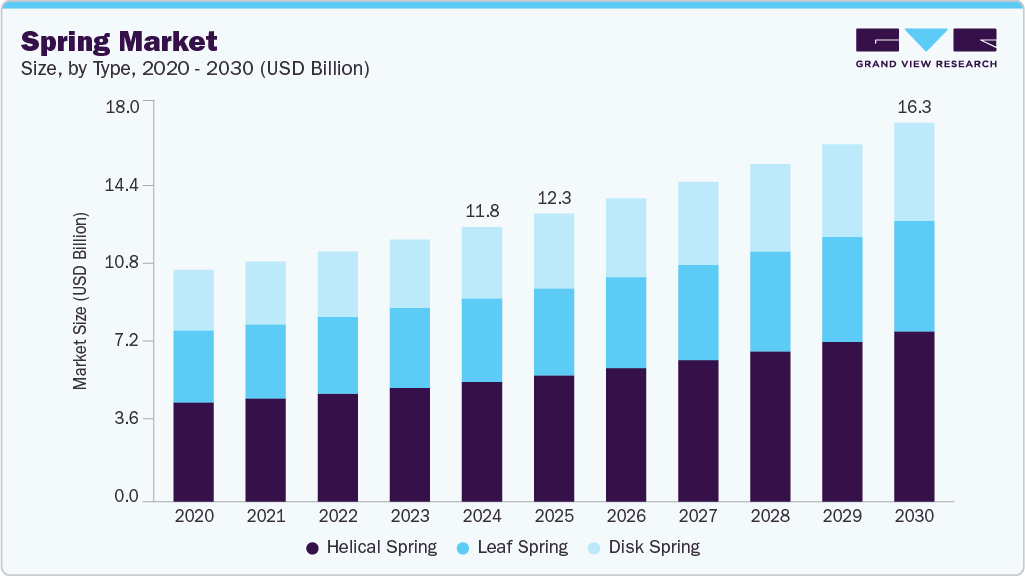

Spring Market Size, Share & Trends Analysis growing at a CAGR of 5.6% from 2025 to 2030

The global spring market size was estimated at USD 11,796.6 million in 2024 and is projected to reach USD 16,278.8 million by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The market growth is primarily driven by increasing demand for springs across various end-use verticals, such as automotive, manufacturing, agriculture, and forestry, which will drive the market over the forecast period.

Key Market Trends & Insights

- Asia Pacific spring market dominated the market with a market share of 37% in 2024.

- The U.S. spring market is expected to grow, driven by the country’s robust automotive and aerospace industries.

- By type, the helical spring segment dominated the market with the largest market share of over 43% in 2024.

- By industry end use, the automotive and transportation segment dominated the market with the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11,796.6 Million

- 2030 Projected Market Size: USD 16,278.8 Million

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/spring-market/request/rs1

No other components are available to replace the utility of springs, and hence, the springs are widely used across all verticals. The growing development and adoption of manufacturing methods, such as the shift from manual manufacturing to automated drive and robotic arms, is also expected to support the growth of the spring market. The increasing use of lightweight and high-strength alloys is significantly influencing the growth of the spring market. Manufacturers are leveraging advanced materials to reduce the overall weight of springs while enhancing durability and load-carrying capacity, making them ideal for aerospace, automotive, and satellite applications. This transition towards lightweight materials is increasing demand in industries focused on fuel efficiency and structural optimization, thereby improving the overall spring industry.

Additionally, the growing integration of springs in critical automotive systems such as suspension, braking, and interior components is propelling the market. With no practical replacement for springs in many automotive applications, the ongoing expansion of the automotive sector directly fuels the demand for various spring types, including helical, coil, and leaf springs. This trend underscores the essential role of springs in ensuring ride quality, safety, and structural support.

Furthermore, the rising adoption of automation and advanced manufacturing technologies such as CAD and CAM is reshaping the spring production landscape. These innovations enable the creation of complex geometries with higher precision and consistency, allowing manufacturers to meet diverse and evolving end user requirements. Enhanced production methods also support higher output levels, catering to increasing global demand while reducing material waste and production errors.