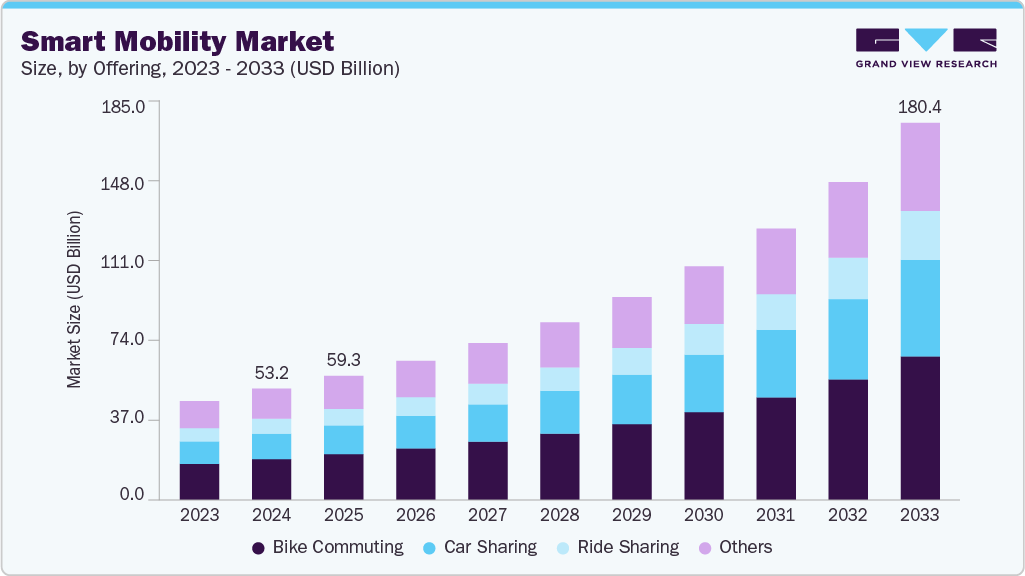

Smart Mobility Market Size, Share & Trends Analysis growing at a CAGR of 14.9% from 2025 to 2033.

The global smart mobility market size was estimated at USD 53.18 billion in 2024 and is projected to reach USD 180.35 billion in 2033, growing at a CAGR of 14.9% from 2025 to 2033. Rapid urbanization across the globe has led to increased population density in cities, resulting in growing traffic congestion and longer commute times.

Key Market Trends & Insights

- North America dominated the smart mobility industry with the largest revenue share of 38.03% in 2024.

- The smart mobility in the U.S. is the largest in North America, primarily due to a combination of advanced infrastructure, high digital penetration, and supportive regulatory frameworks.

- By offering, the bike commuting segment held the largest revenue share of 36.68% in 2024.

- By solution, the traffic management segment held the largest revenue share of 34.38% in 2024.

- By technology, the radio frequency identification (RFID) segment held the largest revenue share of 25.41% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 53.18 Billion

- 2033 Projected Market Size: USD 180.35 Billion

- CAGR (2025-2033): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/smart-mobility-market-report/request/rs1

Municipal governments and transportation authorities are under pressure to enhance mobility efficiency and reduce traffic-related economic losses. Smart mobility solutions such as ridesharing, real-time traffic management, and connected transportation systems are emerging as vital tools for addressing urban transport challenges while enhancing the commuter experience. Governments worldwide are actively promoting smart mobility as part of broader sustainability and urban development goals. Policy frameworks, financial incentives, and investments in smart infrastructure are encouraging the deployment of electric vehicles (EVs), autonomous transport, and smart public transit systems. In addition, regulatory mandates on emissions and urban air quality are compelling transport operators to transition from conventional to intelligent, eco-friendly alternatives.

In addition, advancements in artificial intelligence, Internet of Things (IoT), and 5G connectivity are accelerating the evolution of smart mobility. These technologies enable real-time data exchange between vehicles, infrastructure, and users, allowing for predictive maintenance, intelligent route planning, and seamless multimodal travel. The integration of embedded systems, sensors, and GPS capabilities has also improved the accuracy and responsiveness of transport networks, driving higher adoption rates across public and private mobility services.

However, one of the significant hindrances to the smart mobility growth is the substantial capital investment required to deploy intelligent transport systems, advanced communication infrastructure, EV charging stations, and connected vehicle technology. Municipalities, especially in developing regions, often lack the financial resources and technical capacity to implement large-scale smart mobility projects. In addition, the integration of emerging technologies such as artificial intelligence (AI), IoT, and embedded systems further drives up upfront costs, making it challenging for smaller cities and startups to enter the market.

Smart Mobility Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 59.32 billion |

|

Revenue forecast in 2033 |

USD 180.35 billion |

|

Growth rate |

CAGR of 14.9% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, solution, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Robert Bosch GmbH; Cisco Systems, Inc.; Innoviz Technologies Ltd.; Ford Motor Company; Siemens AG; Toyota Motor Corporation; Excelfore Corporation; TomTom International BV; Daimler AG; Tesla |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |