Security And Vulnerability Management Market Size, Share & Trends Analysis growing at a CAGR of 6.8% from 2025 to 2030

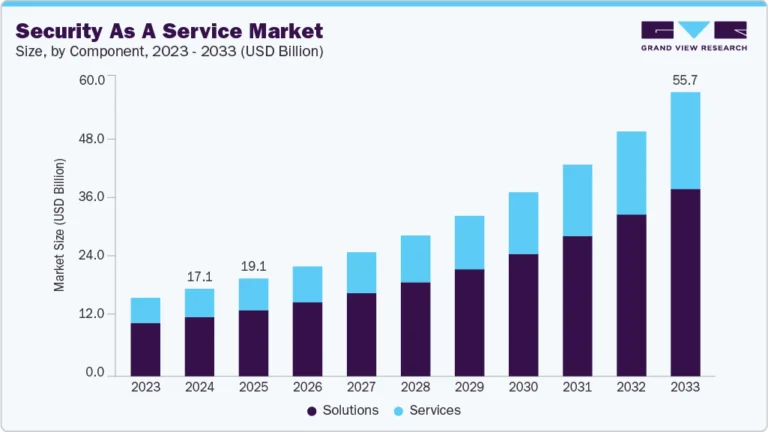

The global security and vulnerability management market size was estimated at USD 16.51 billion in 2024 and is projected to reach USD 24.47 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. This growth is driven by the increasing frequency and complexity of cyber threats, pushing organizations to prioritize robust vulnerability management solutions.

Key Market Trends & Insights

- North America security and vulnerability management industry dominated globally in 2024, accounting for a revenue share of over 37.0%.

- The U.S. security and vulnerability management industry is anticipated to exhibit a significant CAGR over the forecast period.

- By component, the software segment led the market in 2024 with a 64% share of the global revenue.

- By type, the infrastructure protection segment accounted for the largest market revenue share in 2024.

- By target, the content management vulnerabilities segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.51 Billion

- 2030 Projected Market Size: USD 24.47 Billion

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/security-and-vulnerability-management-svm-market/request/rs1

The rapid adoption of IoT and API-driven technologies further creates demand for advanced security systems. In addition, stringent regulatory frameworks across industries like finance, healthcare, and manufacturing are contributing to higher adoption rates. Cloud-based security solutions and a surge in demand for integrated vulnerability management platforms also propel market expansion.

The growth of the security and vulnerability management industry is primarily driven by the rising cyber-attacks, which have increased the demand for proactive security measures. Organizations are transitioning from traditional IT infrastructure to cloud and hybrid environments, necessitating advanced tools to identify and address vulnerabilities. The widespread adoption of remote work and BYOD policies has expanded attack surfaces, prompting enterprises to invest in robust threat detection and management systems. In addition, sectors such as healthcare, BFSI, and government are adopting vulnerability management solutions to comply with stringent data protection regulations and safeguard necessary information. The surge in IoT devices and API-centric applications has created new opportunities for threat actors, emphasizing the need for real-time monitoring and mitigation strategies. Moreover, the growing awareness about ransomware attacks is leading organizations to allocate higher budgets for security solutions.

Technological advancements, such as AI and machine learning, are playing a significant role in enhancing vulnerability detection and threat intelligence capabilities. These technologies enable predictive analytics and automation, helping organizations efficiently manage and prioritize vulnerabilities. The integration of advanced tools into Security Incident & Event Management (SIEM) platforms provides organizations with holistic approaches to mitigate threats. Increasing demand for subscription-based models and managed security services is further supporting market expansion, especially among small and medium enterprises. The market also benefits from strategic collaborations and acquisitions by major players to expand their offerings and regional footprints.

Component Insights

The software segment led the market in 2024 with a 64% share of the global revenue. This growth is driven by the rising need for automated and scalable solutions to combat evolving cyber threats. Organizations increasingly adopt vulnerability scanners, threat intelligence, and Security Incident & Event Management (SIEM) platforms to proactively identify and mitigate risks. The growing trend of cloud adoption has also boosted the demand for software-based security tools tailored for hybrid and multi-cloud environments. Advanced features such as real-time monitoring, predictive analytics powered by AI, and seamless integration with existing IT ecosystems have further contributed to the segment’s dominance.

The services segment is anticipated to exhibit the fastest CAGR over the forecast period. This growth is fueled by the increasing reliance on professional services, such as consulting, deployment, pen testing, and incident response, to address complex security challenges. The rising number of cyberattacks necessitates expert assistance in threat assessment and mitigation, especially for organizations lacking in-house security teams. Managed security service providers (MSSPs) are also gaining traction as companies seek to outsource continuous monitoring and management to specialists. The demand for incident response services is particularly high, given the growing need for rapid containment and recovery from cyber breaches.