Recombinant Cell Culture Insulin growing at a CAGR of 12.5% from 2025 to 2033

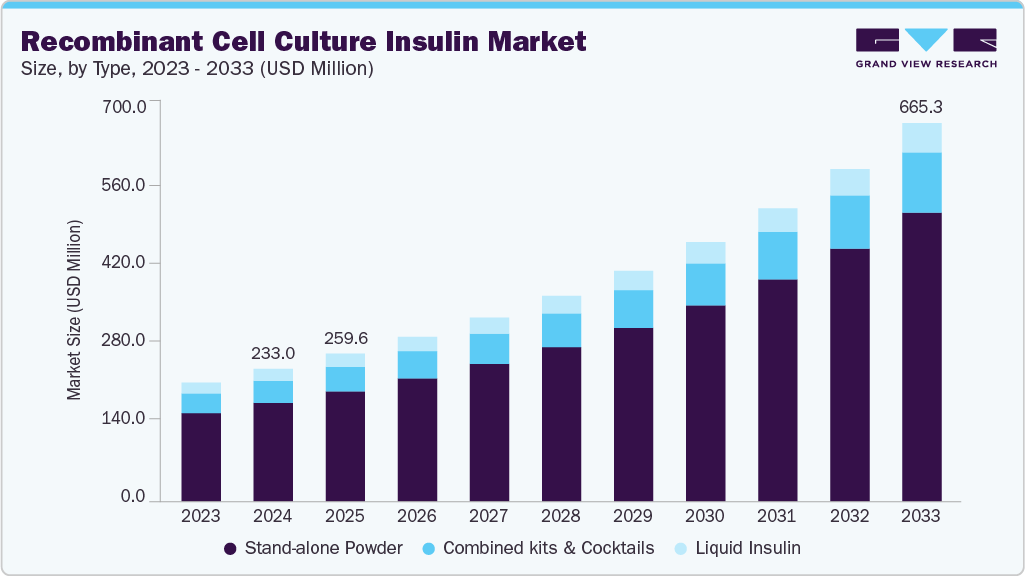

The global recombinant cell culture insulin market size was estimated at USD 233.0 million in 2024 and is projected to reach USD 665.3 million by 2033, growing at a CAGR of 12.5% from 2025 to 2033. The market growth is primarily driven by the increasing adoption of recombinant technologies in biopharmaceutical manufacturing, the rising demand for chemically defined and serum-free media, and the expanding use of insulin as a critical supplement in cell culture applications.

Key Market Trends & Insights

- The North America recombinant cell culture insulin market held the largest share of 41.99% of the global market in 2024.

- The recombinant cell culture insulin industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the stand-alone powder segment held the highest market share of 74.37% in 2024.

- By end-use, the therapeutic protein originators segment held the fastest market share of 22.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 233.0 Million

- 2033 Projected Market Size: USD 665.3 Million

- CAGR (2025-2033): 12.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/recombinant-cell-culture-insulin-market-report/request/rs1

Advancements in Biopharmaceutical manufacturing

Biotechnology advancements have greatly improved the sourcing and utility of recombinant insulin as a supplement for cell cultures. Advances in genetic engineering, microbial and mammalian expression systems, and purification have allowed manufacturers to produce highly pure, consistent, and bioactive insulin on a large scale. These advantages contribute to cell culture media containing recombinant insulin supporting mammalian cells’ optimal growth, viability, and productivity. This is especially important for the scalable production of biologics, vaccines, and therapeutic proteins. As the biopharmaceutical industry continues to be pushed more globally, the demand for high-quality, reproducible cell culture supplements has become an important market driver.

Market Concentration & Characteristics

The degree of innovation in recombinant cell culture insulin industry remains moderate, driven primarily by formulation optimization rather than molecular breakthroughs. Most suppliers focus on enhancing purity, stability, and consistency to support sensitive cell types such as CHO, HEK, and stem cells. Innovation is also occurring around animal-component-free (ACF) and GMP-grade variants, catering to biopharmaceutical manufacturing needs and regulatory compliance. Furthermore, integration of ready-to-use liquid formats, improved scalability, and customized insulin concentrations for specific media formulations are key differentiators driving incremental advancements rather than disruptive innovation.

The recombinant insulin industry has experienced significant mergers and acquisitions (M&A) as companies have sought to diversify their product lines, expand their technological know-how, and solidify their global position. Major pharmaceutical and biotechnology companies are acquiring smaller biotech companies that either focus directly on recombinant insulin or bioprocessing technologies related to insulin development to gain access to developments in advanced formulations, modern cell culture technologies, and specialized manufacturing. These activities enable companies to speed up product development, enter different geographic markets, and gain economies of scale related to manufacturing.

Recombinant Cell Culture Insulin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 259.6 million |

|

Revenue forecast in 2033 |

USD 665.3 million |

|

Growth rate |

CAGR of 12.5% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

Novo Nordisk Pharmatech A/S; Merck KGaA; Thermo Fisher Scientific Inc.; Lonza; Corning Incorporated; GeminiBio LLC.; Elabascience; Capricorn Scientific GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |