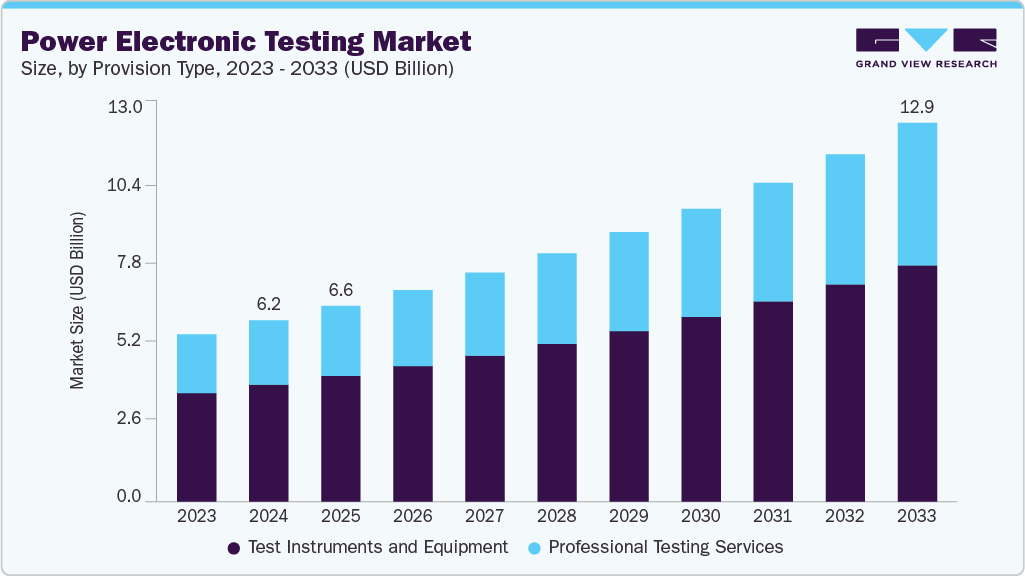

Power Electronic Testing Market Size, Share & Trends Analysis growing at a CAGR of 8.6% from 2025 to 2033

The global power electronic testing market size was estimated at USD 6,163.1 million in 2024 and is projected to reach USD 12,886.9 million by 2033, growing at a CAGR of 8.6% from 2025 to 2033. The market for power electronic testing is expanding steadily due to the increasing adoption of electric vehicles across major economies.

Key Market Trends & Insights

- Asia Pacific Power Electronic Testing dominated the global market with the largest revenue share of 39.3% in 2024.

- The power electronic testing market in the U.S. led the North America market and held the largest revenue share in 2024.

- By provision type, test instruments and equipment led the market and held the largest revenue share of 64.5% in 2024.

- By device type, the individual power provision types segment held the dominant position in the market and accounted for the largest revenue share of 45.2% in 2024.

- By end use, the automotive and mobility solutions segment is expected to grow at the fastest CAGR of 10.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 6,163.1 Million

- 2033 Projected Market Size: USD 12,886.9 Million

- CAGR (2025-2033): 8.6%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/power-electronic-testing-market-report/request/rs1

Rising investments in renewable energy systems are adding to the demand for advanced testing solutions. Manufacturers are focusing on efficiency, safety, and compliance, fueling further market development.

The power electronics testing market is evolving with increasing complexity in device design. To address this, companies are adopting more accurate and repeatable testing methods. Automation is helping reduce testing time while improving efficiency and consistency. High-precision tools are being used to validate performance under realistic operating conditions. These developments support the broader adoption of wide bandgap semiconductors in advanced applications.

As a result, automated and precise testing is becoming the standard approach in the industry. For instance, in April 2025, Rohde & Schwarz, a German-based test and measurement technology company, collaborated with PE-Systems GmbH to enhance power electronics testing solutions. The collaboration focuses on improving double pulse and automated load jump testing using advanced instruments such as the R&S MXO 5 oscilloscope and RT-ZISO isolated probing system.

The power electronics industry is shifting toward advanced semiconductor materials. These include newer options beyond traditional silicon. Such materials are used in high-efficiency and high-performance devices. Their unique electrical and thermal characteristics require specialized validation. Testing systems must handle higher voltages, temperatures, and frequencies. This is increasing the need for more sophisticated and reliable testing solutions. Equipment must be adapted to evaluate material behavior under stress.

The goal is to ensure long-term reliability and compliance with evolving industry standards. Companies are investing in tools that simulate real-world conditions. For instance, in May 2025, EDA Industries S.P.A., an electronics company in Italy, and ChipTest Engineering formed a joint venture to establish a Burn-in and Reliability Testing Laboratory in India, targeting the growing demand for SiC and GaN technologies. This collaboration aims to strengthen India’s semiconductor ecosystem and expand both companies’ reach in domestic and global markets.