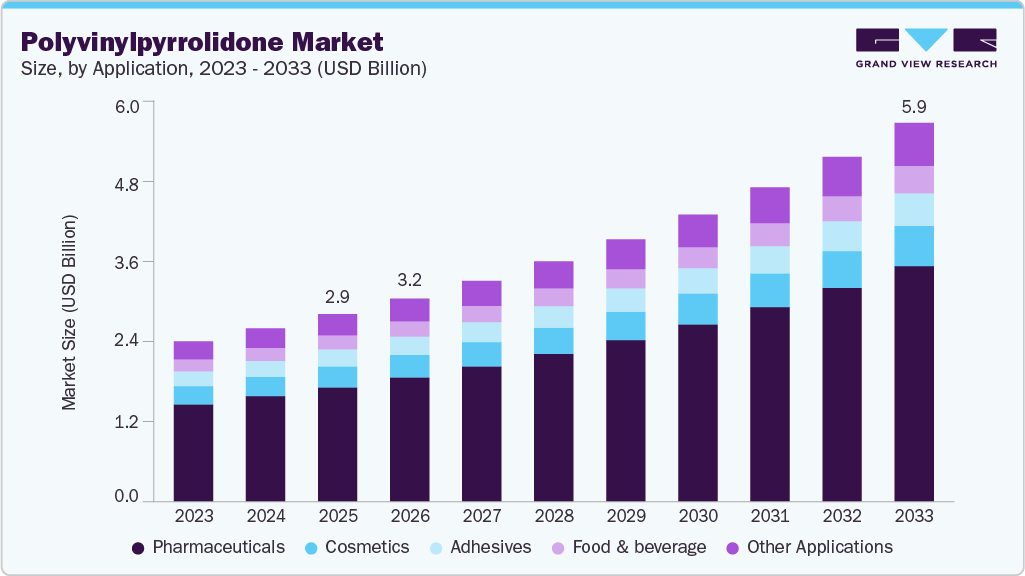

Polyvinylpyrrolidone Market growing at a CAGR of 9.3% from 2026 to 2033

The global polyvinylpyrrolidone market size was estimated at USD 2,925.5 million in 2025 and is projected to reach USD 5,915.3 million by 2033, growing at a CAGR of 9.3% from 2026 to 2033. The demand for polyvinylpyrrolidone (PVP) is on the rise due to its expanding use in cosmetics, food and beverages, adhesives, and pharmaceuticals.

Key Market Trends & Insights

- Asia Pacific dominated the polyvinylpyrrolidone market with the largest revenue share of 33.4% in 2025.

- The China polyvinylpyrrolidone market held a substantial share of Asia Pacific in 2025.

- By application, the pharmaceuticals segment dominated the market with a revenue share of 61.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,925.5 Million

- 2033 Projected Market Size: USD 5,915.3 Million

- CAGR (2026-2033): 9.3%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/polyvinylpyrrolidone-market/request/rs1

A prominent factor contributing to this growth is the increasing popularity of hair care products within the cosmetics sector. The increased use of PVP in the production of shampoos, conditioners, hair sprays, mousses, and hair dyes is expected to drive industry growth.

The product’s superior properties, including excellent film-forming, anti-microbial, moisture-holding, and non-allergic properties offered by the polymer, are anticipated to be the key factors driving the industry’s growth. Furthermore, the rising use of the product in manufacturing nail enamels, lipsticks, skin creams, sunscreen, and mascara is likely to propel PVP demand over the forecast period.

Increasing demand for polyvinylpyrrolidone in brew beverages as a stabilizer is expected to propel demand over the forecast period. Furthermore, rising application scope of PVP in various non-alcoholic drinks such as vinegar, tea drinks, and fruit juices is anticipated to drive the growth of the polyvinylpyrrolidone industry.

Polyvinylpyrrolidone (PVP) is a versatile synthetic polymer widely used across nanotechnology, pharmaceuticals, and polymer chemistry due to its amphiphilic nature and excellent solubility. In nanoparticle synthesis, it stabilizes by adsorbing onto metal surfaces, such as silver or gold, preventing aggregation through steric repulsion. It also serves as a capping agent during the formation of rod-like hydroxyapatite (HAp) nanoparticles, regulating crystal growth for biomedical applications. In the pharmaceutical industry, PVP serves as a drug carrier, enhancing the solubility and bioavailability of poorly water-soluble drugs through solid dispersion systems, as exemplified by formulations such as ibuprofen or ritonavir. Additionally, it is employed as an emulsifier in solution polymerization, such as in the production of vinyl acetate polymers, and as a disintegrant in tablet formulations to enhance drug release. These diverse applications underscore PVP’s critical role in enabling advanced material synthesis and enhancing drug performance.

Market Concentration & Characteristics

The polyvinylpyrrolidone market is moderately concentrated, with a few dominant players holding substantial global shares. Major chemical companies lead the market through vertical integration, leveraging in-house production of vinylpyrrolidone monomers, advanced polymerization technologies, and extensive international distribution networks. Their control across the value chain, from raw material synthesis to final PVP grades, ensures high product consistency, cost efficiency, and reliable supply to high-value industries such as pharmaceuticals, personal care, and food processing.

At the same time, regional manufacturers in Asia Pacific, especially those in China and India, are expanding their presence by capitalizing on low production costs, government-backed infrastructure, and rapidly growing domestic demand. These players primarily focus on industrial-grade and low-to-medium purity PVP, targeting high-volume applications such as adhesives, detergents, textiles, and agriculture. Backed by rising investments in polymer production and R&D, these companies are also gradually improving their quality standards to compete in export markets.

However, the polyvinylpyrrolidone industry faces critical challenges. One key restraint is the increasing scrutiny of synthetic polymers in consumer and pharmaceutical products. Regulatory authorities in regions such as North America and the EU are tightening guidelines for the use of certain synthetic excipients, driven by concerns over biodegradability, microplastic pollution, and residual solvent content. As sustainability gains importance in formulation strategies, manufacturers are pressured to innovate with greener, bio-based alternatives and more transparent supply chains to maintain market access and regulatory compliance.

Application Insights

The pharmaceutical polyvinylpyrrolidone segment dominated the polyvinylpyrrolidone market with a share of 61.0% in 2025, due to the growing demand for polyvinylpyrrolidone in the pharmaceutical application as a drug solubilizer, cosolvent, sterilization disinfectant, and dispersion stabilizer is expected to boost market growth. The product manufactures various drugs, including paracetamol, aspirin, dimethyl tetracycline, benzene sulfonamide, and dipyridamole. Polyvinylpyrrolidone plays a crucial role in ophthalmic medications and injections. The use of polymers in eye drops reduces patient discomfort and prolongs drug contact time, making them a preferred choice for advanced pharmaceutical applications.

The food & beverage segment is expected to grow at a healthy CAGR of 8.9% from 2026 to 2033, due to growing use of PVP in beverage manufacturing, particularly in wine production. Light wines produced from grapes, corn, and barley contain colloidal particles and polyphenols that affect clarity and stability. Cross-linked PVP effectively adsorbs these polyphenols, enabling easy removal through filtration. As a result, rising demand for PVP as an alcoholic beverage stabilizer is anticipated to support market expansion over the forecast period.

Polyvinylpyrrolidone Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 3,171.9 million |

|

Revenue forecast in 2033 |

USD 5,915.3 million |

|

Growth rate |

CAGR of 9.3% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2018 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Ashland; BASF; Boai NKY Pharmaceuticals Ltd.; Glide Chem Private Limited; Hangzhou Motto Science & Technology Co., Ltd.;JH Nanhang Life Sciences Co., Ltd.; NIPPON SHOKUBAI CO., LTD.; Shanghai Qifuqing Material Technology Co., Ltd.; Shanghai Yuking Water Soluble Material Tech Co., Ltd.; Sichuan Lutianhua Co., Ltd; Thermo Fisher Scientific Inc.; Sigma-Aldrich Co. LLC (Merck) |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |