Pharmaceutical Sterility Testing Market Size, Share & Trends Analysis growing at a CAGR of 11.58% from 2025 to 2033

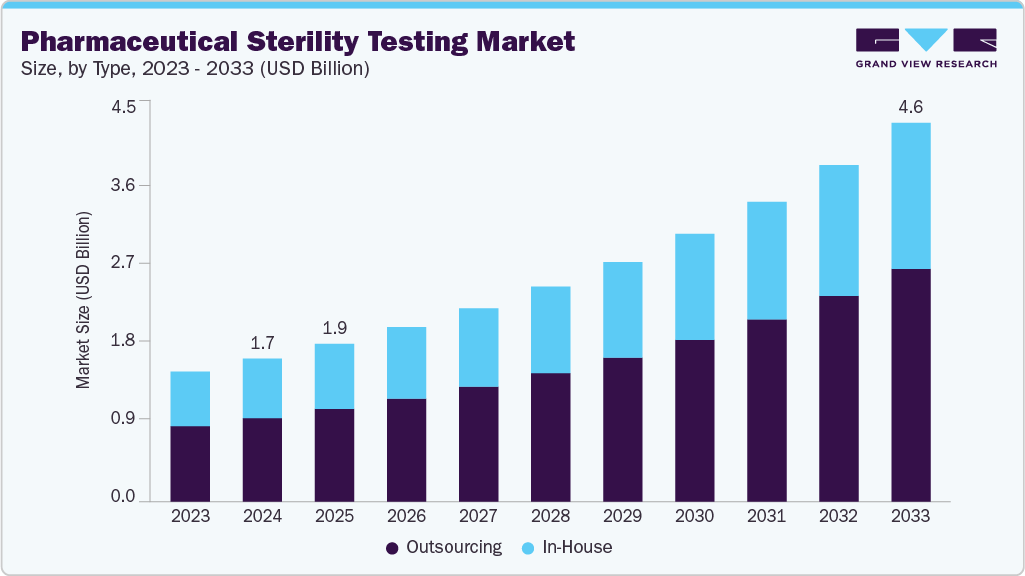

The global pharmaceutical sterility testing market size was estimated at USD 1.75 billion in 2024 and is projected to reach USD 4.64 billion by 2033, growing at a CAGR of 11.58% from 2025 to 2033. Increasing government investments, R&D activities, a growing number of drug launches, and a rising focus on quality & sterility are expected to drive the market growth.

Key Market Trends & Insights

- The North America pharmaceutical sterility testing market held the largest share of 52.88% of the global market in 2024.

- The pharmaceutical sterility testing industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the outsourcing segment led the market with the largest revenue share of 58.50% in 2024.

- Based on test type, the bioburden testing segment led the market with the largest revenue share in 2024.

- By end use, the medical device companies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Billion

- 2033 Projected Market Size: USD 4.64 Billion

- CAGR (2025-2033): 11.58%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/pharmaceutical-sterility-testing-market/request/rs1

The development of comprehensive sterility testing procedures is regulated with stringent policies and quality control standards. Governments in developing economies, such as India and China, are increasingly focusing on providing cost-effective, high-quality medications. The Government of India allocated over USD 8.4 billion for the period from 2021-2022 to 2025-2026 to strengthen the country’s healthcare infrastructure. Furthermore, the Government of India invested over USD 4.4 billion in the National Health Mission (NHM) for FY 2023-24, reflecting a decrease of 1% from the previous year. The objectives of the NHM are to enhance the public healthcare system and improve efficiency in utilizing all available resources. The NHM has also established state-level targets for reducing the incidence of communicable and noncommunicable diseases. Additionally, since 2014, 100.0% Foreign Direct Investment (FDI) has been permitted in the healthcare sector, attracting significant foreign investment to date. Currently, India boasts the highest number of U.S. FDA-approved manufacturing facilities, with 665 plants located outside the U.S. As a result, demand for sterility testing services and products is expected to rise over the forecast period.

The increasing emphasis on R&D activities in the pharmaceutical industry profoundly affects the pharmaceutical sterility testing market. As pharmaceutical companies actively engage in the discovering and developing innovative and advanced drug formulations, there is a rising demand for robust sterility testing protocols to ensure the safety and efficacy of these products. R&D efforts drive the development of new pharmaceuticals, biologics, and vaccines, requiring comprehensive sterility testing methodologies to comply with regulatory requirements.