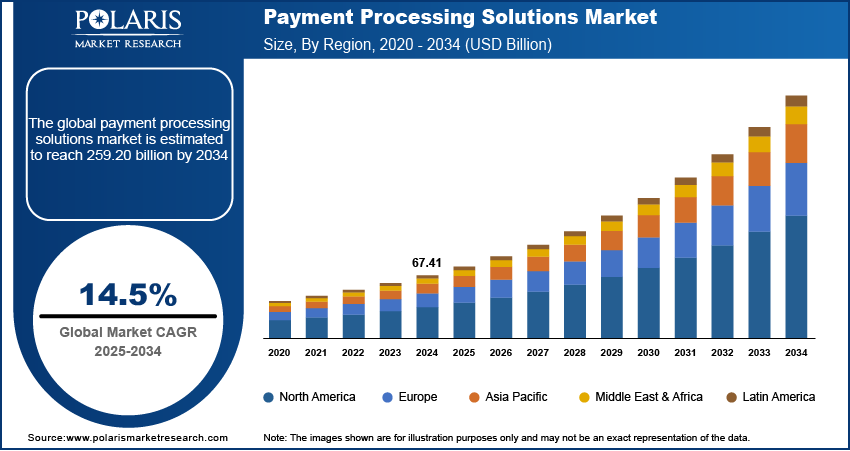

Payment Processing Solutions Market Set to Hit USD 259.20 Billion by 2034 | CAGR: 14.5%

The payment processing solutions market was valued at USD 67.41 billion in 2024 and is projected to grow from USD 76.92 billion in 2025 to reach approximately USD 259.20 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 14.5% during the forecast period. This robust growth is driven by rapid digital transformation, the expanding e-commerce sector, and the global shift toward cashless and contactless payment systems. Increasing adoption of advanced payment technologies and rising demand for secure, real-time transaction solutions are further propelling market expansion.

This market deals with digital systems and software that facilitate the authorization, settlement, and management of financial transactions. Payment processing solutions are critical for e-commerce, retail, banking, and mobile payments. The rise of contactless payments, digital wallets, and fintech innovation propels market growth. Security, speed, and user experience are focal areas for technological development. Regulatory compliance and global expansion of digital banking further boost market demand.

Key Report Highlights:

- In 2024, the retail sector dominated the global market due to the rising trend of online shopping and the integration of advanced payment systems at physical stores.

- Based on mode of payment, e-wallets segment had largest payment processing solutions market share, driven by the adoption of smartphones and the convenience they offer to users.

- In 2024, North America dominated the market, due to its advanced digital infrastructure and widespread adoption of cashless payment systems.

- Asia Pacific is poised for rapid growth during the forecast period, driven by increasing internet penetration, rising smartphone usage, and government initiatives promoting financial inclusion.

Market Overview: Key Figures at a Glance

- Market Value in 2024: USD 67.41 billion

- Projected Market Size in 2034: USD 259.20 billion

- Anticipated CAGR 2025-2034: 14.5%

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Market Growth Drivers:

Surge in Digital Payment Adoption:

- The rise in 5G smartphone usage is driving greater adoption of Payment Processing Solutions.

- As of August 2023, 40% of all transactions in India are conducted digitally (India Brand Equity Foundation).

- The integration of AI and machine learning enhances payment security and efficiency.

- Improved user experience and security are boosting consumer confidence in digital payments.

Increasing Government Initiatives:

- Global governments are promoting digital payments to foster financial inclusion and digital economies.

- Initiatives like India’s Digital India, Europe’s PSD2, and the U.S. FedNow Service are accelerating adoption.

- Real-time payment systems, open banking, and digital identity frameworks support secure, fast transactions.

- Government incentives for small businesses and stricter compliance requirements are driving market expansion.

Market Key Players:

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard Incorporated

- Square, Inc. (Block, Inc.)

- Stripe, Inc.

- Adyen NV

- Worldline SA

- Fiserv, Inc.

- Global Payments Inc.

- Alipay (Ant Group)

- Amazon Pay

- PayU (Prosus Group)

- Clover Network, Inc. (Fiserv)

- Revolut Ltd.

- Paysafe Group