Onychomycosis Market Size, Share & Trends Analysis growing at a CAGR of 4.7% from 2025 to 2033

Onychomycosis Market Summary

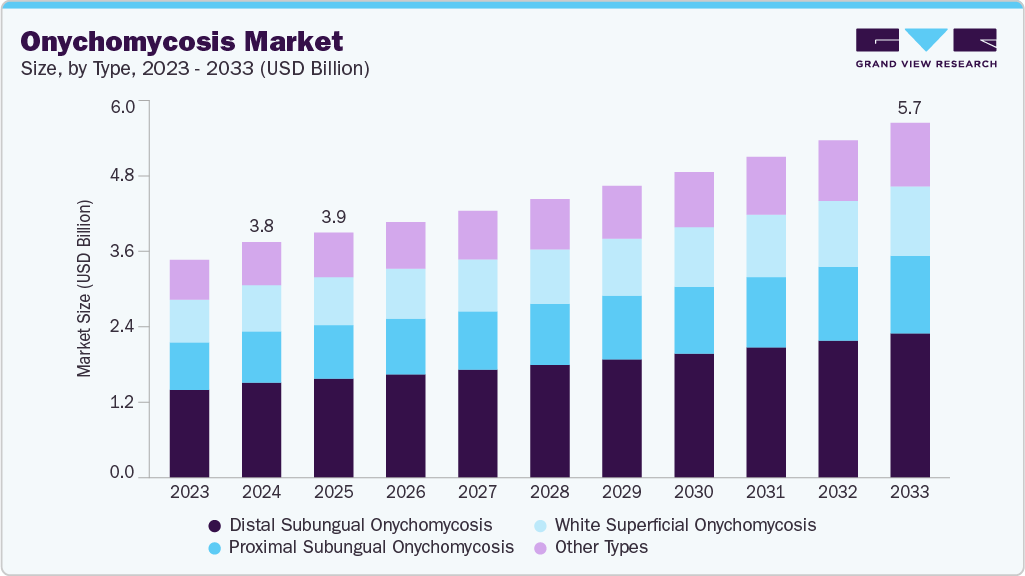

The global onychomycosis market was estimated at USD 3.81 billion in 2024 and is projected to reach USD 5.74 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The market is driven by the rising prevalence of fungal nail infections, increasing incidence of chronic conditions such as diabetes, an aging population, and advancements in treatment options such as topical solutions and laser therapies.

Key Market Trends & Insights

- North America onychomycosis market held the largest share of 40.32% of the global market in 2024.

- The onychomycosis industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the distal subungual onychomycosis segment held the highest market share of 40.39% in 2024.

- By treatment, the topical segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.81 Billion

- 2033 Projected Market Size: USD 5.74 Billion

- CAGR (2025-2033): 4.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/onychomycosis-market-report/request/rs1

Fungal infections, including onychomycosis (nail fungus), are becoming a growing public health concern due to their increasing prevalence and impact on quality of life. Greater awareness and early diagnosis are key factors driving attention to these conditions. In response, initiatives such as the Centers for Disease Control and Prevention’s (CDC) annual Fungal Disease Awareness Week (FDAW), held from September 18 to 22, 2023, aim to educate the public about the risks and challenges posed by fungal diseases. These efforts have highlighted the need for improved diagnostic methods and treatment options, fueling demand in the onychomycosis market.

A variety of antifungal therapies are available, including oral medications, topical creams, sprays, and injectables. Investment in research and development continues to expand treatment options. A notable example is Moberg Pharma AB’s MOB-015, which received national authorization in Sweden in August 2023 for use in adults with mild to moderate nail fungus. While initially approved in Ireland, Sweden became the first country to allow the product’s sale as an over-the-counter remedy, signaling a move toward more accessible antifungal solutions and is expected to boost market uptake.

Furthermore, age is a significant factor influencing susceptibility to fungal infections, as immune function declines over time. Older adults are particularly at risk due to physical and cognitive changes that increase vulnerability to conditions like onychomycosis. This is underscored by demographic trends showing a rising elderly population worldwide. According to the World Health Organization, by 2030, one in six individuals will be over 60 years old, with the global elderly population growing from 1 billion in 2020 to 1.4 billion in 2030. The most rapid growth in older populations is expected in Eastern and South-Eastern Asia, followed by Central and Southern Asia, where the elderly population is projected to reach 328.1 million by 2050. These shifts highlight the growing need for targeted antifungal treatments designed for older adults.