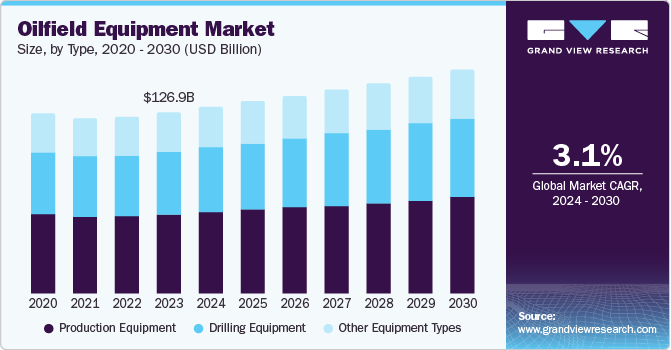

Oilfield Equipment Market growing at a CAGR of 3.1% from 2024 to 2030

The global oilfield equipment market size was valued at USD 126.91 billion in 2023 and is projected to reach USD 156.50 billion by 2030, growing at a CAGR of 3.1% from 2024 to 2030. This growth is attributable to increasing energy demand, technological advancement in oilfield equipment, rising investment in exploration and production, regulatory frameworks & environmental concerns, and geopolitical factors.

Key Market Trends & Insights

- North America oilfield equipment market held the largest revenue share of 39.3% in 2023.

- The U.S. oilfield equipment market held a significant market share in North America in 2023.

- Based on type, the production equipment segment dominated the market and accounted for a revenue share of 43.9% in 2023.

- Based on application, the onshore segment dominated the market and accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 126.91 Billion

- 2030 Projected Market Size: USD 156.50 Billion

- CAGR (2024-2030): 3.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/oilfield-equipments-market/request/rs1

Volatility in the political situation in major oil-producing countries poses a risk to supply chains and production capabilities. Such factors as geopolitical risks affect the supply of oil and the prices, which in turn affects the need to spend more on ensuring business continuity by acquiring better equipment. The growing global population and rapid industrialization, especially in emerging economies, have increased energy demand. Due to the countries’ energy demand, there is a high emphasis on the exploration and production of oil and gas, leading to the increased demand for oilfield equipment. Moreover, technological advancements in drilling techniques, including horizontal drilling and hydraulic fracturing, have highly boosted the effectiveness of oil extraction procedures. These advancements also lower operating expenses while increasing recovery rates from the current fields, thereby driving the need for advanced oilfield equipment.

With fluctuating crude oil prices, companies invest heavily in exploration and production activities to discover new reserves and enhance production from existing fields. Many countries emphasize self-dependency for energy to avoid uncertainties and economic losses, leading to exploration driving the demand for sophisticated oilfield equipment to support these operations. Governments worldwide are implementing stricter regulations regarding environmental protection and safety standards in the oil and gas sector. This has increased demand for advanced equipment that complies with these regulations while minimizing ecological impact.

Type Insights

The production equipment segment dominated the market and accounted for a revenue share of 43.9% in 2023. Production equipment refers to the tools used after the drilling phase, which include separators, pumps, compressors, storage tanks, and flow lines. An increase in energy consumption worldwide propels demand for enhanced production capabilities. Moreover, many existing production facilities require upgrades or replacements due to wear over time, driving demand for new production technologies and adopting advanced recovery methods, which increases the need for specialized production equipment capable of handling complex extraction processes.

The drilling equipment segment is expected to grow at a significant CAGR from 2024 to 2030 due to increased exploration activities, technological advancement, rising oil prices, and regulatory compliances. As global energy demands rise, companies invest in exploration activities in new regions, necessitating advanced drilling technologies. Innovations such as horizontal drilling and hydraulic fracturing have increased efficiency and reduced costs, driving demand for modern drilling rigs and associated equipment. Stricter regulations regarding safety and environmental protection rise demand for advanced & efficient drilling technologies.

Application Insights

The onshore segment dominated the market and accounted for the largest revenue share in 2023. Onshore oilfield exploration mainly comprises drilling and producing crude oil and natural gas from onshore fields. Some of the equipment used in these operations include drilling rigs, well-completion tools, production equipment, and transportation equipment. For instance, using enhanced technologies such as hydraulic fracturing and horizontal drilling techniques has significantly improved the effectiveness of onshore oil extraction. At the same time, the rate of production and cost of operations have gone considerably down.

The offshore segment is expected to grow at the fastest CAGR during the forecast period. As onshore reserves depleted, companies increasingly turn to offshore fields with vast untapped resources, particularly in deep-water regions where advanced technology is required. In addition, advancements in subsea technology and floating production systems have made it feasible to extract oil from deeper waters more efficiently, driving investment into offshore projects. While offshore drilling poses environmental challenges, advancements in safety protocols and spill-prevention technologies drive market growth.

Oilfield Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 130.64 billion |

|

Revenue forecast in 2030 |

USD 156.50 billion |

|

Growth rate |

CAGR of 3.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 – 2022 |

|

Forecast period |

2024 – 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Application, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Norway, Russia, France, Netherlands, China, India, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE and Kuwait |

|

Key companies profiled |

SLB; Baker Hughes Company; Halliburton; Weatherford; NOV; TechnipFMC plc; Saipem; Sinopec Oilfield Equipment Corporation; China Oilfield Services Limited; Aker Solutions; Petrofac Limited; Nabors Industries Ltd.; Tenaris and Subsea7 |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |