Natural Surfactants Market Size, Share & Trends Analysis growing at a CAGR of 4.2% from 2025 to 2033

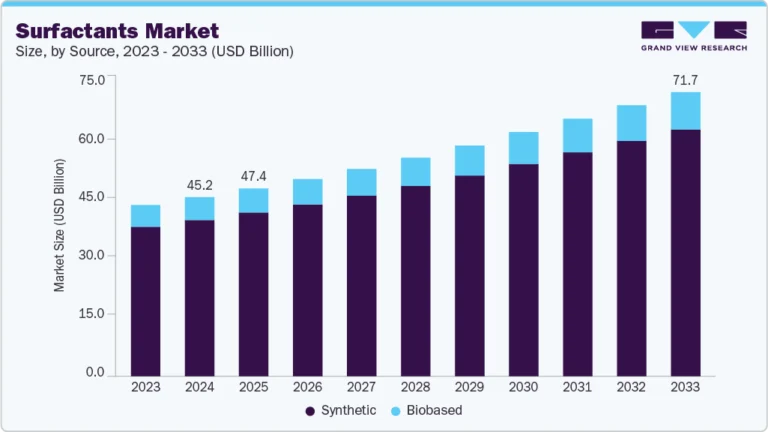

The global natural surfactants market size was estimated at USD 21,485.6 million in 2024 and is projected to reach USD 30,880.9 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market’s growth is mainly fueled by rising consumer demand for eco-friendly and sustainable products, stricter environmental regulations, and increasing awareness of synthetic surfactants’ health and environmental impacts.

Key Market Trends & Insights

- Europe dominated the global natural surfactants market with the largest revenue share of 38.6% in 2024.

- Natural surfactants market in Germany is propelled by stringent domestic chemical regulations and rising environmental awareness.

- By product, the nonionic segment is expected to grow at a considerable CAGR of 4.5% from 2025 to 2033 in terms of revenue.

- By application, the personal care segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 21,485.6 Million

- 2033 Projected Market Size: USD 30,880.9 Million

- CAGR (2025-2033): 4.2%

- Europe: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/natural-surfactants-market-report/request/rs1

Growing environmental consciousness and increasing regulatory pressure against synthetic and petroleum‑derived surfactants catalyze transitions toward plant‑based and microbial biosurfactants. Technological advances in extraction and fermentation processes have reduced costs and improved product efficacy, enhancing competitiveness. The surge in the personal care and cosmetics industry, particularly clean‑beauty formulations, has fueled demand for gentle yet effective surfactants in shampoos, cleansers, and body washes. Finally, expanding organic agriculture and agro-tech usage support the demand for natural surfactants in agrochemicals and industrial cleaners.

Despite its momentum, the market faces significant cost and supply chain constraints that limit broader adoption. Natural surfactants are derived from plant or microbial sources and incur higher production costs due to complex extraction, purification, and specialized equipment. Inconsistent availability of raw inputs such as coconut, palm, or biotech feedstocks introduces volatility in pricing and supply, exacerbated by agricultural risks and climate variability. Formulating natural molecules into stable, multifunctional products also remains technologically demanding, often requiring additional capital investment and R&D. Allergy concerns and regulatory hurdles in certifying natural blends can also delay market entry and add compliance burdens.

Despite strong growth potential, the natural surfactants market faces challenges such as fluctuating raw material prices and limited availability of high-quality inputs, affecting production costs. Compatibility issues between admixtures and certain types of cement or aggregates can lead to performance inconsistencies. Moreover, small-scale contractors in developing regions may lack technical know-how or willingness to adopt high-performance admixtures. Regulatory barriers and concerns about long-term durability or chemical interactions in complex mix designs may also restrain broader market penetration.

Substantial growth opportunities abound as the market shifts towards greener chemistries and circular bioeconomies. Emerging biosurfactants produced via microbial fermentation offer scalable, low‑toxicity, biodegradable alternatives with expanding industrial, agricultural, and cleaning applications. Innovation focuses on multifunctional compounds (foaming, emulsifying, wetting), enabling formulation consolidation and performance gains and meeting cost and sustainability objectives. Finally, government incentives for bio‑based products and increasing corporate ESG commitments encourage investment in R&D and production capacity, reinforcing long‑term market expansion.

Market Concentration & Characteristics

The global natural surfactants market is distinctly consolidated, with a small cohort of major specialty chemical firms commanding the majority of revenue. Industry titans such as Croda International Plc, Croda International, Clariant AG, The Dow Chemical Company and others, lead the competitive landscape. These corporations boast extensive global production networks, formulated through strategic mergers, acquisitions, and partnerships to enhance their biosurfactants portfolios while securing economies of scale. While a few mid‑tier and regional players exist, they occupy narrow niches based on specialty applications or geographic focus. This high concentration enables tight control over pricing, supply chain integration, and technological innovation, posing significant entry hurdles for smaller or new-market entrants seeking substantial market share.