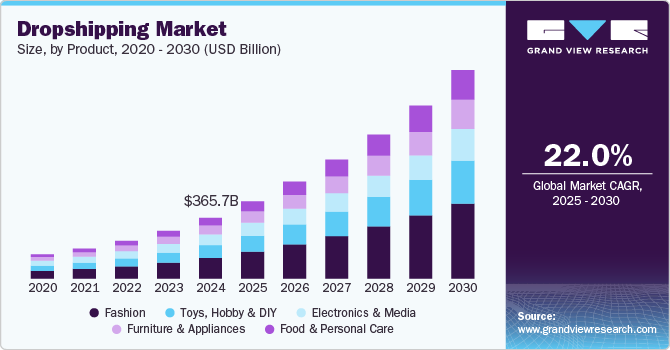

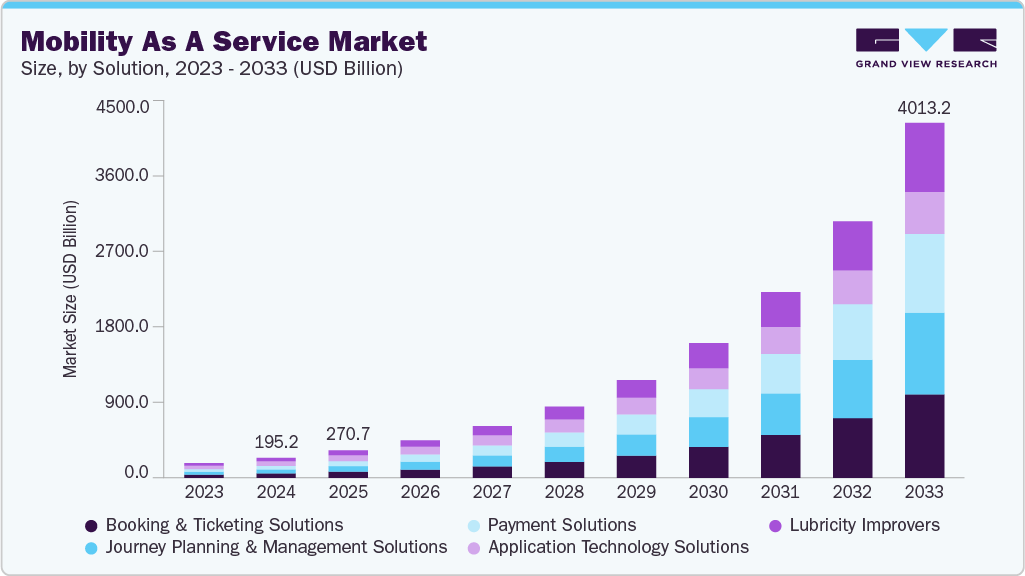

Mobility As A Service Market Size, Share & Trends Analysis growing at a CAGR of 40.1% from 2025 to 2033

The global mobility as a service market size was estimated at USD 195.2 billion in 2024, and is projected to reach USD 4,013.2 billion by 2033, growing at a CAGR of 40.1% from 2025 to 2033. The vehicle subscription model expedites the adoption of mobility as a service by providing a flexible and comprehensive transportation solution.

Key Market Trends & Insights

- Europe mobility as a service market accounted for a 26.1% share of the overall market in 2024.

- Germany’s MaaS market is driven by urban congestion, government-backed multimodal transport, and rising demand for sustainable app-based mobility.

- By transportation type, the public transportation segment accounted for the largest share of 57.3% in 2024.

- By solutions, the application technology solutions segment dominated the market in 2024 and accounted for more than 23.2%.

- By services, the ride-hailing services segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 195.2 Billion

- 2033 Projected Market Size: USD 4,013.2 Billion

- CAGR (2025-2033): 40.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/mobility-as-a-service-market-report/request/rs1

Subscribers have on-demand access to book private vehicles, such as cars and bikes, and even public modes of transport, like buses and trains. Moreover, a cost-effective and convenient transit approach prompts users to embrace mobility as a service platform for transportation services. Through subscription services, mobility as a service platform streamlines vehicle access, thus driving the transition to more integrated and eco-friendly urban mobility solutions. Due to increasing migration to urban areas, the demand for upgraded transportation infrastructure plays a vital role in driving the adoption of mobility as a service. Digital applications that provide travel planning, booking, and payment features facilitate mobility as a service.

Furthermore, the ability of mobility as a service platform to furnish real-time updates on routes, timetables, delays, and the availability of diverse transportation options contributes significantly to user convenience. In addition, mobility as a service incorporates advanced payment and ticketing systems, allowing users to conveniently pay for various modes of transportation within a unified platform. Modernized infrastructure supports contactless payment methods, Quick Response (QR) codes, and digital tickets, ensuring users a seamless payment experience.

Technological advancements are pivotal in propelling the adoption of mobility as a service for entities like travel agencies and municipalities. Integrating mobility as a service into their services allows travel agencies to enhance operational efficiency and provide customers with multimodal options, ultimately bolstering customer satisfaction and loyalty. Meanwhile, municipalities can leverage data-driven insights from mobility as a service platform, optimizing transportation infrastructure and reducing traffic congestion. Data insights also help municipalities improve resource allocation by enabling a better understanding of peak travel times and frequently used routes, leading to more effective management of public transportation and traffic signals during periods of high demand.

Mobility As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 270.7 billion |

|

Revenue forecast in 2033 |

USD 4,013.2 billion |

|

Growth rate |

CAGR of 40.1% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report Coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments Covered |

Solutions, services, transportation type, propulsion type, payment type, operating system, application, end user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Lyft, Inc.; INTEL CORPORATION (Moovit, Inc.); UBER TECHNOLOGIES, INC.; BlaBlaCar; GRAB HOLDINGS LIMITED; Free Now; SkedGo; moovel North America, LLC.; Fluidtime; Cubic Transportation Systems, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |