Metal Cans Market growing at a CAGR of 6.4% from 2025 to 2033

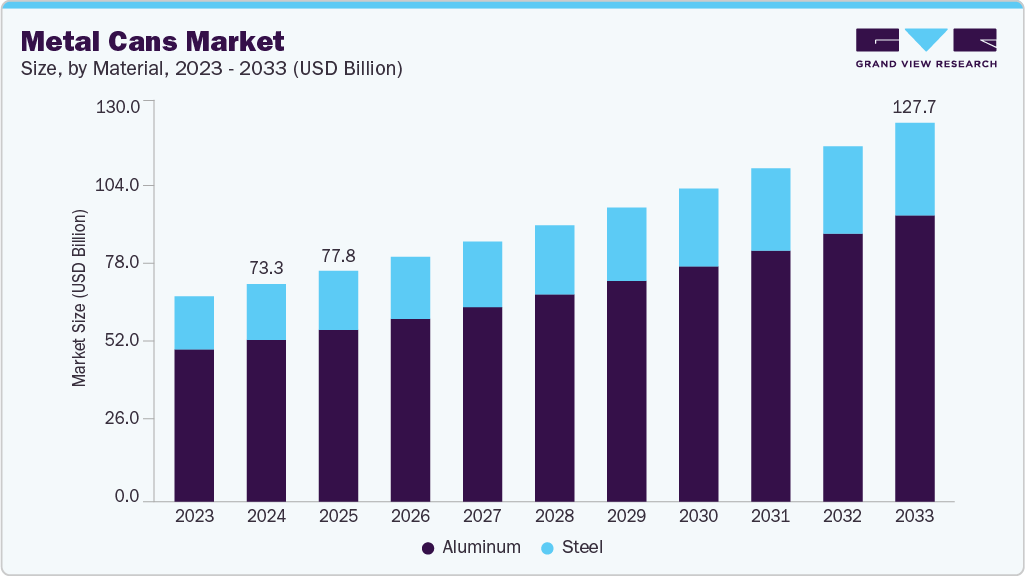

The global metal cans market size was estimated at USD 73.34 billion in 2024 and is projected to reach USD 127.75 billion by 2033 to grow at a CAGR of 6.4% from 2025 to 2033. The global market is driven by increasing demand for sustainable and recyclable packaging, especially in the food and beverage sector.

Key Market Trends & Insights

- North America dominated the metal cans market with the largest revenue share of 32.2% in 2024.

- U.S. metal can market growth stems from high packaged food and drink consumption, robust recycling, and rising demand for sustainable packaging.

- By material, the aluminum segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

- By product, the 2- piece drawn and ironed segment is expected to grow at a considerable CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By closure type, the easy- open end (EOE) segment is expected to grow at a considerable CAGR of 6.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 73.34 Billion

- 2033 Projected Market Size: USD 127.75 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/metal-cans-market/request/rs1

Additionally, rising urbanization and consumer preference for convenient, ready-to-eat products are boosting market growth. The push for sustainable packaging is a major catalyst for market growth. Metal, especially aluminum, is infinitely recyclable and retains material quality through repeated cycles. Aluminum cans use about 90% less energy when made from recycled content. Beverage industry giants such as Coca‑Cola and PepsiCo are scaling up recycled-aluminum usage in response to consumer and regulatory pressure.

In India, for instance, in May 2024, Ball Corporation partnered with CavinKare to introduce retort two-piece aluminum cans for CavinKare’s popular milkshakes in India, marking a significant move towards sustainable and convenient dairy packaging. Both companies emphasize that this collaboration not only delivers superior product quality but also significantly reduces environmental impact, supporting a shift towards 100% sustainable packaging and reinforcing their leadership in eco-conscious innovation within the Indian beverage sector.

In addition, urban lifestyles and busier schedules are fueling demand for ready-to-drink (RTD) yogurt, soups, beverages, and on-the-go meals. Metal cans offer durability, portability, extended shelf life, and strong barrier properties, ideal for these applications. A growing number of brands, from Nespresso’s canned coffee to craft beer, are adopting metal, supported by innovations such as resealable tops, embossed branding, and lightweighting.

Beverages, particularly soft drinks, energy drinks, beer, and alcoholic RTDs, account for around 77% of the metal can market. The craft beer movement and premium drinks market are driving demand for eye-catching designs, slimmer cans, and specialty coatings. In July 2023, Effingut, a craft brewing company, announced the launch of its signature craft beers in 500-ml cans.

Despite strong demand, the market is sensitive to global metal costs and policy shifts. Aluminum and steel price fluctuations, amplified by U.S. tariffs such as the recent 25-50% levies, are raising production costs and potentially nudging some manufacturers toward cheaper plastic alternatives. For example, U.S. canned food producers face price increases of 9-15%, which could impact demand. However, a stronger recycling infrastructure and lightweighting efforts offer long-term mitigation by reducing dependence on virgin aluminum.

Market Concentration & Characteristics

The metal cans industry requires significant capital investment in high-speed can manufacturing lines, coating/printing systems, and recycling infrastructure. Companies also invest in R&D for innovations such as BPA-free linings, light-weighting technologies, and advanced forming techniques. Automation and quality control technologies (e.g., AI-based inspection) are increasingly adopted to reduce waste and boost throughput.

Metal cans are regulated under food safety and packaging directives such as the FDA (U.S.), EFSA (Europe), and REACH compliance. Environmental regulations, such as extended producer responsibility (EPR) schemes and single-use packaging bans, encourage the use of recyclable materials. Sustainability is both a requirement and a value proposition, with aluminum being among the most recycled materials globally, with recycling rates over 70% in many regions.

Metal Cans Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 77.79 billion |

|

Revenue forecast in 2033 |

USD 127.75 billion |

|

Growth rate |

CAGR of 6.4% from 2025 to 2033 |

|

Actual data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million, volume in million units, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, product, closure type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Indonesia; Thailand; Vietnam; Philippines; Malaysia; Singapore; Brazil; Saudi Arabia |

|

Key companies profiled |

Sonoco Products Company; Toyo Seikan Co., Ltd.; Ball Corporation; Crown; CANPACK; Ardagh Group S.A.; Hindustan Tin Works Ltd; Trivium Packaging; Silgan Containers; Ohio Art Metal Pack, LLC; Mauser Packaging Solutions; Envases Group; Nampak Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |