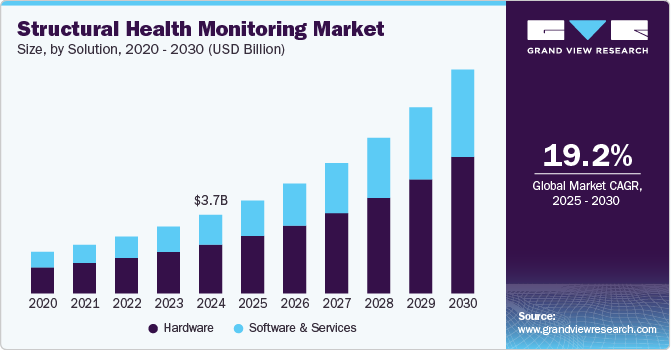

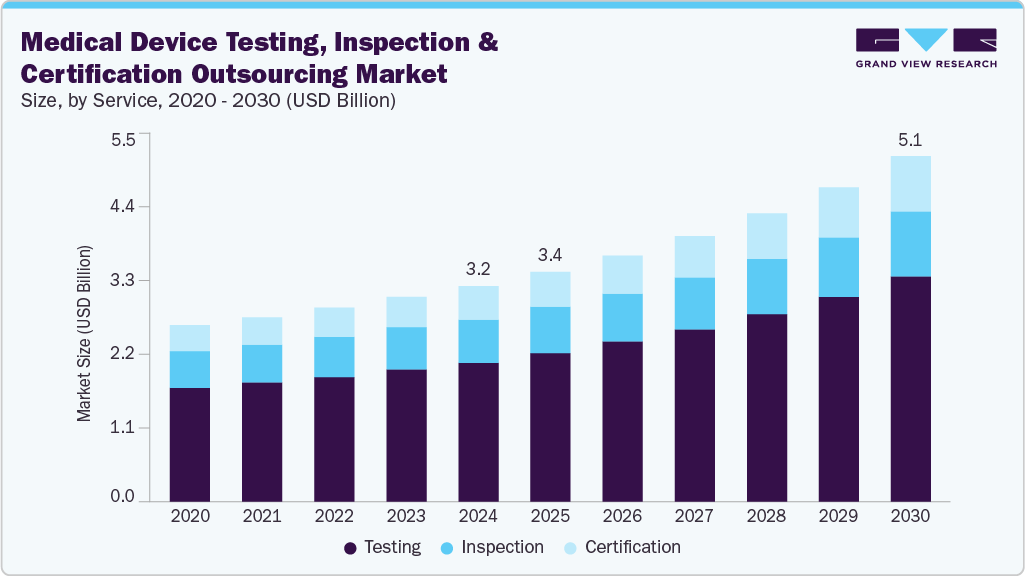

Medical Device Testing, Inspection And Certification Outsourcing Market Size, Share, & Trend Analysis growing at a CAGR of 8.48% from 2025 to 2030

The global medical device testing, inspection, and certification outsourcing market size was estimated at USD 3.18 billion in 2024 and is projected to reach USD 5.11 billion by 2030, growing at a CAGR of 8.48% from 2025 to 2030. The market growth is primarily attributable to the stringent regulatory scenario, accelerated innovation cycles, and expanding device complexity across diagnostic, therapeutic, and wearable categories.

Key Market Trends & Insights

- The medical device testing, inspection, and certification outsourcing market in Europe dominated and accounted for a revenue share of 43.50% in 2024.

- The medical device testing, inspection, and certification outsourcing market in Germany accounted for the highest revenue share in the Europe region.

- By service, the testing service segment dominated the market and accounted for the highest revenue share of 64.77% in 2024.

- By device, the class II medical devices segment accounted for the largest revenue share in the global medical device testing, inspection and certification (TIC) outsourcing market in 2024

Market Size & Forecast

- 2024 Market Size: USD 3.18 Billion

- 2030 Projected Market Size: USD 5.11 Billion

- CAGR (2025-2030): 8.48%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/medical-device-testing-inspection-certification-outsourcing-market-report/request/rs1

Growing scrutiny from several regulatory bodies across regions, such as the U.S. FDA, EU MDR, and China’s NMPA, has enhanced demand for third-party TIC expertise for compliance, safety assurance, and faster market access. Moreover, rising complexity in device design, particularly with the integration of software, connectivity, and AI, demands advanced testing capabilities that several in-house teams lack, offering growth opportunities. Furthermore, increasing cost pressures and the need for operational efficiency also enhance outsourcing TIC services, especially among small and mid-sized manufacturers. Growing global trade of medical devices further boosts demand for standardized certification services.

The accelerating commercialization of high-risk, technologically advanced Class II and III devices, including implantables, active therapeutic systems, and digital diagnostics, has strengthened requirements for clinical validation, electrical safety, biocompatibility, and cybersecurity testing. These devices demand multi-domain TIC expertise, driving demand for specialized third-party service providers. Furthermore, mandatory post-market surveillance (PMS), vigilance reporting, and periodic safety update reporting (PSUR) requirements are increasing the volume and complexity of post-market evidence generation and compliance activities. For instance, the European Union’s Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have introduced more severe compliance assessments, especially for Class II and III devices. Regulatory authorities often require continuous performance evaluation across device lifecycles, leading OEMs to outsource recurring testing, risk management, and adverse event analytics to qualified TIC partners.