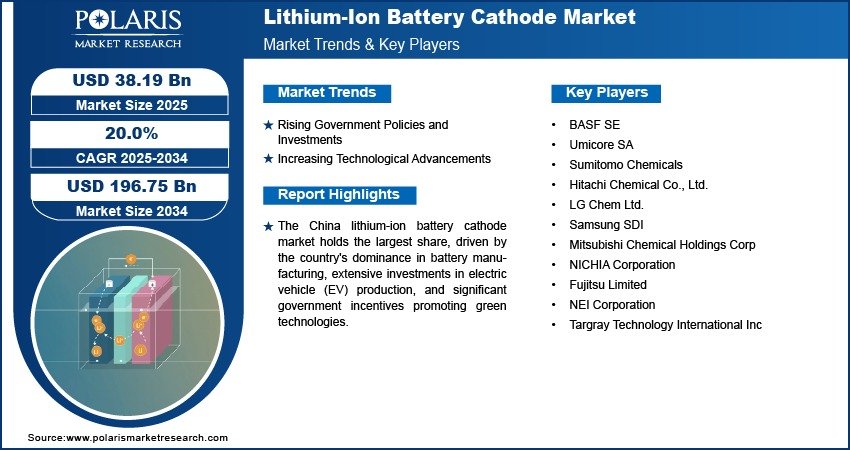

Lithium-Ion Battery Cathode Market to Surpass $196.75 Billion by 2034, Exhibiting a Strong CAGR of 20.0%

The global lithium-ion battery cathode market was valued at USD 31.86 billion in 2024. It is anticipated to expand significantly, reaching USD 38.19 billion in 2025 and ultimately USD 196.75 billion by 2034, growing at a robust CAGR of 20.0% during the forecast period. This growth reflects the surging global demand for clean energy solutions and electric mobility, making lithium-ion cathodes central to battery innovation and energy storage technologies.

Key Market Trends:

-

Transition to High-Nickel Chemistries: There is a noticeable industry shift toward high-nickel cathode materials such as NMC 811 and NCA, driven by their higher energy densities and improved driving range in electric vehicles (EVs).

-

Expansion of EV Production: Automakers globally are scaling up EV production in response to government mandates and consumer demand. This is significantly driving the need for advanced cathode materials.

-

Rise of Solid-State Batteries: R&D efforts are accelerating in solid-state battery technologies, which require specialized cathode materials for higher stability, further diversifying the cathode demand landscape.

-

Strategic Partnerships and Investments: Battery manufacturers are entering joint ventures with mining and chemical companies to ensure long-term access to key cathode materials such as lithium, cobalt, and nickel.

-

Regional Diversification of Supply Chains: To reduce dependency on limited sources, countries and companies are working toward localizing cathode material production and securing raw material supply chains.

Market Size & Forecast:

|

Market Size Value in 2024 |

USD 31.86 billion |

|

Market Size Value in 2025 |

USD 38.19 billion |

|

Revenue Forecast by 2034 |

USD 196.75 billion |

|

CAGR |

20.0% from 2025 to 2034 |

Request for Free Sample:

Industry Overview:

The lithium-ion battery cathode market plays a critical role in the evolving energy storage ecosystem. Cathodes—key components in lithium-ion cells—determine performance, capacity, and lifespan. With global focus shifting toward sustainable energy, electric transportation, and portable electronics, the demand for efficient and powerful cathode materials is at an all-time high. Regions like Asia Pacific dominate the market, driven by large-scale manufacturing hubs in China, South Korea, and Japan. However, North America and Europe are also making rapid advancements in cathode development and battery production, encouraged by supportive policies and infrastructure investments.

Key Market Drivers & Barriers:

Drivers:

-

Surging Demand for Electric Vehicles: With governments promoting EV adoption and phasing out internal combustion engines, cathode demand is experiencing exponential growth.

-

Energy Storage Systems (ESS) Expansion: The increasing use of grid storage and renewable integration is boosting large-format battery use, favoring high-performance cathode materials.

-

Technological Advancements: Continuous innovation in cathode chemistries for better thermal stability, energy density, and cost-efficiency is enhancing product viability.

Barriers:

-

Raw Material Supply Constraints: Limited availability and price volatility of cobalt, nickel, and lithium pose a challenge for scalable production.

-

Environmental and Ethical Concerns: The mining of key cathode materials, especially cobalt, raises environmental and human rights issues, pushing manufacturers to explore alternatives.

Market Opportunity:

The rapid electrification of transport, coupled with the global green energy transition, offers immense growth potential for the lithium-ion battery cathode market. Emerging economies are investing in EV infrastructure and manufacturing, creating new demand centers. Additionally, the proliferation of energy storage systems for renewables and smart grids further amplifies the need for advanced cathode technologies. Companies investing in sustainable sourcing, recycling, and next-generation cathode materials are likely to capitalize the most on the forthcoming growth phase.