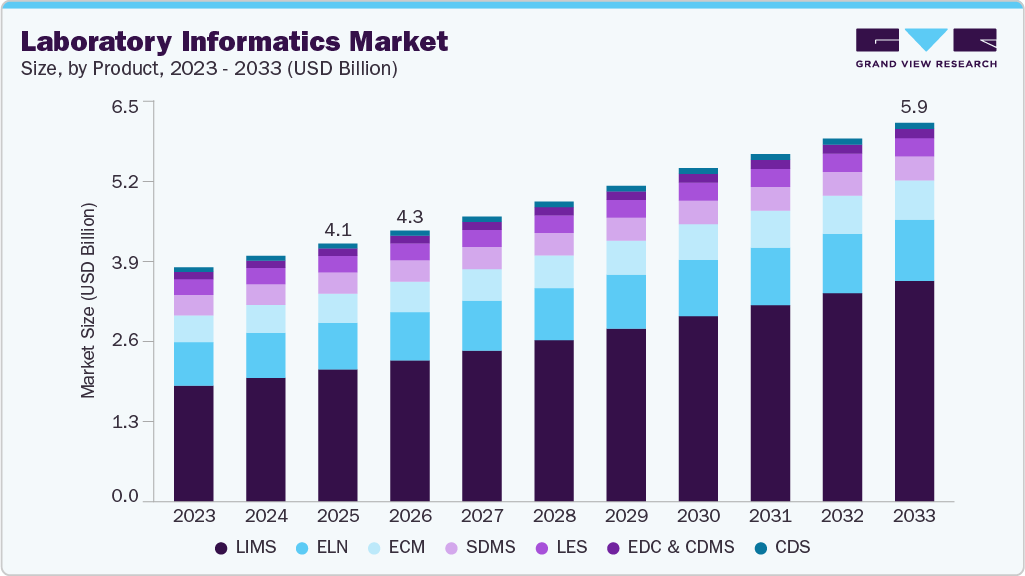

Laboratory Informatics Market growing at a CAGR of 4.90% from 2026 to 2033

The global laboratory informatics market size was estimated at USD 4.07 billion in 2025 and is expected to reach USD 5.98 billion by 2033, growing at a CAGR of 4.90% from 2026 to 2033. Rising demand for laboratory automation is driving adoption, fueled by advancements in molecular genomics, genetic testing, and personalized medicine.

Key Market Trends & Insights

- North America laboratory informatics market held the largest share of 42.68% in 2025.

- The laboratory informatics market in U.S. held the largest share in 2025.

- Based on product, the laboratory information management systems (LIMS) segment dominated the market with a revenue share of 51.22% in 2025.

- Based on components, the services segment accounted for the largest revenue share of 58.50% in 2025.

- Based on delivery mode, the web-based segment dominated the market with a revenue share of 43.25% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.07 Billion

- 2033 Projected Market Size: USD 5.98 Billion

- CAGR (2026-2033): 4.90%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/laboratory-informatics-market/request/rs1

The shift toward cancer genomics and increased patient engagement further accelerates this trend. Moreover, research labs are increasingly adopting cloud, mobile, and voice technologies, boosting demand for lab informatics solutions. The adoption of laboratory informatics solutions is increasingly expanding across healthcare, pharmaceuticals, biotechnology, and contract research organizations, driven by the need for enhanced efficiency, error reduction, and data management. Laboratory information systems are increasingly used in biobanks, academic research institutes, and CROs due to their advantages, including process optimization, regulatory compliance, intellectual property protection, reduced throughput time, and paperless data management.

Moreover, the rise of advanced technologies such as artificial intelligence and robotics for process automation in healthcare has made laboratory operations more reproducible and efficient, allowing faster experiment setup, execution, and analysis. High-throughput systems enable rapid evaluation of experimental results, boosting overall laboratory productivity. In addition, advancements in laboratory equipment are accelerating the transition from manual data evaluation to automated methods, improving accuracy and speed. For instance, in January 2026, SandboxAQ launches OpenFold3, an open-source AI model for pharma R&D. It enables rapid, structure-free binding affinity prediction, addressing early-stage drug discovery bottlenecks.

Furthermore, laboratories are increasingly seeking to adopt advanced technology infrastructure to support new initiatives, remove inefficiencies, and improve their service offerings. Among products, LIMS has the highest growth potential and ability to capture the market followed by Electronic Lab Notebooks (ELN) and Enterprise Content Management (ECM). Other products have comparatively low growth potential and the ability to gain market share. The high growth potential and market-capturing ability of LIMS can be attributed to the growth of value-based healthcare and increase in demand for new interoperability & information sharing/reporting requirements.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the laboratory informatics market is fragmented, with many service providers entering the market. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The degree of innovation in the industry is high. The market is experiencing significant innovation as numerous providers introduce new products to meet demand for scientific data integration solutions in various industries. For instance, in May 2024, Thermo Fisher Scientific Inc. launched Applied Biosystems Axiom BloodGenomiX Array and Software. This innovative solution is designed for precise blood genotyping in clinical studies.

The level of merger & acquisition in the industry is moderate due to a rise in acquisition of emerging players by major players to increase their capabilities, expand product portfolios, and improve competencies. For instance, in July 2025, Clinisys acquired Orchard Software from Francisco Partners. This acquisition is likely to deliver comprehensive, scalable cloud-based informatics for healthcare, life sciences, public health, physician offices, reference labs, and veterinary clinics.

Component Insights

Based on component, the services segment accounted for the largest revenue share of 58.50% in 2025. In addition, this segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the need for a flexible, expandable, and easy-to-use service-oriented LIMS for efficient data and process management. Large pharma and research labs outsource advanced analytics due to internal skill and resource shortages. The lab informatics market provides services such as compliance, social analytics, manufacturing analytics, predictive and preventive maintenance, and benchmarking.

The software segment is anticipated to grow at the fastest growth rate over the forecast year due to the availability of technologically advanced software, such as SaaS, which offers effective information management solutions for laboratories. The software offered for laboratory informatics can perform critical functions such as data capture, storage, interpretation, and analysis. Periodic upgradation of this software is necessary to coordinate with the latest analytics methods.

End Use Insights

Based on end use, the life sciences segment dominated the market with revenue share of 28.93% in 2025. The demand for laboratory informatics is increasing in the life sciences industry to develop innovative products, improve product quality, and operational efficiency. Laboratory informatics systems allow effective management of large amount of data and break down research & discovery silos. Increasing technological advances in healthcare owing to rising R&D in the field of medicine is anticipated to fuel the demand for LIMS. Increasing adoption of LIMS in hospital and research labs due to its growing application scope for patient engagement, workflow management, billing, patient health information tracking and quality assurance is expected to augment the growth.

Laboratory Informatics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 4.28 billion |

|

Revenue forecast in 2033 |

USD 5.98 billion |

|

Growth rate |

CAGR of 4.90% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, delivery mode, component, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Abbott; Agilent Technologies, Inc.; IDBS; LabLynx, Inc.; LabVantage Solutions, Inc.; LabWare; McKesson Corporation; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Waters; Computing Solutions, Inc.; CloudLIMS.com (LabSoft LIMS); Ovation; LABTRACK; AssayNet Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |