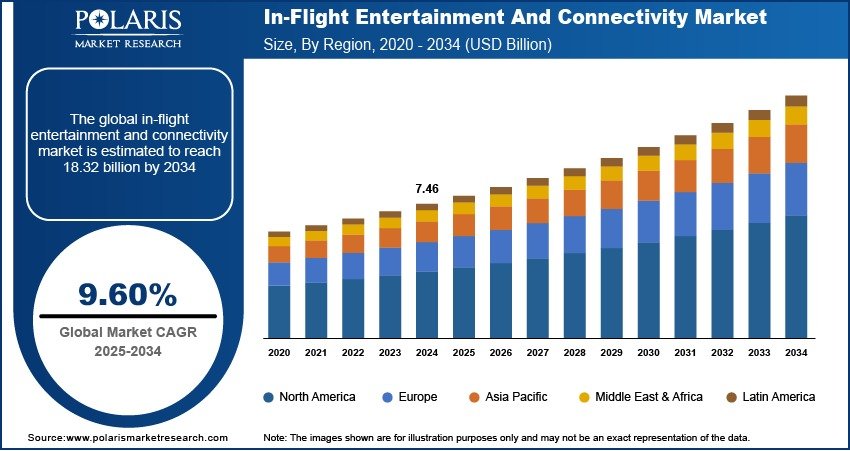

In-flight Entertainment and Connectivity (IFEC) Market to Reach USD 18.32 Billion by 2034 | Growing at a CAGR of 9.60%

The global in-flight entertainment and connectivity (IFEC) market was valued at USD 7.46 billion in 2024 and is expected to grow at a CAGR of 9.60% from 2025 to 2034. This growth is driven by increasing air travel and rising passenger demand for enhanced onboard digital experiences.

Market Definition

The In-Flight Entertainment and Connectivity (IFEC) market refers to the systems and services provided on board aircraft to enhance passenger experience through entertainment options and internet connectivity. This includes seat-back screens, audio/video on demand, live TV, gaming, and Wi-Fi access. IFEC solutions are increasingly being integrated into both commercial and business aircraft as airlines seek to differentiate their services, improve customer satisfaction, and generate ancillary revenue. Technological advancements, growing passenger expectations, and the rising number of long-haul flights are key factors driving market growth.

Key Report Highlights

· The report highlights the key region that accounts for the highest revenue share in the global In-flight Entertainment and Connectivity (IFEC) Market.

· It identifies the leading country within this region that makes a significant contribution to the market’s overall performance.

· The report outlines the dominant segment that holds a major share of the market.

· It also emphasizes the fastest-growing segment projected to gain strong traction during the forecast period.

· Qualitative and quantitative market analysis have been used to provide an in-depth understanding of the market.

Market Overview: Key Figures at a Glance

Market size value in 2025- USD 8.03 Billion

Revenue Forecast in 2034 – USD 18.32 Billion

CAGR – 9.60% from 2024 – 2034

Base year – 2024

Get access to the full report or request a complimentary sample for in-depth analysis:

https://www.polarismarketresearch.com/industry-analysis/in-flight-entertainment-and-connectivity-market/request-for-sample

Market Growth Drivers

1. Rising Passenger Expectations for Digital Connectivity

Modern airline passengers increasingly expect seamless access to internet and digital entertainment during flights. The growing ubiquity of smartphones, tablets, and personal streaming devices has heightened demand for high-speed in-flight Wi-Fi, streaming services, and real-time connectivity. Airlines are responding by investing heavily in IFEC systems to enhance customer experience and brand loyalty.

2. Fleet Modernization and Aircraft Deliveries

Airlines worldwide are upgrading their fleets with next-generation aircraft that are pre-equipped or easily retrofitted with advanced IFEC solutions. The delivery of new aircraft models such as the Airbus A350 and Boeing 787, which support cutting-edge connectivity infrastructure, is accelerating the adoption of IFEC systems.

3. Increased Competition Among Airlines

As competition in the commercial aviation sector intensifies, especially among low-cost carriers (LCCs) and full-service airlines, differentiated passenger experience becomes a critical success factor. Offering advanced IFEC features, such as personalized entertainment, live TV, or premium connectivity packages, helps airlines attract and retain tech-savvy travelers.

4. Expansion of Long-Haul and International Flights

The growth of long-haul flights, particularly in emerging markets, has increased the need for onboard entertainment and reliable internet access. Passengers on 6+ hour journeys consider IFEC a vital service, prompting carriers to invest in satellite-based broadband systems and diverse content offerings to improve passenger satisfaction.

5. Advancements in Satellite and Wireless Communication Technologies

Technological advancements, including Ka-band and Ku-band satellite systems, have significantly improved the speed, reliability, and coverage of in-flight internet services. The development of Low Earth Orbit (LEO) satellite constellations (e.g., Starlink, OneWeb) further promises to revolutionize in-flight connectivity with low-latency, high-speed global internet, creating new growth opportunities for IFEC providers.

6. Increased Focus on Ancillary Revenue Generation

Airlines view IFEC as a strategic tool for boosting ancillary revenues through paid internet services, targeted advertisements, e-commerce, and on-demand content. By leveraging connectivity for personalized ads or onboard shopping, airlines can transform IFEC platforms into profit centers rather than cost centers.

7. Growing Adoption of BYOD (Bring Your Own Device) Solutions

The rise of BYOD trends allows passengers to access IFEC services via personal devices, reducing the need for built-in seatback screens while lowering costs for airlines. This trend supports the widespread deployment of wireless streaming systems and portable entertainment servers, making IFEC implementation more flexible and scalable.

8. Supportive Regulatory and Infrastructure Developments

Government initiatives and aviation authorities are increasingly supporting connectivity through streamlined licensing, allocation of frequency bands, and improved air-to-ground networks. Regulatory clarity and infrastructure investments are helping airlines expand IFEC offerings without violating safety or operational protocols.

Market Key Players

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- Anuvu

- BAE Systems

- Collins Aerospace

- Eutelsat Communications

- Gogo LLC

- Honeywell International Inc.

- Inmarsat Global Limited

- Iridium Communications Inc.

- Panasonic Avionics

- SAFRAN Group

- SITA

- Thales Group

- ViaSat, Inc.

- moment.tech