Head And Neck Cancer Therapeutics Market

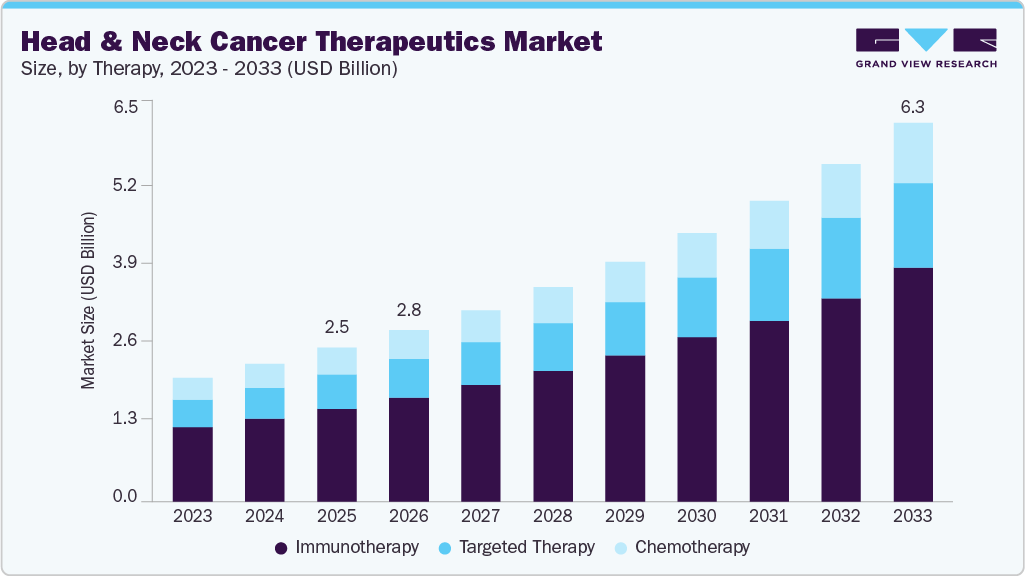

The global head and neck cancer therapeutics market size was estimated at USD 2.53 billion in 2025 and is projected to reach USD 6.25 billion by 2033, growing at a CAGR of 12.00% from 2026 to 2033. The market is growing due to the rising incidence of head and neck cancers, increasing demand for targeted and immunotherapy-based treatments, and advancements in diagnostic precision.

Key Market Trends & Insights

- North America head and neck cancer therapeutics industry held the largest share of 44.63% of the global market in 2025.

- The head and neck cancer therapeutics industry in the U.S. is expected to grow significantly over the forecast period.

- By therapy, the immunotherapy segment held the largest market share of 60.41% in 2025.

- By route of administration, the injectable segment held the largest market share in 2025.

- By distribution channel, the retail and specialty pharmacies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.53 Billion

- 2033 Projected Market Size: USD 6.25 Billion

- CAGR (2026-2033): 12.00%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/head-neck-cancer-drugs-therapeutics-market/request/rs1

The incidence of head and neck cancers continues to rise, driving greater demand for targeted therapies and immunotherapy-based treatment approaches. Diagnostic accuracy is improving rapidly, supported by new clinical evidence. For instance, in June 2025, GORTEC’s Phase III REACH trial reported positive outcomes for avelumab combined with radiotherapy in cisplatin-ineligible head and neck cancer patients. The study achieved its primary endpoint of improved progression-free survival and showed a favorable safety profile in more than 500 participants. Increasing awareness among patients and healthcare providers is also strengthening early detection and expanding the use of multi-line treatment strategies. Meanwhile, the growing preference for minimally invasive, lower-toxicity options is boosting the adoption of innovative drug classes. In addition, ongoing clinical trial expansion and accelerated regulatory pathways are improving product accessibility across major global markets.

The growing prevalence of human papillomavirus (HPV)-associated oropharyngeal cancers is emerging as a significant driver for market growth. These HPV-related subtypes often respond differently to treatment, prompting a rise in research and tailored drug development. Clinical guidelines increasingly differentiate therapeutic approaches based on HPV status, fueling demand for precision therapies. Pharmaceutical companies are investing in treatment protocols that address viral oncogenesis, expanding the therapeutic landscape. The increasing incidence of HPV-positive cases among younger adults has shifted the disease demographic, creating new market opportunities. Enhanced public awareness and screening for HPV-related malignancies contribute to earlier diagnosis and treatment initiation.

Adopting combination therapy strategies is gaining momentum in the head and neck cancer therapeutics space, offering improved response rates and survival outcomes. Treatment regimens integrating immunotherapy with chemotherapy or targeted agents are being tested in both first-line and refractory settings. For instance, in June 2025, the FDA’s approval of Keytruda for PD-L1-positive head and neck cancer patients highlights the growing focus on biomarker-based therapies. The announcement also emphasized the unmet need in PD-L1-negative patients. CEL-SCI’s Multikine aims to address this gap by treating patients before standard therapies, regardless of PD-L1 status. Designed to stimulate an early immune response, Multikine represents a novel approach that could broaden treatment access and improve outcomes across diverse patient groups.

Market Concentration & Characteristics

The head and neck cancer therapeutics industry demonstrates a moderate-to-high level of innovation, largely driven by advances in immunotherapy and targeted therapies. While chemotherapy remains a foundation, companies like Bristol-Myers Squibb and Merck have introduced checkpoint inhibitors that offer enhanced survival outcomes. Innovations focus on minimizing toxicities while improving progression-free survival rates. Recent clinical trials emphasize biomarker-driven approaches for therapy selection. This evolving landscape fosters competition among key players to develop next-generation treatments with differentiated profiles.

The market poses significant entry barriers due to the high cost of clinical trials, stringent regulatory demands, and intellectual property protection held by leading firms. Established players such as Eli Lilly and AstraZeneca benefit from extensive R&D capabilities and global commercialization networks, which newcomers often lack. In addition, oncological drug development requires long timelines, specialized trial endpoints, and robust safety data. Market entrants must also navigate hospital formulary approvals and secure access to specialty distribution channels. These obstacles make it difficult for smaller firms to gain a foothold.

Regulatory oversight shapes market dynamics, especially for injectable and immunotherapeutic treatments. Agencies like the FDA and EMA demand rigorous clinical data on efficacy, safety, and tolerability before approving therapies. Post-approval surveillance requirements, black-box warnings, and REMS programs can impact product uptake. For example, accelerated approvals may be granted for therapies with significant survival benefits, influencing market timelines. Companies must continuously adapt to shifting regulatory frameworks and evolving clinical guidelines in oncology.

Therapy Insights

The immunotherapy segment dominated the market with the largest revenue share of 60.41% in 2025, driven by the ability to deliver durable responses and improved survival outcomes in advanced-stage patients. Agents such as PD-1 inhibitors have demonstrated clinical effectiveness in recurrent or metastatic head and neck squamous cell carcinoma. High adoption among oncologists is supported by favorable safety profiles and reduced toxicity compared to conventional chemotherapy. For instance, in April 2025, Oncology Central reported that the Phase III KEYNOTE-689 trial showed perioperative pembrolizumab significantly improved event-free survival in head and neck cancer patients. Presented at AACR 2025, this Merck-funded study marked the first major therapeutic advancement in over two decades, enhancing outcomes through pre- and post-surgery immunotherapy.

Distribution Channel Insights

The retail and specialty pharmacies segment dominated the market with the largest revenue share of 57.15% in 2025, due to their broad reach and ability to handle complex oncology prescriptions. These channels offer streamlined access to high-cost therapies, including immunotherapies and targeted agents. Integration with specialty care services ensures timely delivery and dosage management. Patient support programs and pharmacist-led counseling contribute to improved adherence. Pharmaceutical companies increasingly partner with specialty pharmacies to ensure proper handling and cold chain logistics. The growing role of outpatient cancer care further drives reliance on this distribution channel.

Head And Neck Cancer Therapeutics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 2.83 billion |

|

Revenue forecast in 2033 |

USD 6.25 billion |

|

Growth rate |

CAGR of 12.00% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Therapy, route of administration, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key company profiled |

Eli Lilly and Company; Sanofi; Merck & Co., Inc.; Cumberland Pharmaceuticals Inc.; Bristol-Myers Squibb Company; AstraZeneca; Takeda Pharmaceutical Company Limited; Teva Pharmaceutical Industries Ltd.; F. Hoffmann-La Roche Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |