Glyoxal Market growing at a CAGR of 5.9% from 2026 to 2033

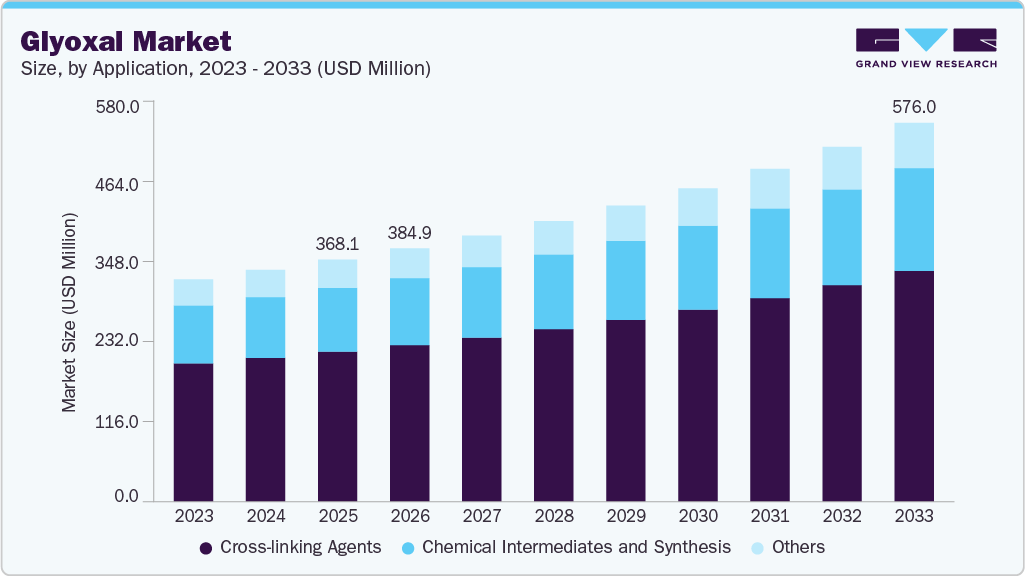

The global glyoxal market size was estimated at USD 368.1 million in 2025 and is projected to reach USD 576.0 million by 2033, growing at a CAGR of 5.9% from 2026 to 2033, driven by steady demand from textile finishing, paper processing, and resin applications, along with rising preference for low-formaldehyde and sustainable chemical solutions across industrial end-use sectors. Market expansion is also supported by the increasing use of glyoxal in construction chemicals and specialty resin systems, where it enhances bonding performance, water resistance, and product durability.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 45.3% in 2025.

- The market in China is expected to grow at a significant CAGR of 5.3% from 2026 to 2033.

- The liquid segment held the largest revenue share of 84.2% in 2025.

- By application, the cross-linking agents segment held the largest revenue share of 61.9% in 2025 in terms of revenue.

- By end use, textiles held the largest revenue share of 46.5% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 368.1 Million

- 2033 Projected Market Size: USD 576.0 Million

- CAGR (2026-2033): 5.9%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/glyoxal-market/request/rs1

Rising infrastructure investment, growth in renovation activities, and higher consumption of adhesives, coatings, and cement additives across developing and developed regions are contributing to consistent demand growth. The market offers attractive opportunities through the development of differentiated glyoxal grades tailored for high-value applications, including pharmaceuticals, advanced materials, and specialty chemicals. Growing regulatory focus on product performance and safety is encouraging manufacturers to invest in process optimization and application-specific solutions, creating scope for margin expansion and long-term growth.

Market Concentration & Characteristics

The global glyoxal industry exhibits a moderately concentrated structure, with a mix of large multinational chemical manufacturers and regional producers accounting for a significant share of total supply. Established players benefit from integrated production capabilities, long-term customer relationships, and economies of scale, while smaller manufacturers mainly compete on pricing and regional availability.

Market characteristics are defined by stable industrial demand, standardized product grades, and price sensitivity linked to raw material fluctuations. The market is largely volume-driven, with limited product differentiation; however, value-added and application-specific grades are gaining traction as end users increasingly prioritize performance consistency, regulatory compliance, and supply reliability.

Application Insights

The cross-linking agents segment held the largest revenue share of 61.9% in 2025, driven by its widespread use in textile finishing, paper processing, and resin formulations to improve strength, durability, and crease resistance. Consistent demand from large-scale industrial applications and the need for cost-effective cross-linking solutions continue to support the segment’s leading market share.

Chemical intermediates and synthesis is expected to grow at a CAGR of 6.3% from 2026 to 2033, supported by increasing utilization of glyoxal in pharmaceuticals, agrochemicals, and specialty chemical production. Growing investments in downstream chemical manufacturing and rising demand for high-purity intermediates are accelerating adoption, positioning this segment as a key growth contributor over the forecast period.

End Use Insights

The textile segment held the largest revenue share of 46.5% in 2025, driven by its extensive application in fabric finishing processes to enhance wrinkle resistance, dimensional stability, and durability. Strong demand from apparel and home textile manufacturing, particularly in large textile-producing regions, continues to support the segment’s leading position.

Intermediates are growing the fastest within the market, with a projected CAGR of 6.3%. This strong growth is supported by increasing use of glyoxal as a key building block in pharmaceuticals, agrochemicals, and specialty chemical synthesis. Expanding downstream manufacturing activities and rising demand for high-value chemical intermediates are accelerating growth across this segment.

Glyoxal Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 384.9 million |

|

Revenue forecast in 2033 |

USD 576.0 million |

|

Growth rate |

CAGR of 5.9% from 2026 to 2033 |

|

Actual data |

2018 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, form, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; MEA; Latin America |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Saudi Arabia; South Africa; Brazil; Argentina |

|

Key companies profiled |

BASF SE; Eastman Chemical Company; Dow; INEOS AG; WeylChem International GmbH; SINOPEC; Reliance Industries Ltd.; Amzole Industrial (P) Ltd.; Kemira Oyj |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |