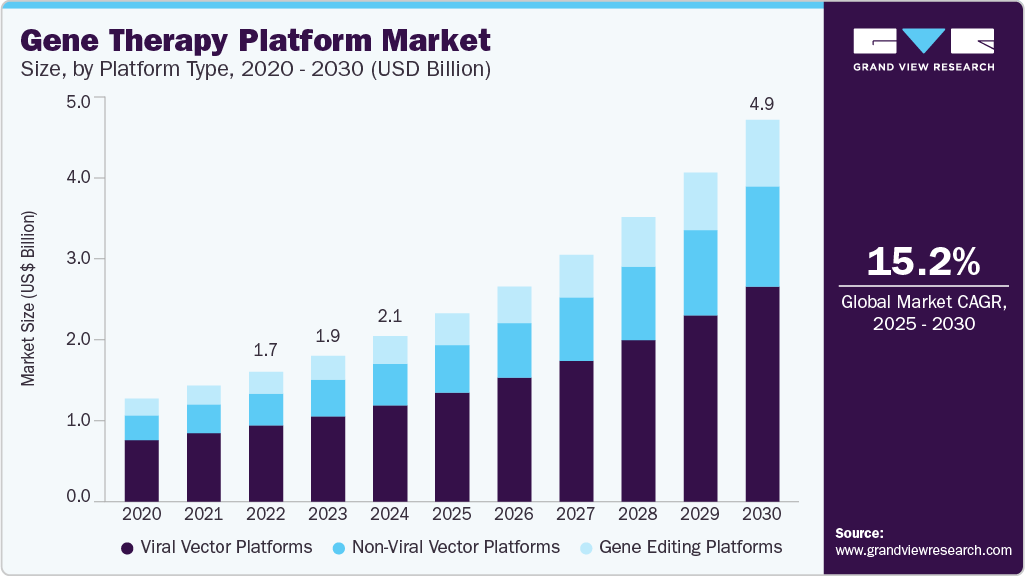

Gene Therapy Platform Market Size, Share & Trends Analysis grow at a CAGR of 15.2% from 2025 to 2030.

The global gene therapy platform market size was estimated at USD 2.14 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. The growth is driven by several key drivers, including rapid technological advancements, increasing prevalence of genetic and chronic diseases, growing investments and funding in biopharmaceutical research, and supportive regulatory frameworks facilitating faster approvals.

Key Highlights:

- North America dominated the global gene therapy platform market and accounted for the largest share of 35.96% in 2024.

- The gene therapy platform market in the U.S. is experiencing rapid advancements in gene therapy

- By platform type, the viral vector platforms segment dominated the market with the largest revenue share of 58.12% in 2024

- By application, the oncology segment held the largest revenue share in 2024

- By delivery method, the in vivo gene therapy segment held the largest revenue share in the 2024 market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/gene-therapy-platform-market-report/request/rs1

Innovations in viral vector technologies, gene editing tools including CRISPR, integration of AI and automation in manufacturing are enhancing therapy precision and production efficiency. For instance, in March 2023, Catalent is enhancing its UpTempo AAV platform to speed up the development of gene therapies.

The increasing number of FDA approvals for gene therapies targeting rare and genetic diseases has validated the clinical potential of these platforms, encouraging investment and R&D. For instance, in December 2023[, CRISPR-based therapies, like Exagamglogene autotemcel (Casgevy), received FDA approval for sickle cell disease and beta-thalassemia, marking a significant milestone in gene therapy. These breakthroughs are pushing the field forward, enabling more efficient technology for various genetic disorders.

The rising prevalence of genetic disorders and chronic diseases worldwide, is fueling demand for gene therapies that target disease at the molecular level. Conditions such as cystic fibrosis, hemophilia, spinal muscular atrophy, and various cancers are increasingly treated with gene therapy approaches that offer potentially curative outcomes. The World Health Organization (WHO) in 2024 projected a sharp increase in cancer cases globally, with over 35 million new cases expected by 2050, up 77% from 2022. This growing patient pool creates urgent demand for advanced treatments, driving investment and innovation in gene therapy technologies to address unmet medical needs.

Moreover, regulatory support for innovative therapies is driving market growth. Regulatory agencies, including the FDA and the European Medicines Agency (EMA), have streamlined approval processes for gene therapies, recognizing their transformative potential. In addition, regulatory incentives such as fast-track designations and orphan drug status further support the development of gene therapies. These measures help reduce development timelines and encourage the introduction of new treatments to address unmet medical needs.

The COVID-19 pandemic significantly impacted the market, disrupting clinical trials, manufacturing, and supply chains. The increased demand for raw materials for COVID-19 vaccine production caused shortages, affecting the availability of essential components for gene therapy manufacturing. Despite these challenges, the pandemic also spurred innovation, with some gene therapy developers adapting their efforts toward COVID-19-related therapeutics and vaccines, highlighting the resilience and potential of the gene therapy sector.