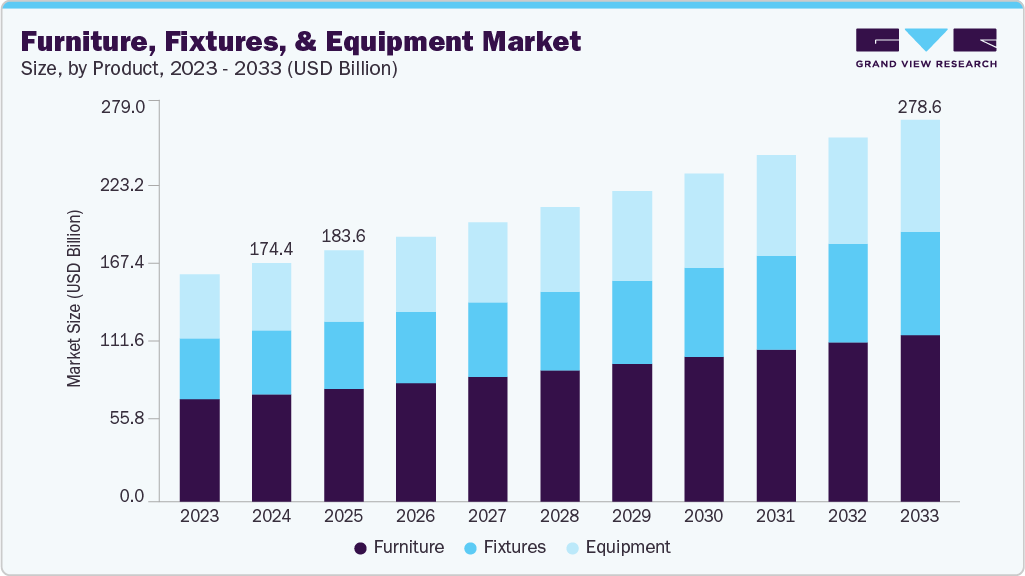

Furniture, Fixtures, And Equipment Market growing at a CAGR of 5.4% from 2025 to 2033

The global furniture, fixtures, and equipment market size was estimated at USD 174.44 billion in 2024 and is expected to reach USD 278.55 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is experiencing robust growth, driven by expanding commercial construction, rising hospitality investments, and increased corporate spending on workplace modernization.

Key Market Trends & Insights

- By region, Europe led the market with a share of 33.2% in 2024.

- By product, furniture led the market and accounted for a share of 45.1% in 2024.

- By end use, the hotels & hospitality segment led the market and accounted for a share of 39.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 174.44 Billion

- 2033 Projected Market Size: USD 278.55 Billion

- CAGR (2025-2033): 5.4%

- Europe: Largest market in 2024

- Asia Pacific : Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/furniture-fixtures-equipment-market-report/request/rs1

The growing focus on infrastructure development across emerging and developed economies, particularly in hospitality, healthcare, and corporate sectors, is propelling the demand for integrated furniture, fixtures, and equipment (FF&E) solutions. Governments and private developers are actively investing in large-scale projects such as hotels, hospitals, offices, and retail outlets, all of which require coordinated FF&E installations to meet aesthetic, functional, and operational needs. For instance, according to Saudi Arabia’s National Transformation Plan, the country will build more than 555,000 residential units, more than 275,000 hotel keys, over 4.3 million sq m of retail space, and over 6.1 million sq m of new office space by 2030. Saudi Arabia’s Vision 2030 and other national transformation programs worldwide are promoting large real estate developments, thereby strengthening demand for FF&E products globally.

Moreover, the increasing capital investments in office infrastructure, primarily driven by the development of Information Technology (IT) hubs in various countries, are expected to prompt the need for office furniture, fixtures, and equipment during the forecast period. According to the Economic Impact Study commissioned by the Building Owners and Managers Association International (BOMA), the establishment of business offices in the U.S. is increasing. Moreover, government initiatives focusing on the development of the real estate industry will consequently drive the demand for furniture. According to Saudi Arabia’s National Transformation Plan, the country will build more than 555,000 residential units, more than 275,000 hotel keys, over 4.3 million sq m of retail space, and over 6.1 million sq m of new office space by 2030.

The market is witnessing a clear shift toward customized, ergonomic, and sustainable FF&E solutions that cater to diverse end-use sectors such as corporate offices, hospitality, healthcare, and educational institutions. With continuous investments in real estate and infrastructure projects globally, the demand for high-quality products is anticipated to remain strong, positioning the market for steady growth over the coming years. According to a Resume Builder survey of 1,000 company leaders, 90% of companies planned to implement return-to-office policies by the end of 2024. This will increase the demand for furniture solutions that accommodate the needs of modern office environments.

Furniture, Fixtures, And Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 183.55 billion |

|

Revenue forecast in 2033 |

USD 278.55 billion |

|

Growth rate |

CAGR of 5.4% from 2025 to 2033 |

|

Actuals |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; CSA; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

Kimball International Inc.; Global Furniture Group; Steelcase Inc.; Herman Miller Inc.; Haworth Inc.; Stryker Corporation; Ashley Furniture Industries, Inc.; Inter IKEA Systems B.V.; Häfele, Kinnarps Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |