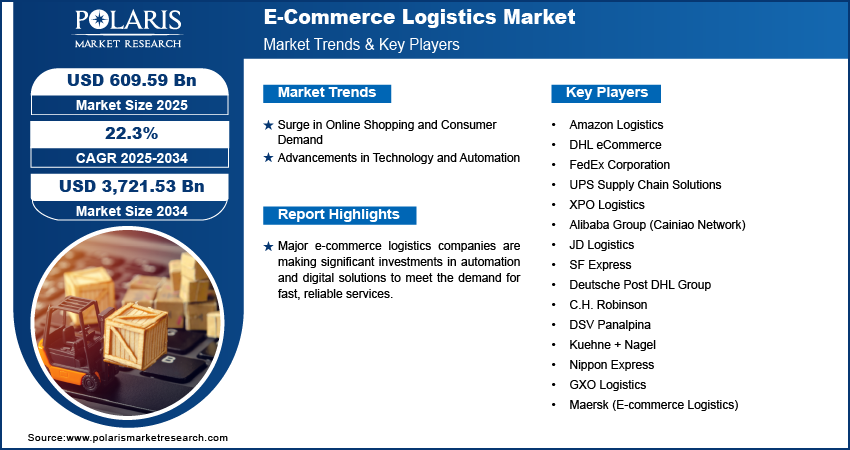

E-Commerce Logistics Market Analysis: Opportunities, Innovations, and Growth Potential Through 2034

The global e-commerce logistics market size was valued at USD 500.76 billion in 2024 and is expected to reach USD 609.59 billion by 2025 and USD 3,721.53 billion by 2034, exhibiting a CAGR of 22.3% from 2025 to 2034. This upward trajectory is largely fueled by E-commerce logistics refers to the essential infrastructure that supports the smooth movement of goods from online retailers to consumers. It includes warehousing, transportation, last-mile delivery, reverse logistics, and the integration of advanced technologies to ensure efficient order fulfillment and delivery.

Market Definition

E-Commerce Logistics Market Covers logistics services that support online retail operations, including warehousing, order fulfillment, shipping, and last-mile delivery.

Key Report Highlights

- The report highlights the key region that accounts for the highest revenue share in the global E-Commerce Logistics market.

- It identifies the leading country within this region that makes a significant contribution to the market’s overall performance.

- The report outlines the dominant segment that holds a major share of the market.

- It also emphasizes the fastest-growing segment projected to gain strong traction during the forecast period.

- Qualitative and quantitative market analysis have been used to provide an in-depth understanding of the market.

Market Overview: Key Figures at a Glance

- Market Value in 2024: USD 500.76 billion

- Projected Market Size in 2034: USD 3,721.53 billion

- Anticipated CAGR 2034: 22.3%

Get access to the full report or request a complimentary sample for in-depth analysis: https://www.polarismarketresearch.com/industry-analysis/e-commerce-logistics-market

Market Growth Drivers

Market Key Players

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

Add key players by referring to the RD for the E-Commerce Logistics market available on our website.

- UPS Supply Chain Solutions

- XPO Logistics

- Alibaba Group (Cainiao Network)

- JD Logistics

- SF Express

- Deutsche Post DHL Group

- C.H. Robinson

- DSV Panalpina

- Kuehne + Nagel

- Nippon Express

- GXO Logistics

- Maersk (E-commerce Logistics)