E-Commerce Automotive Aftermarket Size, Share & Trends Analysis growing at a CAGR of 20.5% from 2024 to 2030

The global e-commerce automotive aftermarket size was valued at USD 62.12 billion in 2023 and is projected to reach USD 208.16 billion by 2030, growing at a CAGR of 20.5% from 2024 to 2030. The growing usage of online platforms to purchase car parts and accessories is a significant trend driven by consumers seeking convenience, variety, and competitive prices.

Key Market Trends & Insights

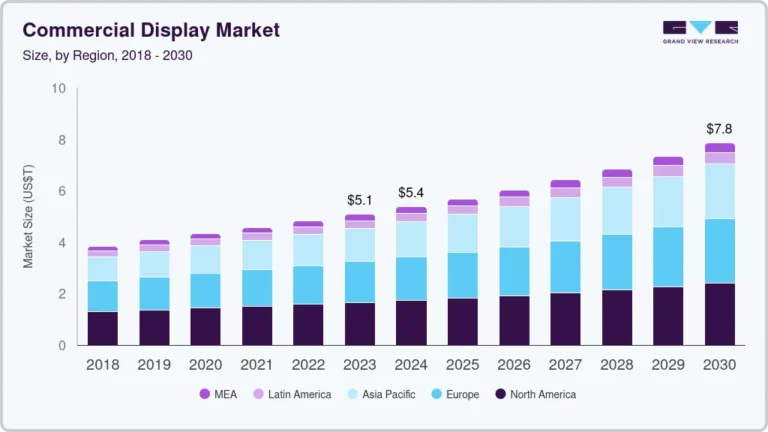

- North America e-commerce automotive aftermarket held the largest market revenue share of 28.9% in 2023.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- Based on replacement parts, the transmission and steering segment held the largest market revenue share of 22.7% in 2023.

- Based on end use, the business-to-customer segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 62.12 Billion

- 2030 Projected Market Size: USD 208.16 Billion

- CAGR (2024-2030): 20.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/e-commerce-automotive-aftermarket-report/request/rs1

Enhancements in technology, such as improved logistics and real-time inventory management, improve the overall online shopping process. Moreover, the increasing number of smartphones and internet availability make reaching e-commerce websites easier.

The growing preference for online shopping across various sectors, including automotive parts and accessories drives market growth. Consumers find it more convenient to search, compare, and purchase automotive components online, thanks to the easy accessibility of information, user reviews, and competitive pricing offered by e-commerce platforms. This shift towards digital retail channels has been further amplified by the proliferation of mobile devices, which enable customers to make purchases anytime and anywhere, thus accelerating the demand for online automotive aftermarket services.

Additionally, advancements in logistics and supply chain networks have enhanced the capabilities of e-commerce platforms to deliver automotive parts quickly and efficiently. This has made online purchases more attractive to consumers who need timely delivery for maintenance and repair services. The rising availability of a wide range of automotive products, faster shipping options, and easier returns policies also support the demand surge. Including original equipment manufacturer (OEM) parts and aftermarket alternatives on online platforms provides consumers with more choices, encouraging further adoption of e-commerce in the automotive sector.

The growing penetration of the internet and the rising importance of digitization in emerging markets have also contributed to the increased demand for e-commerce automotive aftermarket services. In regions where access to traditional physical automotive parts stores may be limited, e-commerce is a crucial channel for sourcing necessary parts. This trend is expected to continue as internet access and digital literacy improve globally, making e-commerce platforms the preferred method for purchasing automotive aftermarket products.

Replacement Parts Insights

The transmission and steering segment held the largest market revenue share of 22.7% in 2023. As vehicles age, components such as steering and transmission systems experience wear and tear, leading to a higher need for replacement parts. E-commerce platforms offer a wide range of these parts, making it easier for consumers to find compatible components at competitive prices. Additionally, advancements in delivery logistics and user-friendly interfaces on e-commerce platforms have fueled this demand, allowing DIY enthusiasts and repair shops to access the necessary parts quickly.

The lighting segment is expected to grow at the fastest CAGR over the forecast period. The rising need for improved vehicle safety and visibility has led to an uptick in consumers seeking high-quality lighting solutions such as LED and HID bulbs. Additionally, the increasing number of vehicles on the road, combined with the frequent need to replace or upgrade automotive lighting due to wear and tear or technological advancements, has contributed to this growth. The trend is also influenced by the growing preference for energy-efficient lighting options, making replacement parts such as headlights, taillights, and interior lighting prevalent in the aftermarket segment.