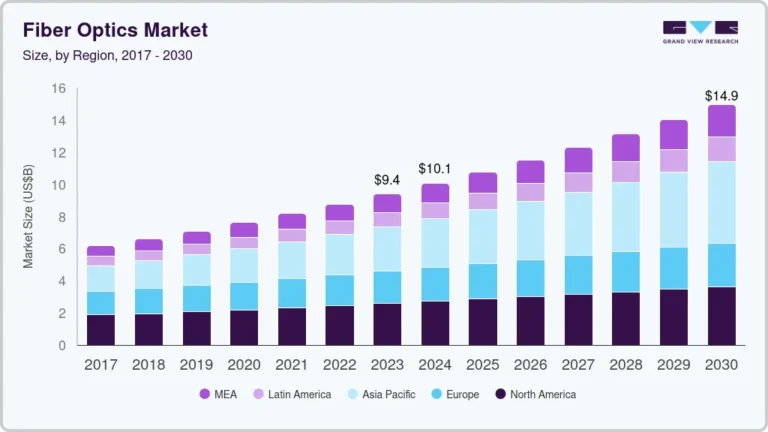

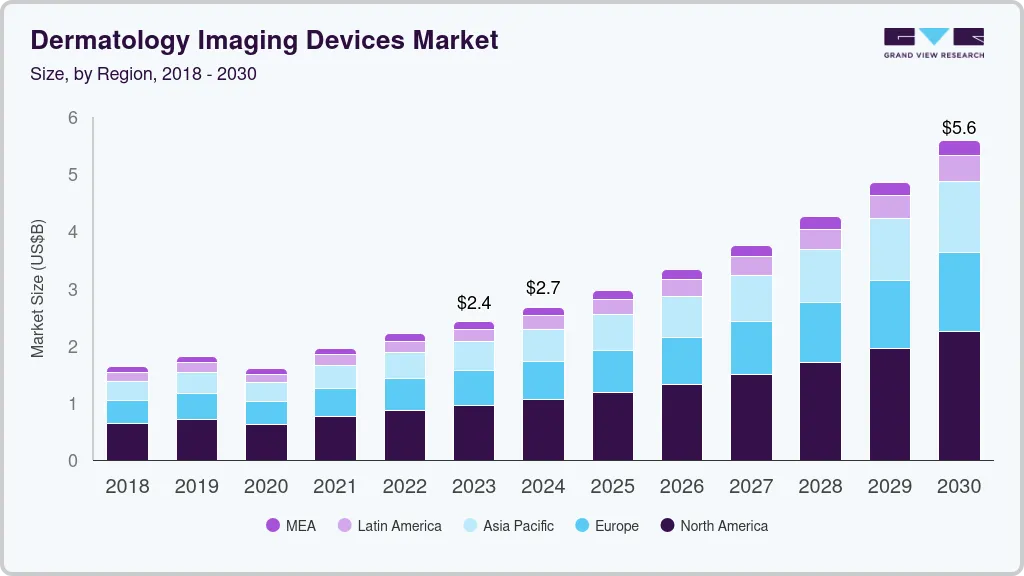

Dermatology Imaging Devices Market growing at a CAGR of 13.09% from 2024 to 2030

The global dermatology imaging devices market size was estimated at USD 2.42 billion in 2023 and is projected to reach USD 5.60 billion by 2030, growing at a CAGR of 13.09% from 2024 to 2030. The growing prevalence of skin disorders, rising awareness about skin cancers, and the growing demand for non-invasive diagnostic procedures are some of the major factors anticipated to boost the market growth over the forecast period.

Key Market Trends & Insights

- North America dermatology imaging devices market dominated the market with the revenue share of 39.48% in 2023.

- The dermatology imaging devices market in the U.S. is expected to grow at the fastest CAGR over the forecast period.

- Based on end-use, the hospitals segment led the market with the largest revenue share of 43.99% in 2023.

- Based on modality, the dermatoscope segment led the market with the largest revenue share of 41.42% in 2023.

- Based on application, the skin cancers segment led the market with the largest revenue share of 48.63% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.42 Billion

- 2030 Projected Market Size: USD 5.60 Billion

- CAGR (2024-2030): 13.09%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/dermatology-imaging-devices-market-report/request/rs1

Furthermore, technological advancements have developed advanced dermatology imaging devices with higher accuracy and faster results. For instance, the introduction of optical coherence tomography (OCT) and confocal microscopy has transformed the diagnosis of skin disorders by providing high-resolution images of skin layers in a non-invasive procedure.

The increasing prevalence of skin cancer worldwide has created a strong demand for market in the forecast period. According to the American Academy of Dermatology Association, skin cancer is most prevalent in the U.S.; around 9,500 people get diagnosed with skin cancer daily, and above 1 million are currently suffering from melanoma. As per the estimates, around 197,700 new cases of melanoma will be diagnosed in 2022, among which non-invasive methods diagnose 97,920 and 99,780 are diagnosed by invasive procedures. Skin cancers are predominantly found in women than in men below age 50, but it is significantly higher in men above age 50. It can be attributed to the differences in recreation and work-related UV exposure. According to the estimates, around 1 in 27 men and 1 in 40 women are expected to suffer from melanoma. Melanoma holds only 1% of all the skin cancers found in the U.S., whereas it leads to the highest number of deaths from skin cancer. According to the American Society of Clinical Oncology (ASCO), it is evaluated that around 7,990 deaths, among which 5,420 are men and 2,570 are women from melanoma, will occur in the United States in 2023.

The field of dermatology has seen significant technological advancements in imaging devices in recent years. Several companies have launched new products that utilize innovative partnerships to improve patient outcomes. These new technologies have allowed for more accurate diagnoses and better treatment options for skin conditions. For instance, In August 2023, BioActor, a Solabia subsidiary, and Pixience, a manufacturer of digital dermatoscope technology, have collaborated to develop a new skin imaging technology to test and validate nutritional bioactives used for skin health. Pixience has developed a skin image-capturing device called C-Cube and image analysis software called QuickScale, which can evaluate various skin health parameters, including 3D image evaluation.

The demand for noninvasive imaging tools for diagnosing and treatment of skin cancers and other skin-related disorders is expected to create lucrative growth opportunities in the forecast period. Patients and physicians prefer noninvasive technologies, as they are less painful, have minor risks, and require less recovery time. According to an article published by Memorial Sloan Kettering Cancer Center, Early detection of skin cancer can be challenging. Traditionally, dermatologists use biopsies to examine skin cancer, but this can be invasive and cause scarring.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market has witnessed a high degree of innovation, marked by several instances of regulatory approvals, partnerships, and collaborations. In recent years, the market has seen a surge in the number of new product launches, making it increasingly challenging for market leaders to sustain themselves in the ever-changing market. However, leading players are investing heavily in R&D activities to develop advanced imaging technologies, which is expected to fuel market growth. For instance, Canfield Scientific, Inc. launched VISIA Skin Analysis, facial imaging device in December 2023. VISIA is an AI integrated device used to capture high quality standardized images to analyze the results.

Technological advancements and product launches drive the market growth. Startups like MetaOptima are leading the way in developing innovative AI-powered solutions for skin cancer detection. MetaOptima’s DermEngine platform utilizes AI algorithms to analyze images of skin lesions, enabling dermatologists to accurately diagnose and manage skin cancer cases at an early stage. With the growing demand for early skin cancer detection and other dermatological conditions, these startups are poised to revolutionize the market growth.

Dermatology Imagine Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.67 billion |

|

Revenue forecast in 2030 |

USD 5.60 billion |

|

Growth rate |

CAGR of 13.09% from 2024 to 2030 |

|

Actual data |

2018 – 2022 |

|

Forecast period |

2024 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Modality, application, end-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Canfield Scientific, Inc.; FotoFinder Systems GmbH; e-con Systems Inc.; Courage+Khazaka electronic GmbH; Longport, Inc.; Cortex Technology; DRAMIŃSKI S. A.; GE HealthCare; VisualSonics; Clarius; Koninklijke Philips N.V.; Michelson Diagnostics Ltd (MDL); Caliber Imaging and Diagnosis.; and DermLite |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |