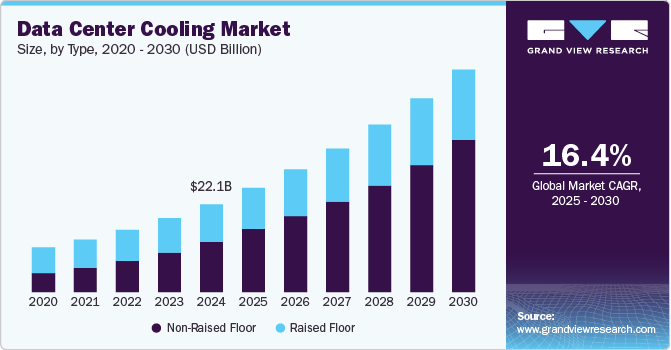

Data Center Cooling Market Size, Share & Trends Analysis growing at a CAGR of 16.4% from 2025 to 2030

The global data center cooling market size was estimated at USD 22.13 billion in 2024 and is projected to reach USD 56.15 billion by 2030, growing at a CAGR of 16.4% from 2025 to 2030. The growing need for energy-efficient data centers is expected to present significant growth opportunities for the data center cooling industry.

- The data center cooling industry in North America held a significant share of over 34.0% in 2024.

- The data center cooling industry in the U.S. is expected to grow significantly at a CAGR of 10.8% from 2025 to 2030.

- By application, the telecom segment dominated the market and accounted for the revenue share of over 28.0% in 2024 .

- By solution, the air conditioners segment dominated the market in 2024 .

Market Size & Forecast

- 2024 Market Size: USD 22.13 Billion

- 2030 Projected Market Size: USD 56.15 Billion

- CAGR (2025-2030): 16.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/data-center-cooling-market/request/rs1

Many leading companies are planning expansions in response to this demand. Additionally, the positive growth outlook is driven by the rapid surge in data generation, which in turn fuels the increasing demand for data centers worldwide. Given that data centers consume substantial amounts of energy, they also generate a considerable amount of heat, which increases the necessity for advanced and efficient cooling solutions.

Several prominent companies are acquiring data center cooling providers to broaden their market presence in untapped regions. For instance, in October 2024, Schneider Electric announced an agreement to acquire a majority stake in Motivair Corporation, a U.S.-based company specializing in liquid cooling and advanced thermal management solutions for high-performance computing systems. Additionally, these companies are adopting innovations within the data center cooling sector, such as integrating artificial intelligence and automation to monitor and analyze trends, which is fueling growth in this segment.

The data center cooling industry is directed by various regulations, with governments across different regions emphasizing the importance of efficient data center incident response and recovery protocols. Cooling systems play a crucial role in preventing equipment overheating and ensuring the continued operation of data centers during and after emergencies.

The threat of substitutes remains moderate. As energy costs rise and data centers continue to expand to meet increasing demand, mechanical cooling becomes an increasingly expensive operational burden. In response, virtual containment technology has emerged as an energy-efficient alternative. For instance, in March 2025, Chemours Company, a U.S.-based company in performance chemistry, launched a full-scale product trial with NTT DATA and Hibiya Engineering, Ltd. to test two-phase immersion cooling for data centers using Chemours’ Opteon 2P50 dielectric fluid. This trial follows successful lab tests and is a key step in the product’s commercialization.