Compact Agricultural Tractors growing at a CAGR of 9.0% from 2025 to 2030

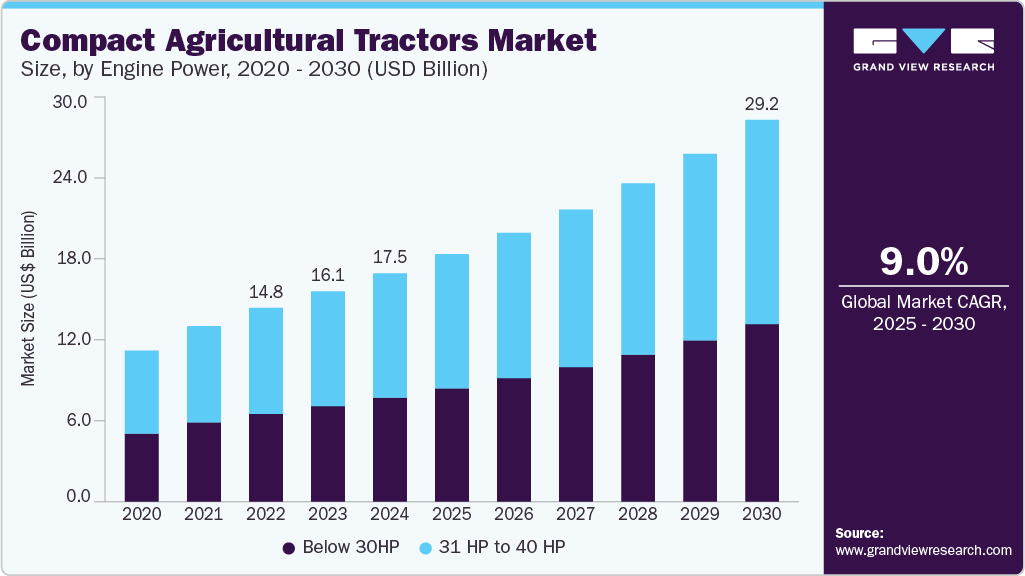

The global compact agricultural tractors market size was estimated at USD 17.48 billion in 2024 and is anticipated to reach USD 29.21 billion by 2030, growing at a CAGR of 9.0% from 2025 to 2030. The rising trend of small-scale and precision farming across both developed and developing regions is driving the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the compact agricultural tractors market with the largest revenue share of 53.0% in 2024.

- The compact agricultural tractors market in India is projected to grow at the fastest CAGR during the forecast period.

- By engine power, the 31 HP to 40 HP segment led the market with the largest revenue share of 54.38% in 2024.

- By driveline, the 2WD segment led the market with the largest revenue share of 88.85% in 2024.

- By propulsion, the ICE segment led the market with the largest revenue share of 86.79% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.48 Billion

- 2030 Projected Market Size: USD 29.21 Billion

- CAGR (2025-2030): 9.0%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/compact-agricultural-tractors-market-report/request/rs1

As agricultural land holdings shrink due to urbanization and land division among heirs, farmers are increasingly adopting compact tractors that are more suitable for managing small plots of land efficiently. These tractors are easier to maneuver, require less fuel, and are ideal for tasks like tilling, plowing, and hauling within tight field boundaries. The affordability and versatility of compact tractors make them highly attractive to smallholder farmers who seek to increase productivity without investing in large-scale machinery.

The increased mechanization of farming in developing countries, particularly in Asia and Africa, is driving the adoption of compact agricultural tractors. Governments in these regions are actively promoting farm mechanization to address labor shortages and enhance food security. Compact tractors are often subsidized or supported through rural development schemes, making them accessible to a broader base of farmers. These tractors also require less infrastructure for operation and maintenance, which is particularly beneficial in rural areas with limited access to service centers. As more countries focus on agricultural modernization, the demand for compact tractors is expected to rise.

The growing use of compact tractors for non-agricultural applications is also boosting the market. Compact agricultural tractors are being increasingly used in landscaping, municipal maintenance, snow removal, and construction activities. Their compact size, ease of attachment to multiple implements, and fuel efficiency make them suitable for a wide variety of tasks beyond traditional farming. Municipal bodies and contractors prefer these machines for their ability to work in confined spaces, such as parks, gardens, and roadside maintenance areas. This cross-industry usage is diversifying the customer base and expanding the overall market demand.

The increased demand for horticulture and organic farming, particularly in peri-urban and semi-urban areas, is driving market growth. As consumer preferences shift toward healthier food options, farmers and agribusinesses are focusing on high-value crops such as fruits, vegetables, and herbs. These crops often require more precise and frequent cultivation, which is well-suited to compact tractors due to their agility and compatibility with various specialized implements. Compact tractors can easily navigate between closely planted rows and operate in greenhouses or polyhouses, where larger machines would be impractical.

Moreover, dealer network expansion and digital sales platforms are making compact tractors more accessible to rural and semi-urban customers. Manufacturers are investing in wider dealership coverage, especially in underserved regions, and engine power demo programs that allow farmers to test equipment before purchasing. The rise of online sales and digital financing tools has also reduced barriers to purchase, particularly for tech-savvy younger farmers. This expanded access, coupled with improved after-sales service and spare parts availability, is strengthening consumer confidence and accelerating market penetration.

Compact Agricultural Tractors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 18.95 billion |

|

Revenue forecast in 2030 |

USD 29.21 billion |

|

Growth rate |

CAGR of 9.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Engine Power, driveline, propulsion, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

AGCO Corporation; CLAAS KGaA mbH; CNH Industrial N.V.; Daedong Corporation; Deere & Company; International Tractors Limited; Kubota Corporation; Mahindra & Mahindra Ltd.; TYM Corporation; YANMAR HOLDINGS CO., LTD. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |