Bioplastic Packaging Market growing at a CAGR of 17.24% from 2025 to 2030

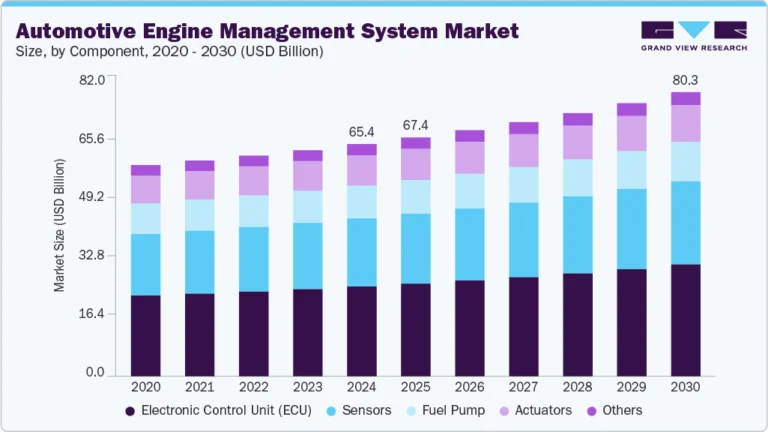

The global bioplastic packaging market size was estimated at USD 19.55 billion in 2024 and is projected to reach USD 50.57 billion by 2030, growing at a CAGR of 17.24% from 2025 to 2030. The factors that drive the market growth include the increasing consumption of renewable and bio-based products, growing demand from the flexible packaging industry, and exceptional properties of bioplastic, such as contributing less to the carbon footprint and decomposing faster than plastic.

Key Market Trends & Insights

- Europe bioplastic packaging market dominated the global industry and accounted for the largest revenue share of 32.73% in 2024, largely attributed to its robust regulatory framework and commitment to achieving a circular economy.

- In the U.S., stringent state-level regulations and federal support for sustainable materials are major drivers for the bioplastic packaging industry.

- Based on material, biodegradable dominated the bioplastic packaging market in terms of revenue, accounting for an industry share of 52.68% in 2024, owing to the rising demand for bio-based plastics in various end-use industries.

- In terms of type, flexible packaging dominated the bioplastic packaging industry across the distribution channel segmentation in terms of revenue, accounting for a market share of 58.11% in 2024.

- On the basis of application, food and beverages dominated the market for bioplastic packaging across the distribution channel segment in terms of revenue, accounting for a market share of 58.95% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.55 billion

- 2030 Projected Market Size: USD 50.57 billion

- CAGR (2025-2030): 17.24%

- Europe: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/bioplastic-packaging-market/request/rs1

However, the price competitiveness of bioplastic packaging over conventional plastics is restraining the market growth to some extent.

The bioplastic packaging industry is witnessing a strong trend toward the adoption of bio-based materials as businesses and consumers increasingly prioritize sustainability. Packaging made from renewable resources such as corn starch, sugarcane, and cellulose is becoming more common across industries like food and beverage, personal care, and retail. This shift is driven by heightened environmental awareness, stringent regulations on conventional plastics, and the growing demand for eco-friendly alternatives. Companies are also leveraging advanced biopolymer technologies to produce high-performance materials with enhanced durability and barrier properties, enabling broader application across diverse packaging formats.

Drivers, Opportunities & Restraints

Government policies and international regulations aimed at curbing single-use plastic waste are a major driver for the bioplastic packaging market growth. Numerous countries have implemented bans or restrictions on conventional plastic bags, straws, and packaging materials, creating significant opportunities for bioplastic alternatives. For instance, the European Union’s Single-Use Plastics Directive and similar initiatives in Asia and North America are encouraging industries to transition to biodegradable and compostable packaging. These regulatory frameworks not only push businesses to adopt sustainable materials but also provide incentives and support for innovation in bioplastic production technologies.

Emerging economies in Asia, Africa, and Latin America present substantial growth opportunities for the bioplastic packaging market. With rapid urbanization, growing middle-class populations, and increased consumer awareness about environmental issues, these regions are shifting toward sustainable packaging solutions.

Bioplastic Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 22.82 billion |

|

Revenue forecast in 2030 |

USD 50.57 billion |

|

Growth rate |

CAGR of 17.24% from 2025 to 2030 |

|

Historical data |

2018 – 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Material, type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Germany; UK; France; Russia; Italy; China; Japan; India; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Amcor Plc.; Novamont S.p.A; NatureWorks, LLC.; Coveris; Sealed Air; Alpha Packaging; Constantia Flexibles ;Mondi; Transcontinental Inc.; ALPLA |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |