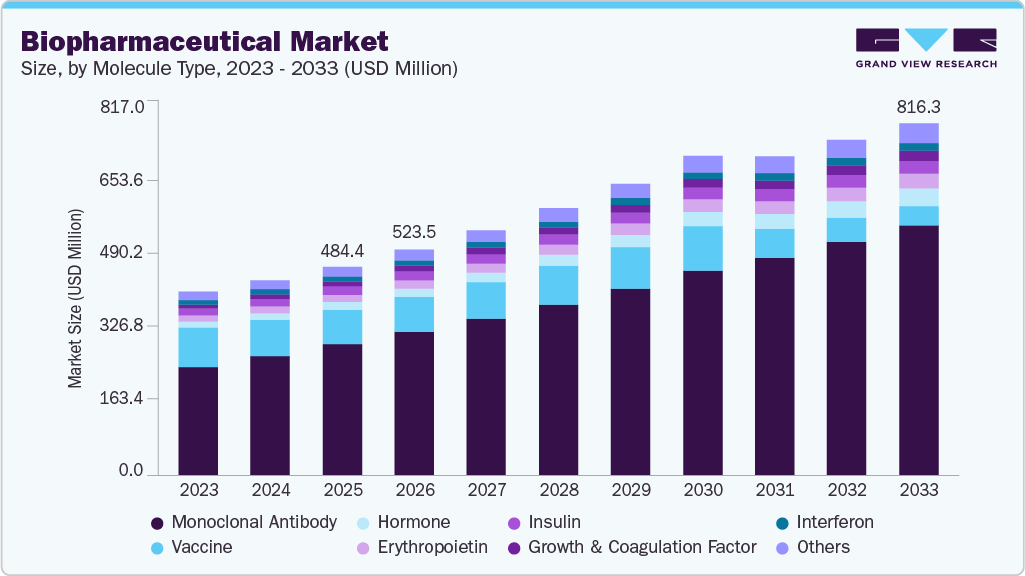

Biopharmaceutical Market growing at a CAGR of 6.55% from 2026 to 2033

The global biopharmaceutical market size was estimated at USD 484.38 million in 2025 and is projected to reach USD 816.30 million by 2033, growing at a CAGR of 6.55% from 2026 to 2033. The biopharmaceutical industry’s growth is driven by increasing demand for targeted therapies, advancements in biotechnology, the rising prevalence of chronic diseases, and an aging population.

Key Market Trends & Insights

- North America dominated the global biopharmaceutical market with the largest revenue share of 54.35% in 2025.

- The biopharmaceutical industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- Based on molecule type, the monoclonal antibody (mAb) segment led the market with the largest revenue share of 63.05% in 2025

- Based on disease, the oncology segment led the market with the largest revenue share of 31.17% in 2025.

- Based on drug type, the proprietary (branded) segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 484.38 Million

- 2033 Projected Market Size: USD 816.30 Million

- CAGR (2026-2033): 6.55%

- North America: Largest market in 2025

- Latin America: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/biopharmaceutical-market/request/rs1

The biopharmaceutical industry is witnessing rapid growth, driven by significant advancements in biotechnology and drug development. Innovations in vaccine technology, monoclonal antibodies, gene therapies, and next-generation biologics are transforming treatment paradigms across multiple therapeutic areas. These breakthroughs enhance treatment efficacy, improve patient outcomes, and address unmet medical needs. Recent developments highlight the impact of these advancements on the global healthcare landscape, underscoring the pivotal role of biopharmaceuticals in combating diseases.

In February 2025, Zydus Lifesciences introduced VaxiFlu-4, India’s first quadrivalent influenza vaccine, marking a significant leap in vaccine technology. This novel flu protection vaccine, developed at Zydus’s Vaccine Technology Centre in Ahmedabad, has been formulated according to the WHO recommended composition to combat emerging strains of the influenza virus. With clearance from the Central Drug Laboratory, VaxiFlu-4 is expected to play a crucial role in preventing flu outbreaks and addressing public health challenges. This innovation exemplifies how advancements in vaccine development are bolstering disease prevention strategies and contributing to the growth of the biopharmaceutical industry.

As companies seek to enhance their research and development capabilities, strengthen distribution networks, and improve patient access, strategic initiatives are emerging as a key driver of market growth. In January 2024, Barinthus Biotherapeutics announced a partnership with the Coalition for Epidemic Preparedness Innovations (CEPI) and the University of Oxford to advance the development of VTP-500, a vaccine targeting Middle East Respiratory Syndrome (MERS) a highly fatal disease with no licensed vaccines or treatments. CEPI has committed an investment of up to USD 34.8 million to Barinthus Bio, supplementing prior funding allocated to the University of Oxford for emergency MERS vaccine stockpiling. The VTP-500 project leverages the ChAdOx1 platform, a proven vaccine technology, and its success in Phase 2 trials could pave the way for regulatory approval and rapid deployment during significant MERS outbreaks.

Market Concentration & Characteristics

The biopharmaceutical industry is rapidly evolving with advancements in monoclonal antibodies, gene therapies, and novel biologic formulations. Innovations in targeted drug delivery, extended half-life formulations, and combination biologics are enhancing treatment efficacy while reducing side effects. Emerging biologics are addressing oncology, metabolic disorders, autoimmune diseases, and infectious diseases, driving the next wave of transformative therapies.

Mergers and acquisitions play a crucial role in shaping the biopharmaceutical industry, as large pharmaceutical companies acquire biotech firms to strengthen their biologics pipelines. Strategic collaborations focus on expanding manufacturing capabilities, integrating advanced delivery technologies, and accelerating clinical development. The rising demand for precision medicine and cell and gene therapies is fueling industry consolidation, enhancing competition and innovation.

Regulatory bodies such as the FDA and EMA enforce strict guidelines to ensure the safety, efficacy, and quality of biologics. The long and costly approval processes, involving extensive preclinical and clinical evaluations, impact market entry timelines. Additionally, pricing and reimbursement challenges influence the adoption of high-cost biologics. Global regulatory harmonization is essential to streamline approvals and improve patient access.

Molecule Type Insights

The monoclonal antibody (mAb) segment led the market with the largest revenue share of 63.05% in 2025, driven by their broad therapeutic applications in oncology, immunology, and infectious diseases. Their targeted mechanism of action and high efficacy in treating chronic and life-threatening conditions have made them a cornerstone of modern biopharmaceuticals. The monoclonal antibody (mAb) and biopharmaceutical industry is experiencing robust growth, driven by the increasing prevalence of chronic diseases like cancer and autoimmune disorders. For instance, as per a report by National Cancer Institute, in 2024, it is projected that 2,001,140 new cancer cases will be diagnosed in the U.S., with an estimated 611,720 people expected to lose their lives to the disease. mAbs, engineered proteins that mimic the body’s natural antibodies, offer highly targeted therapies, leading to improved efficacy and reduced side effects compared to traditional drugs.

Disease Insights

The oncology segment led the market with the largest revenue share of 31.17% in 2025. The increasing incidence of cancer worldwide, coupled with strong clinical pipelines for targeted biologics and immunotherapies, is driving significant market expansion. The oncology segment is one of the most dynamic and rapidly growing areas of the biopharmaceutical industry, driven by the increasing prevalence of cancer worldwide and the continuous advancements in cancer treatment. For instance, as per a report by WHO in 2024, cancer is a leading cause of global mortality, responsible for approximately 1 in every 6 deaths and impacting nearly every household.

Drug Type Insights

The proprietary (Branded) biopharmaceuticals segment led the market with the largest revenue share of 77.45% in 2025. High R&D investments, patent protection, and continued innovation in biologics contribute to this dominance. These drugs are patented medications marketed under proprietary names, addressing multiple critical healthcare complications related to oncological, cardiovascular, neurological, immunological, and other diseases. These products are often priced on the premium side of the pricing spectrum. This pricing is the result of multiple factors like substantial investment in research, development, and regulatory approvals and the value they deliver in advancing treatment standards.

Biopharmaceutical Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 523.49 million |

|

Revenue forecast in 2033 |

USD 816.30 million |

|

Growth rate |

CAGR of 6.55% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Molecule type, disease, drug type, drug development type, formulation, route of administration, prescription type, sales channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

F. Hoffmann-La Roche Ltd; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GSK plc.; AstraZeneca; Takeda Pharmaceutical Company Limited; Biogen; Eli Lilly and Company; Novo Nordisk A/S; Amgen Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |