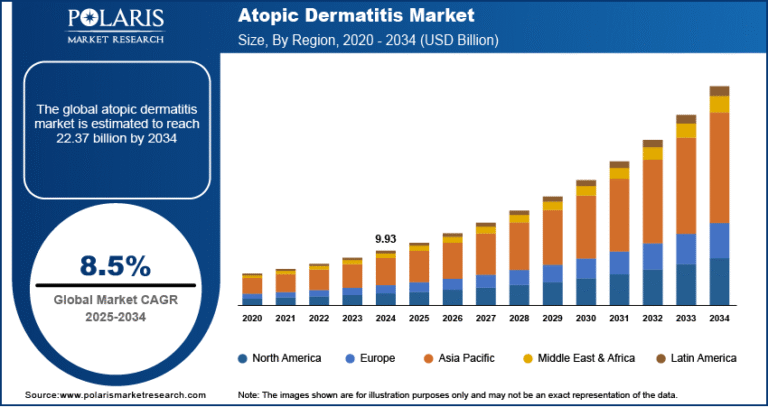

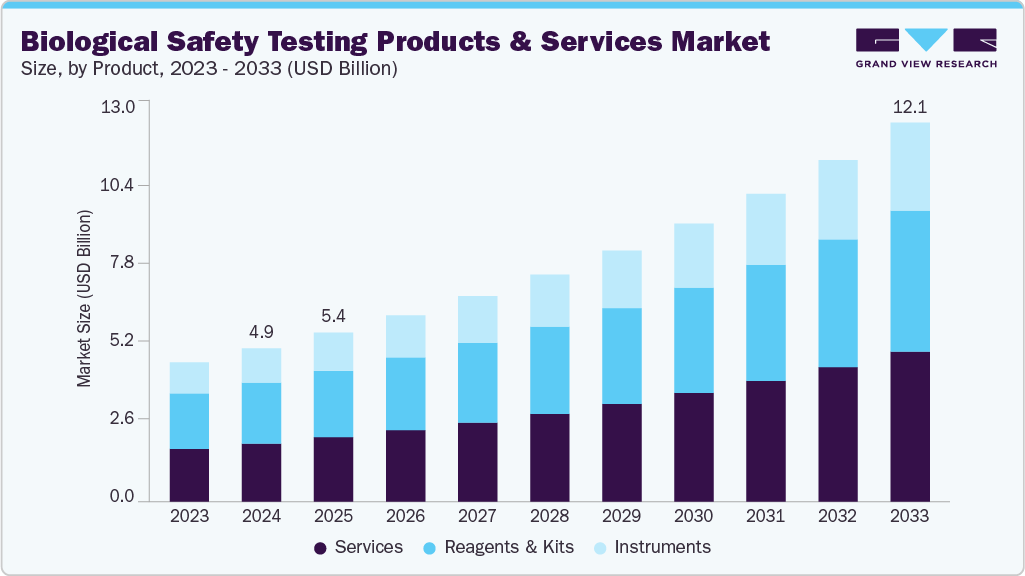

Biological Safety Testing Products And Services Market Size, Share & Trends Analysis growing at a CAGR of 10.64% from 2025 to 2033

The global biological safety testing products & services market size was estimated at USD 4.89 billion in 2024 and is projected to reach USD 12.09 billion by 2033, growing at a CAGR of 10.64% from 2025 to 2033. The growing prevalence of target diseases and rising production of next-generation biologics by various biotechnology and pharmaceutical organizations are anticipated to boost the biological safety testing products & services industry’s growth.

Key Market Trends & Insights

- North America biological safety testing products & services market held the largest share of 36.59% of the global market in 2024.

- The biological safety testing products & services market in the U.S. is expected to grow significantly over the forecast period.

- By product, the reagents & kits segment held the highest market share of 39.69% in 2024.

- Based on application, the vaccines & therapeutics segment held the highest market share in 2024.

- By test, the endotoxin tests segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.89 Billion

- 2033 Projected Market Size: USD 12.09 Billion

- CAGR (2025-2033): 10.64%

- North America: Largest market in 2024

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/biological-safety-testing-market/request/rs1

The growing demand for biologics has led to an unprecedented increase in the number of biopharmaceutical companies. The escalating competition to produce highly effective therapeutic drugs on a large scale has encouraged manufacturers to focus on improving various aspects of industrial processes, including cost-effectiveness and productivity. For instance, in July 2023, Biocon Biologics, an India-based organization, announced the launch of the rheumatoid arthritis drug Humira, a biosimilar version of AbbVie in the U.S., at a lower price that would be readily available throughout the region. Several organizations are thus implementing improved manufacturing practices involving rigorous biological testing at multiple levels of the production cycle with greater accessibility, thereby driving the market growth.

The expansion of the biopharmaceutical and biotechnology sectors is a key driver of the biological safety testing products and services market. The global growth of biologics, biosimilars, cell and gene therapies, and regenerative medicines is accelerating demand for accurate, validated biosafety testing. As regulatory expectations rise and therapeutic pipelines deepen, companies are investing heavily in testing infrastructure, innovation, and partnerships to address the biosafety needs of evolving biologic modalities. A surge of capital projects, mergers, and platform developments globally further supports this growth.

The increasing number of government initiatives to stimulate biological safety testing products and services is expected to drive overall growth throughout the forecast period. For instance, in June 2022, Pfizer and BioNTech announced their collaboration with the U.S. Government to provide additional vaccine supplies to control the spread of the COVID-19 virus. Consequently, government and private organizations are expected to improve underlying biological safety practices in response to the rising incidence of microbial contamination and bioburden during the production of pharmaceuticals and biologics.