Bio-based Platform Chemicals Market Size, Share & Trends Analysis growing at a CAGR of 5.8% from 2025 to 2033

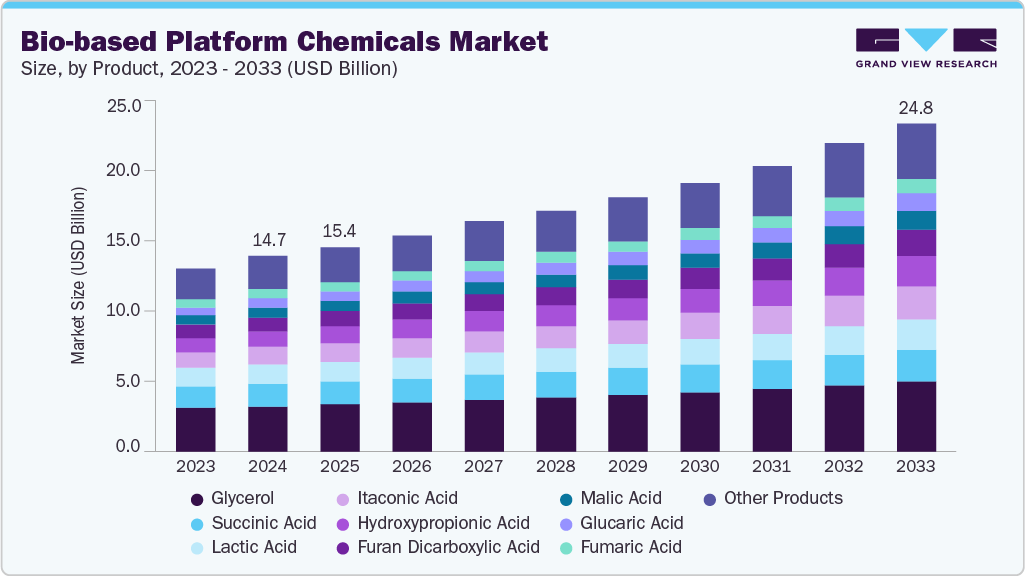

The global bio-based platform chemicals market size was estimated at USD 14.7 billion in 2024 and is projected to reach USD 24.8 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The growing demand for sustainable and eco-friendly alternatives drives interest in producing chemicals from biomass, a renewable feedstock.

Key Market Trends & Insights

- The Asia Pacific region led the global bio-based platform chemicals market in 2024, accounting for a 33.1% share.

- The bio-based platform chemicals market in China held a substantial share of the APAC market in 2023.

- By product, the glycerol bio-based platform chemicals segment dominated with a market share of 23.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.7 Billion

- 2033 Projected Market Size: USD 24.8 Billion

- CAGR (2025-2033): 5.8%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/bio-based-platform-chemicals-market/request/rs1

To compete effectively with fossil-based refineries, integrated biorefineries are increasingly being utilized to upgrade biomass using a range of feedstocks and conversion technologies. These biorefineries produce biofuels and bio-based platform chemicals, which are gaining significant traction in the global market. Key platform chemicals are in high demand due to their versatility and potential to replace a wide array of fossil-derived industrial chemicals. Their use as building blocks for a broad spectrum of downstream products underscores their growing importance in transitioning to a bio-based economy. Developing integrated biorefinery systems into the current industrial infrastructure is crucial in establishing a successful bio-based chemical industry. By advancing biorefinery technologies, it becomes possible to efficiently and cost-effectively convert biological raw materials into a wide array of bio-based products.

The transportation sector is the primary driver for advancing and implementing new biorefinery technologies. Meeting regulatory mandates for renewable energy, particularly in the short to medium term, requires significant volumes of renewable fuels. Second-generation biofuels are expected to play a key role in addressing this demand, especially for sectors like heavy-duty road transport and aviation, where alternatives to fossil fuels are limited.

Succinic acid (SA) is recognized as one of the leading platform chemicals due to its broad range of applications across multiple industries. Its molecular structure, featuring two terminal carboxylic acid groups, makes it highly versatile and suitable for conversion into numerous valuable derivatives. The biological production of SA presents a cleaner and more sustainable alternative to traditional methods, with the added benefit of helping to mitigate climate change by capturing carbon dioxide, a major greenhouse gas. This bio-based approach recycles renewable carbon from biomass (an indirect form of CO₂) and directly fixes CO₂ into SA, offering a carbon-negative production pathway that can significantly reduce atmospheric CO₂ levels. These compelling environmental and economic advantages drive a shift from fossil-based to microbial production of SA, a trend supported by several commercial-scale bio-SA facilities established in recent years.

Market Concentration & Characteristics

The bio-based platform chemicals industry is moderately concentrated, with a few major, vertically integrated players holding significant market share. These companies capitalize on economies of scale, proprietary biotechnologies, and well-established global supply chains to reinforce their competitive positions. Their integration across the bio-based value chain, from feedstock sourcing and biomass processing to the production and distribution of platform chemicals, enables them to achieve cost efficiencies, maintain consistent product quality, and ensure reliable supply. This strategic integration supports their operations across various end-use sectors, including automotive, packaging, agriculture, textiles, and specialty chemicals.

At the same time, emerging producers in the Asia-Pacific and Middle East regions are strengthening their foothold in the bio-based platform chemicals industry by leveraging access to low-cost biomass feedstocks, favorable energy prices, and rising local demand. These regional players primarily target price-sensitive markets and large-volume applications such as bioplastics, biofuels, and agricultural chemicals, supported by investments in bio-refining infrastructure within industrial clusters and special economic zones. This dual trend of global consolidation by established players and regional expansion by cost-advantaged newcomers is shaping the competitive market dynamics.

Bio-based Platform Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 15.4 billion |

|

Revenue forecast in 2033 |

USD 24.8 billion |

|

Growth rate |

CAGR of 5.8% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico, UK; Germany; Italy; France, Spain, China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Cargill; dsm-Firmenich; GFBIOCHEMICALS; BASF; Mitsubishi Chemical Group Corporation; PTT Global Chemical Public Company Limited; DuPont; Tate & Lyle; Braskem; Evonik Industries AG; Aktin Chemicals, Inc.; Champlor; LyondellBasell Industries Holdings B.V.; NIPPON SHOKUBAI CO., LTD.; Novozymes A/S, part of Novonesis Group |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |