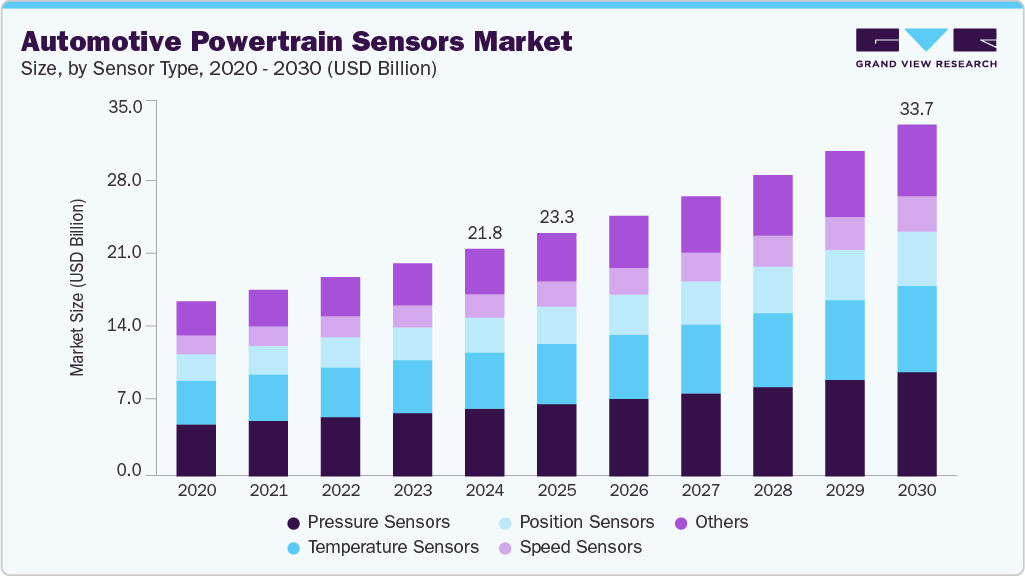

Automotive Powertrain Sensors Market Size, Share & Trends Analysis growing at a CAGR of 7.7% from 2025 to 2030

The global automotive powertrain sensors market size was estimated at USD 21.77 billion in 2024 and is projected to reach USD 33.66 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The ongoing shift toward electric vehicles (EVs) has significantly boosted the demand for advanced powertrain sensors designed specifically for battery systems, electric motors, and thermal control.

Key Market Trends & Insights

- The North America automotive powertrain sensors market accounted for 22.5% share of the overall market in 2024.

- The U.S. Automotive Powertrain Sensors industry held a dominant position in 2024.

- Based Sensor Type, The Pressure Sensors segment accounted for the largest share of 29.7% in 2024.

- By Vehicle Type, The Passenger Cars segment held the largest market share in 2024.

- By Propulsion Type, The Internal Combustion Engine (ICE) Vehicles segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.77 Billion

- 2030 Projected Market Size: USD 33.66 Billion

- CAGR (2025-2030): 7.7%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/automotive-powertrain-sensors-market-report/request/rs1

According to the U.S. Department of Energy (DOE), the global automotive sensor market surge from 7.5 billion units in 2017 to 11.0 billion units by 2024, with electrification alone accounting for 35% of this expansion. This transformation has propelled market growth by necessitating the development of sensors capable of managing tasks such as monitoring inverter temperatures, detecting voltage imbalances in battery cells, and enhancing regenerative braking systems.

Moreover, innovations such as zirconia-based oxygen sensors, originally intended for internal combustion engines (ICEs), are now being adapted for fuel cell electric vehicles (FCEVs) to measure hydrogen purity and fuel stack efficiency. The sensor ecosystem in EVs has also become more energy-intensive-DOE estimates indicate the energy demand for manufacturing and operating EV sensors reaches 1,540 petajoules (PJ) by 2024, up from 1,050 PJ in 2017, demonstrating the dual challenge of performance enhancement and lifecycle energy management. These technical advances and demand pressures are directly boosting the automotive powertrain sensors market.

Another key trend that has propelled market growth is the convergence of powertrain sensors with autonomous driving and ADAS technologies. These systems rely on real-time data from sensors to make critical adjustments to torque, braking, and energy use. ARPA-E studies show that cloud-based integration of sensor data allows hybrid powertrains to adapt dynamically to road conditions and traffic patterns, resulting in up to 12% lower energy consumption. Components like inertial measurement units (IMUs) and wheel-speed sensors now feed into centralized electronic control units (ECUs) alongside LiDAR and radar, optimizing drive profiles and fuel efficiency. The Environmental Protection Agency (EPA) notes that such integration enhances emission control by keeping engines or electric motors within their peak efficiency zones during autonomous operation. With regulatory mandates for collision avoidance and CO₂ reduction taking effect, over 70% of new vehicles in North America and Europe are projected to include ADAS-linked powertrain sensors by 2025, further boosting the market outlook.