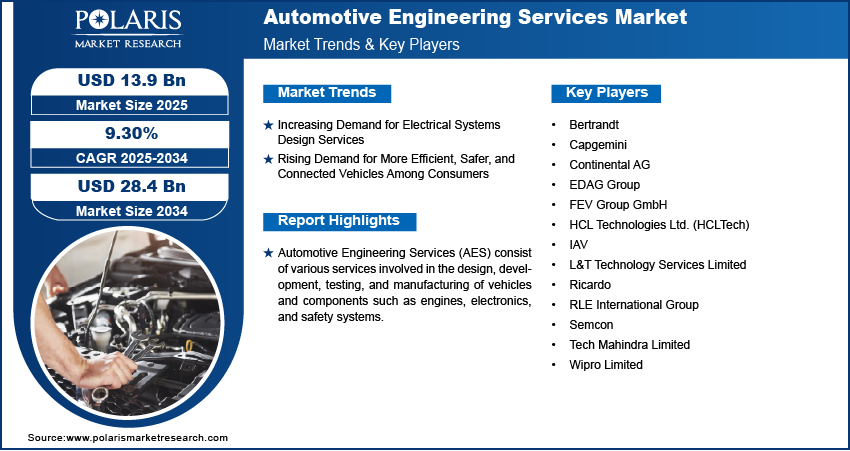

Automotive Engineering Services Market Valuation to Rise to USD 28.4 Billion By 2034 with a 9.30% CAGR

The global Automotive Engineering Services Market was valued at USD 12.7 billion in 2024 and is expected to grow at a CAGR of 9.30% from 2025 to 2034. Demand for advanced vehicle design and EV development is a major growth catalyst.

Automotive Engineering Services Market – Trends & Insights

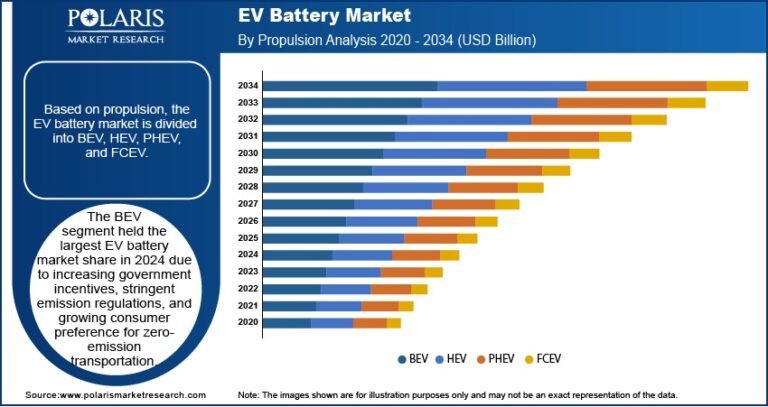

- Shift Toward Electrification: Engineering services for electric powertrains, battery management systems, thermal management, and EV platform development are in high demand as the transition to electric mobility accelerates.

- Growth of Software-Defined Vehicles (SDVs): The rise of vehicles governed more by code than hardware is fueling demand for software engineering, embedded systems, and over-the-air update capabilities.

- ADAS and Autonomous Driving Focus: There is a strong emphasis on engineering services for sensors, control algorithms, simulations, and safety validation in the pursuit of higher vehicle autonomy levels.

- Virtual Validation and Digital Twins: Automakers are increasingly adopting digital engineering tools such as simulations, CAE, and digital twins to test vehicle systems in virtual environments, reducing physical prototyping costs.

- Connected Vehicle Services: Integration of 5G, V2X communication, and cloud platforms is creating new avenues for connected vehicle development, requiring multi-domain engineering expertise.

Market Size & Forecast

Market size value in 2025 USD – 12.7 billion

Revenue forecast in 2034 USD – 28.4 billion

CAGR – 9.30% from 2025 – 2034

Request for Free Sample:

Market Overview:

The Automotive Engineering Services Market is witnessing strong growth as the automotive industry undergoes rapid transformation driven by electrification, autonomous technologies, digitalization, and sustainability demands. These services encompass a wide range of activities including vehicle design, prototyping, testing, system integration, simulation, and embedded software development. OEMs and tier-one suppliers are increasingly outsourcing engineering tasks to specialized service providers to enhance innovation, reduce time-to-market, and optimize costs. The market is gaining traction across electric vehicle (EV), connected vehicle, and advanced driver-assistance system (ADAS) domains, particularly in North America, Europe, and parts of Asia-Pacific.

Key Market Growth Drivers:

- Rapid Advancement in EV Technologies: The global push for sustainable transport is driving investment in EV engineering, covering battery design, charging infrastructure, and e-motor development.

- Increased R&D Outsourcing: Automakers and suppliers are outsourcing more engineering functions to manage costs, access niche expertise, and accelerate innovation.

- Stringent Safety and Emissions Regulations: Global regulatory mandates are pushing OEMs to invest in advanced engineering services for compliance, especially around crashworthiness, ADAS, and emissions control.

- Rising Vehicle Complexity: Modern vehicles integrate mechanical, electrical, and software systems, necessitating sophisticated, multidisciplinary engineering services.

- Expansion of Autonomous and Smart Mobility Solutions: Demand for self-driving, ride-sharing, and mobility-as-a-service (MaaS) vehicles is boosting engineering needs for sensors, AI algorithms, and control systems.

Market Challenges:

- Talent Shortage in Niche Domains: There is a automotive engineering services market growing gap between demand and availability of skilled professionals in AI, software integration, and battery engineering.

- High Development Costs and Time: Engineering complex systems, particularly for autonomous vehicles, requires substantial investment and lengthy validation cycles.

- Cybersecurity Concerns: As vehicles become more connected, ensuring secure software development and system-level protection becomes a critical engineering concern.

- IP and Data Security Risks: Collaboration with third-party engineering providers raises concerns about protecting intellectual property and sensitive vehicle data.

- Integration Complexity: Aligning new technologies with legacy systems poses integration challenges, especially in platform transitions from ICE to EV or for global model variations.