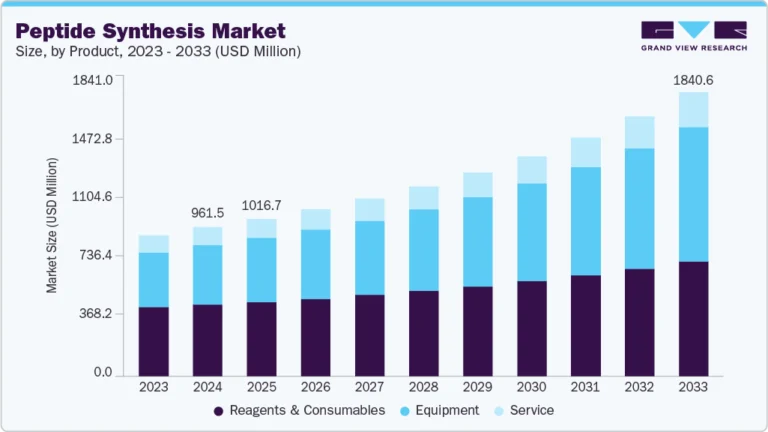

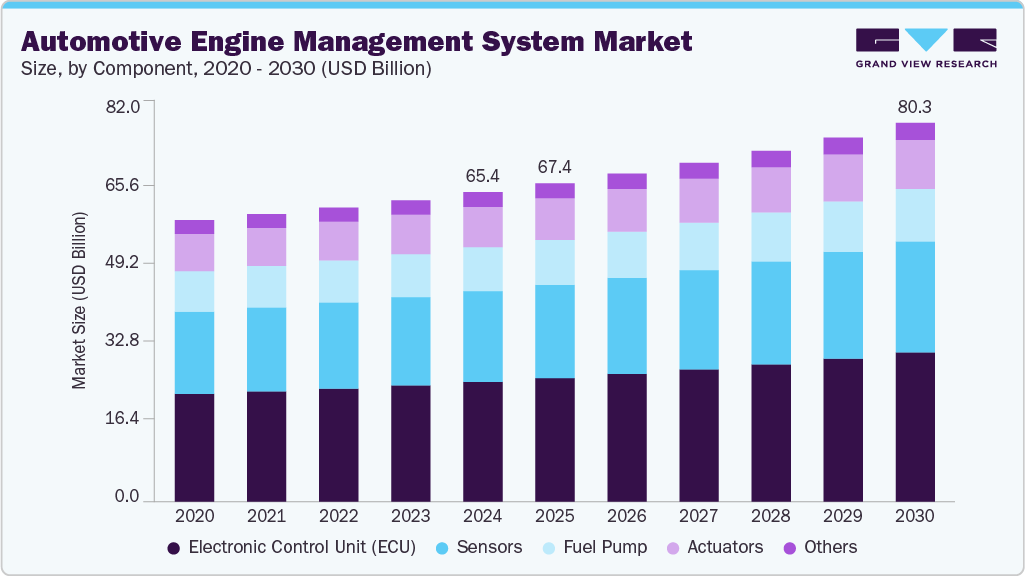

Automotive Engine Management System Market Size, Share & Trends Analysis growing at a CAGR of 3.6% from 2025 to 2030

The global automotive engine management system market size was estimated at USD 65.54 billion in 2024 and is projected to reach USD 80.25 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. Modern engine management systems are increasingly designed to accommodate renewable and alternative fuels, a shift driven by the need to reduce greenhouse gas emissions and dependence on fossil fuels, which boosts the market growth.

Key Market Trends & Insights

- The Asia Pacific automotive engine management system market accounted for a largest revenue share of 43.8% in 2024.

- The U.S. automotive engine management system industry held a dominant position in 2024.

- By component, the electronic control unit (ECU) segment accounted for the largest revenue share of 38.7% in 2024.

- By engine type, the gasoline engines segment held the largest share of the automotive engine management system industry in 2024.

- By vehicle type, the passenger cars segment dominated the automotive engine management system market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 65.54 Billion

- 2030 Projected Market Size: USD 80.25 Billion

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/automotive-engine-management-system-market-report/request/rs1

The U.S. Department of Energy emphasizes that internal combustion engines (ICEs) can operate on fuels such as natural gas, propane, biodiesel, and ethanol without significant modifications to existing infrastructure.

For instance, hydrogen combustion engines represent a pivotal innovation, with Sandia National Laboratories demonstrating that hydrogen-powered ICEs achieve 50% fuel-to-electricity efficiency while producing near-zero nitrogen oxide (NOx) emissions. This capability positions hydrogen as a viable transitional fuel for hybrid vehicles and stationary power applications. The adaptability of EMS to diverse fuel chemistries is critical for enabling a carbon-neutral future. Research under the Advanced Combustion Engines subprogram focuses on co-optimizing engine designs with fuel properties, ensuring optimal combustion dynamics for both conventional and alternative fuels. For example, ethanol’s high octane rating allows for higher compression ratios in spark-ignition engines, improving thermal efficiency by 10-15% compared to gasoline. Such advancements underscore the EMS’s role in bridging the gap between existing ICE architectures and future renewable fuel ecosystems.

The integration of hybrid electric powertrains with advanced EMS has emerged as a cornerstone strategy for improving fuel economy and reducing emissions. DOE studies reveal that combining internal combustion engines with hybrid electric systems can enhance fuel efficiency by 25-50%, depending on vehicle class and driving conditions. A notable instance is the Plug-in Hybrid Electric Vehicle (PHEV) initiative, where Oak Ridge National Laboratory developed engine control strategies to minimize cold-start emissions, a persistent challenge in hybrid systems.

By decoupling engine operation from immediate driver demand, series hybrid configurations enable optimized warm-up cycles, reducing hydrocarbon emissions by 45% during cold starts. Furthermore, the application of synergistic technologies, such as engine downsizing and turbocharging, allows manufacturers to maintain performance while reducing displacement. Ricardo’s roadmap for gasoline engine efficiency highlights that downsizing a 2.0L engine to 1.4L, coupled with direct injection and variable valve timing, can improve fuel economy by 20% without sacrificing power output. These advancements rely on EMS algorithms that dynamically adjust air-fuel ratios, ignition timing, and boost pressure to balance efficiency and drivability.The pursuit of higher engine efficiencies propelled the market growth, which necessitates materials capable of withstanding extreme temperatures and pressures. DOE’s Vehicle Technologies Office (VTO) identifies lightweight alloys and advanced ceramics as critical enablers for next-generation engines, with the potential to save 5 billion gallons of fuel annually by 2030 if deployed across 25% of the U.S. fleet. For instance, silicon carbide (SiC) coatings on piston crowns and cylinder liners reduce heat loss, enabling combustion temperatures exceeding 1,500°C, a 15% improvement in thermal efficiency over conventional aluminum components.

Automotive Engine Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 67.40 billion |

|

Revenue forecast in 2030 |

USD 80.25 billion |

|

Growth rate |

CAGR of 3.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, engine type, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Robert Bosch GmbH; Continental AG; Denso Corporation; BorgWarner Inc.; Hitachi Astemo, Ltd.; Valeo; Infineon Technologies AG; Sensata Technologies, Inc.; Niterra Co., Ltd.; Mitsubishi Heavy Industries Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |