Astaxanthin Market growing at a CAGR of 9.54% from 2026 to 2033

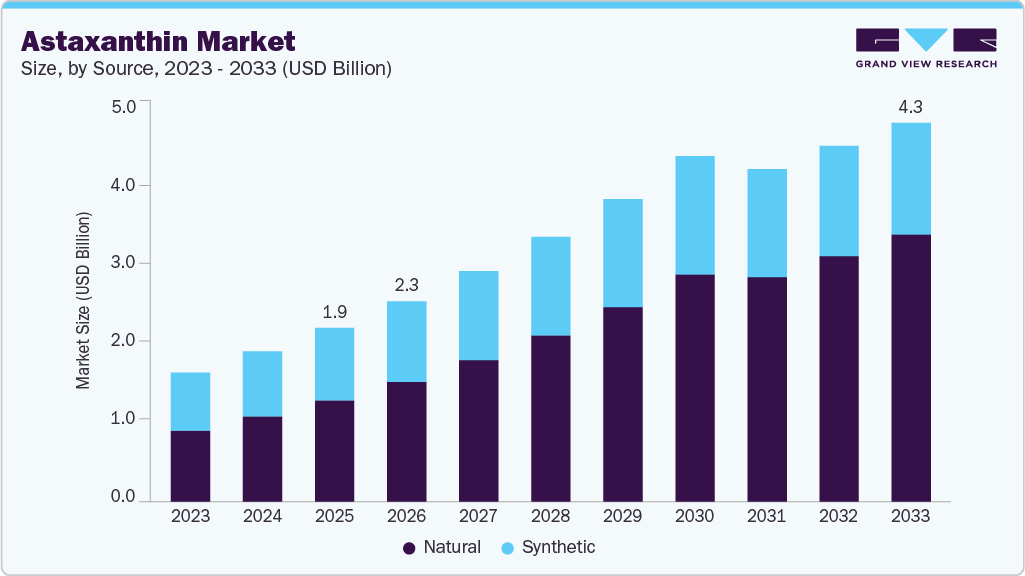

The global astaxanthin market size was estimated at USD 1.96 billion in 2025 and is anticipated to reach USD 4.27 billion by 2033, growing at a CAGR of 9.54% from 2026 to 2033. The growing demand for astaxanthin is being fueled by its increasing use in various industries, including aquaculture, animal feed, nutraceuticals, cosmetics, pharmaceuticals, and food and beverages, among others.

Key Market Trends & Insights

- The North America astaxanthin market accounted for the largest share of 35.01% in 2025.

- The U.S. astaxanthin market is expanding, driven by the rising demand for natural antioxidants.

- By source, the natural segment held the largest revenue share of 58.37% in 2025.

- By product, dried algae meal or biomass accounted for the largest share of 24.95% in 2025.

- By application, the aquaculture & animal feed segment held the largest share of 45.74% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.96 Billion

- 2033 Projected Market Size: USD 4.27 Billion

- CAGR (2026-2033): 9.54%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/global-astaxanthin-market/request/rs1

The rising awareness about nutrition for a healthy lifestyle and the increasing preference for dietary supplements owing to the high hospitalization cost are projected to drive the demand for nutraceuticals & natural antioxidants. The market players are significantly increasing their production capacities to compete with the growing demand for nutraceutical products. For instance, in April 2023, Algalif announced that its 12,500 m² sustainable natural astaxanthin production facility in Iceland was progressing as planned. The USD 30 million expansion, initiated in summer 2021, is expected to be fully operational by the end of 2023. This significant investment underscores. Furthermore, in April 2022, Beijing Gingko Group announced a second expansion of its pristine region’s astaxanthin farm capacity in the last 2 years, which would maximize its production capacity. Algatech Ltd. increased its production capacity threefold for FucoVital, a product derived from brown algae, to fulfill the increasing demand for the dietary supplements market.

The introduction of advanced technologies to increase astaxanthin production is expected to boost market growth. For instance, in March 2024, Kuehnle AgroSystems (KAS) secured USD 3 million in Series A2 funding, led by S2G Ventures. This investment aims to accelerate the commercialization of KAS’s innovative approach to producing natural astaxanthin. Utilizing a patented dark fermentation process, KAS offers a solution that delivers higher yields, lower costs, and reduced resource consumption compared to conventional methods. This advancement supports the shift from synthetic to natural, addressing a market valued at USD 3.7 billion and driven by increasing consumer preference for natural, sustainable products.

Market Concentration & Characteristics

The astaxanthin industry showcases a high degree of innovation, with companies developing novel formulations and sustainable production methods. For example, Sirio Europe (SIRIO) revealed in August 2023 its plan to introduce two new softgel products targeting the pharmaceutical sector during the CPHI Barcelona 2023 event.

The astaxanthin industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. In January 2022, ENEOS Corporation disclosed its acquisition of Ecocert Inputs Attestation, a globally recognized certification organization. This strategic move strengthens ENEOS’ position in the astaxanthin industry, particularly for Panaferd-AX. The merger reflects the company’s commitment to quality and international standards, contributing to the evolution of the sector.

The astaxanthin industry is also subject to regulatory scrutiny. Under DSHEA, dietary supplements such as astaxanthin are considered to be food products rather than drugs and therefore do not require premarket approval by the FDA. However, supplement manufacturers are still required to ensure that their products are safe and accurately labeled. The FDA has the authority to take enforcement action against any supplement product that is found to be unsafe or misbranded.

The market is witnessing innovation as dietary lutein emerges as a potential substitute. Companies are exploring the incorporation of lutein-rich sources into formulations, tapping into their antioxidant properties. This shift underscores a trend towards diversification and the exploration of alternative natural compounds within the dynamic astaxanthin industry.

Source Insights

The natural segment held the largest revenue share of 58.37% in 2025 and is anticipated to grow at a rapid rate during the forecast period, owing to advantages such as high efficacy and sustainability. Currently, it is used to treat hypercholesterolemia, stroke, Parkinson’s disease, Alzheimer’s disease, and cancer. Moreover, natural astaxanthin has very good effects on the skin and eyes, as many studies reported the use of these products in the treatment of ophthalmic diseases such as cataract, uveitis, & glaucoma, and skin photo-aging treatments, as it has 10 times higher free radical inhibitory action than other antioxidants. Moreover, ongoing research activities to enhance the quality and usage of yeast-derived products are expected to boost segment growth. For instance, in February 2023, according to research by China Medical University Hospital, National Chung Hsing University, and National Taiwan Ocean University, genetically modified yeast could be a promising source of astaxanthin for shrimp feeds.

Product Insights

Dried algae meal or biomass accounted for the highest share of 24.95% in 2025 due to its high yield and cost-effectiveness. A December 2024 study in the International Journal of Biological Macromolecules demonstrated that using an alginate hydrogel membrane (AHM) with cotton gauze for cultivating Haematococcus pluvialis increased productivity by 70.8%, with a 55.2% improvement over conventional methods. This advanced technique optimizes cultivation parameters, such as light intensity and inoculum density, enhancing biomass yield and reducing production costs. The segment’s scalability and efficiency make it crucial for meeting rising demand in industries such as supplements, animal feed, and cosmetics. In addition, dried biomass simplifies downstream extraction, ensuring high-quality products, reinforcing its market dominance.

Application Insights

The aquaculture & animal feed segment accounted for the highest share of 45.74% in 2025, owing to its extensive use as a feed additive. Natural variants are used as feed to induce reddish pigmentation in salmon, trout, and shrimp, which is an important factor driving consumer preference. The oil can also increase feed uptake, resulting in faster growth of shrimp. Thus, the increasing adoption of these products in the aquaculture industry for improving seafood quality is contributing to the segment’s significant share in the market. In addition, key players are introducing novel products for animal feed with medical benefits. For instance, in July 2022, AstaReal introduced Novasta, an ingredient designed for use in animal feed. This product launch expands the potential for health-enhancing applications in the field of animal nutrition.

Regional Insights

North America held the largest astaxanthin market share, accounting for 35.01% in 2025. Consumers in the region show a high preference for premium wellness products that improve immunity and skin health. Expanding applications in functional foods is creating steady growth potential. Investments in algae-based cultivation facilities are improving supply stability. The presence of key nutraceutical brands is strengthening regional competitiveness. Rising interest in sports nutrition is further enhancing product adoption.

Astaxanthin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 2.26 billion |

|

Revenue forecast in 2033 |

USD 4.27 billion |

|

Growth rate |

CAGR of 9.54% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2026 to 2033 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Source, product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Algatech Ltd; Cyanotech Corporation; Algalíf Iceland ehf; Beijing Gingko Group (BGG); PIVEG, Inc.; Fuji Chemical Industries Co., Ltd.; ENEOS Corporation; Atacama Bio Natural Products S.A.; E.I.D. – Parry (India) Limited; ALGAMO |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |