Antibody Production growing at a CAGR of 11.2% from 2025 to 2033

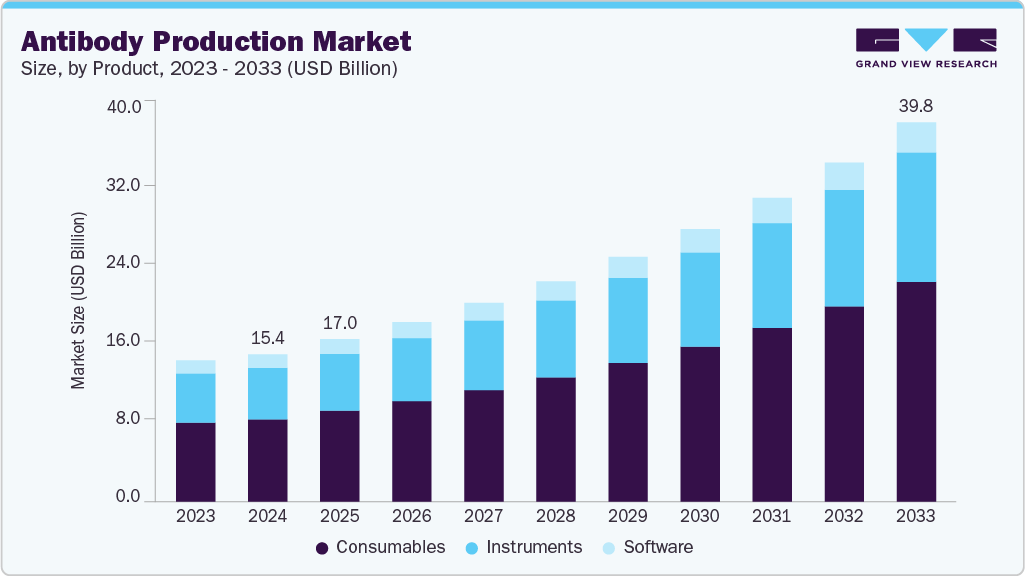

The global antibody production market size was estimated at USD 15.44 billion in 2024 and is projected to reach USD 39.80 billion by 2033, growing at a CAGR of 11.2% from 2025 to 2033. Increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, coupled with the growing demand for therapeutic antibodies, has led to the rapid growth of the antibody production market.

Key Market Trends & Insights

- North America antibody production market held the largest share of 37.78% of the global market in 2024.

- The antibody production industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held the largest market of 55.91% in 2024.

- By process, the downstream processing segment held the largest market share in 2024.

- By type, monoclonal antibody segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.44 Billion

- 2033 Projected Market Size: USD 39.80 Billion

- CAGR (2025-2033): 11.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/antibody-production-market/request/rs1

Personalized and Next-Generation Antibodies

The global antibody production market is experiencing a significant shift as the industry moves beyond conventional monoclonal antibodies toward more complex, next-generation formats. Personalized therapies are increasingly becoming the standard of care, with bispecific antibodies, antibody-drug conjugates (ADCs), and engineered monoclonal antibodies emerging as critical tools in targeting diseases with greater precision and efficacy. These novel modalities not only enhance therapeutic outcomes but also open new opportunities for biopharmaceutical companies to differentiate their portfolios in an increasingly competitive landscape.

The rise of next-generation antibodies is fueling demand for advanced and highly specialized production technologies. Unlike traditional mAbs, which rely on relatively standardized production processes, bispecifics and ADCs require more sophisticated cell line development, purification techniques, and conjugation platforms. Manufacturers are rapidly adopting innovative solutions such as high-density perfusion bioreactors, modular single-use systems, and integrated continuous bioprocessing to meet these evolving requirements. This technological advancement is essential to achieve cost-effective scalability while maintaining the high quality and safety standards expected for complex biologics.

Market Concentration & Characteristics

The antibody production industry demonstrates a high degree of innovation, driven by advances in bioprocessing technologies, adoption of single-use systems, and development of next-generation formats such as bispecifics and antibody-drug conjugates. Continuous investments in R&D, capacity expansion, and digitalized manufacturing solutions are enhancing scalability, efficiency, and product quality. These innovations are not only meeting rising therapeutic demand but also shaping a competitive market landscape with accelerated time-to-market for novel biologics.

The antibody production industry demonstrates a high degree of innovation, driven by advances in bioprocessing technologies, adoption of single-use systems, and development of next-generation formats such as bispecifics and antibody-drug conjugates. Continuous investments in R&D, capacity expansion, and digitalized manufacturing solutions are enhancing scalability, efficiency, and product quality. These innovations are not only meeting rising therapeutic demand but also shaping a competitive market landscape with accelerated time-to-market for novel biologics.

Antibody Production Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.03 billion |

|

Revenue forecast in 2033 |

USD 39.80 billion |

|

Growth rate |

CAGR of 11.2% from 2025 to 2033 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, process, type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Danaher Corporation; Sartorius; Thermo Fisher Scientific; Eppendorf; Merck KGaA; Lonza Group; AGC Biologics; Wuxi Biologics; Charles River Laboratories; Biointron |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |