Automated Cell Counting Market growing at a CAGR of 15.4% from 2026 to 2033

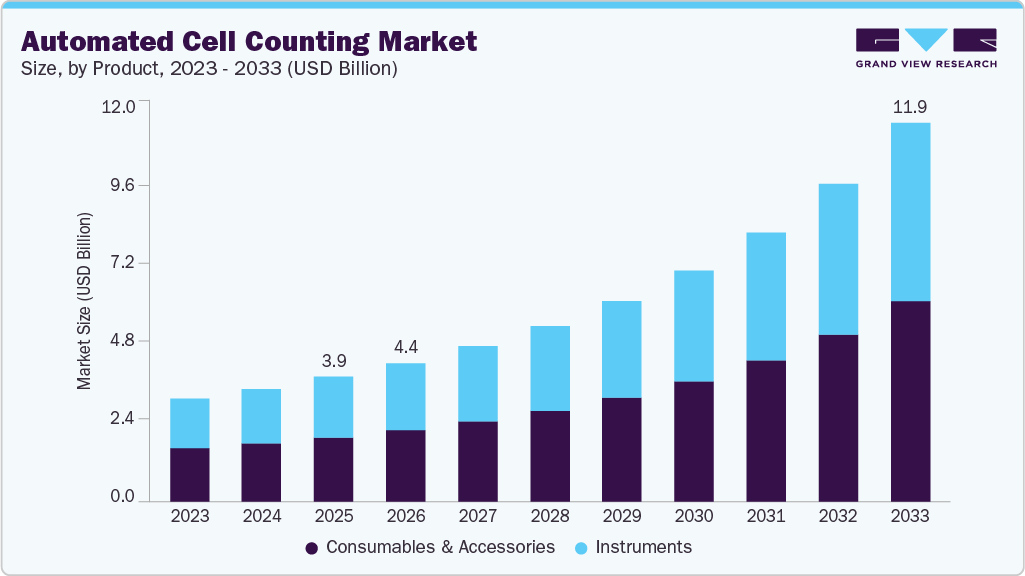

The global automated cell counting market size was estimated at USD 3.93 billion in 2025 and is expected to reach USD 11.92 billion by 2033, growing at a CAGR of 15.4% from 2026 to 2033. Automated cell counters are instruments that count and analyze cells in medical diagnostics, pharmaceutical research, and food quality monitoring.

Key Market Trends & Insights

- North America automated cell counting market held the largest share of 37.92% of the global market in 2025.

- The automated cell counting industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumable and accessories segment held the largest market share in 2025.

- By application, the cell line development segment held the largest market share in 2025.

- By end use, the pharmaceutical and biotechnology companies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.93 Billion

- 2033 Projected Market Size: USD 11.92 Billion

- CAGR (2026-2033): 15.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automated-cell-counting-market-report/request/rs1

Market Concentration & Characteristics

Innovation in the automated cell counting industry is driven by advancements in imaging, artificial intelligence, fluorescence analysis, and high-throughput capabilities that improve accuracy, speed, and automation over traditional manual methods. Vendors are integrating AI and cloud connectivity into instruments to enable real-time data analytics, enhanced viability measurements, and support for complex samples, particularly for cell therapy and stem-cell research workflows. The advancement of smarter, multi-modal platforms has expanded applications in both clinical and research settings, as new portable and high-throughput devices are introduced to the market.

While the automated cell counting industry isn’t characterized by blockbuster mergers on the scale of some adjacent diagnostics sectors, strategic transactions and partnerships are evident among key life-science toolmakers. Established players such as Beckman Coulter (part of Danaher) and Thermo Fisher expand their portfolios through acquisitions and collaborations that integrate complementary technologies (e.g., analytical workflows and automation modules). Broader consolidation among lab automation and analytics firms continues to shape competitive dynamics and provides scale benefits in R&D, distribution, and cross-selling.

Product Insights

The consumables & accessoriessegment is expected to witness the largest share in 2025 and the fastest CAGR during the forecast period. The segment is largely driven by its inherently recurring nature and essential role in operational workflows. Consumables, such as reagents, assay kits, slides, microplates, and sample preparation tools, must be replaced frequently for each analysis, ensuring steady, repeat purchases from research, clinical, and biopharma labs worldwide. Their critical function in maintaining accuracy, reducing contamination risks and supporting high-throughput testing across applications like stem cell research, cancer studies and bioprocessing further cements this demand.

Application Insights

The cell line development application segment held 31.59% of the global market share in 2025, accounting for the largest proportion of the market. Cell line development is an essential component of research and biological medicine production. Cell line generation is used in the lab to assess cytotoxicity and drug metabolism, as well as to examine gene function in order to develop vaccines, antibodies, and cell treatments. Thus, it is likely to increase the demand for automated cell counting products and further boost the segment growth.

Stem cell research is expected to witness the fastest growth during the forecast period. The exponential growth is due to the increasing demand for mass manufacturing of human stem cells for therapeutic and research purposes. Stem cells are critical in areas including regenerative medicine, cancer treatment, and transplantation. Automated equipment makes it easier to precisely determine stem cell viability & nucleated cell concentration in cord blood and human bone marrow. Furthermore, features such as fluorescence imaging are becoming increasingly used to quantify GFP efficacy in stem cell transfection applications.

Automated Cell Counting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 4.37 billion |

|

Revenue forecast in 2033 |

USD 11.92 billion |

|

Growth rate |

CAGR of 15.4% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Thermo Fischer Scientific Inc.; Countstar Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd; Chemometec A/S; Danaher; Olympus Corporation; Merck KGaA; Sysmex Corporation; Agilent Technologies, Inc.; Abbott. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |