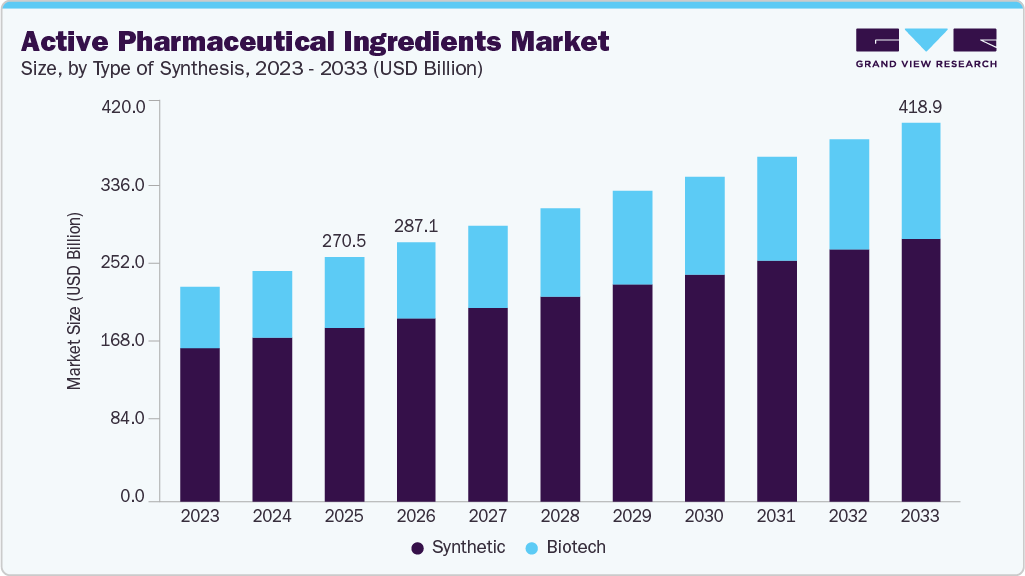

Active Pharmaceutical Ingredients Market growing at a CAGR of 5.55% from 2026 to 2033

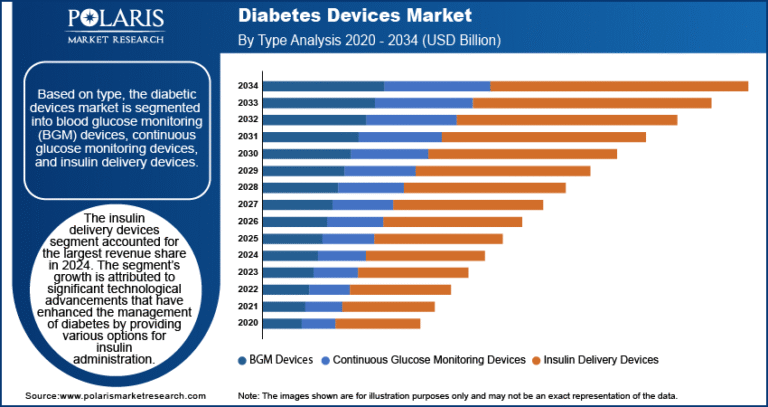

The global active pharmaceutical ingredients market size was estimated at USD 270.53 billion in 2025 and is expected to reach USD 418.99 billion by 2033, growing at a CAGR of 5.55% from 2026 to 2033. The rising global demand for pharmaceuticals, especially in emerging markets, drives growth due to increasing chronic diseases like cancer, diabetes, and cardiovascular conditions.

Key Market Trends & Insights

- The North America active pharmaceutical ingredients market accounted for the largest global revenue share of 37.66% in 2025.

- The U.S. active pharmaceutical ingredients industry led North America, with the largest revenue share in 2025.

- By type of synthesis, the synthetic segment held the largest revenue share of 70.99% in 2025.

- By type of manufacturer, the captive APIs segment dominated the market, with the largest revenue share of 50.58% in 2025.

- By type, the innovative APIs segment held the largest revenue share of 53.82% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 270.53 Billion

- 2033 Projected Market Size: USD 418.99 Billion

- CAGR (2026-2033): 5.55%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/active-pharmaceutical-ingredients-market/request/rs1

Advancements in biologics and biosimilars, along with innovative drug formulations, are further boosting the need for specialized APIs. Moreover, the shift toward generic medicines and the rise in contract manufacturing organizations (CMOs) are accelerating API production and distribution, driving the growth of the active pharmaceutical ingredients industry.

The global geriatric population is increasing. According to the UN, in 2023, people aged 65 and above accounted for approximately 771 million of the population, and the number is expected to reach 994 million by 2030, and 1.6 billion by 2050. The number of older adults is showing the fastest growth in Africa, with a threefold increase estimated in people aged 60 and above, followed by Latin America, which is projected to reach 18.8 billion by 2050. Aging is considered the greatest risk factor for the development of diseases, including cardiovascular and neurological diseases. Thus, the rapidly growing global geriatric population is becoming a high-impact driver for the API market.

The increasing prevalence of infectious diseases and hospital-acquired infections is driving market growth. Additionally, the increasing prevalence of cardiovascular, genetic, and neurological disorders is expected to be a significant driver of market growth. Cardiovascular Diseases (CVDs) are the most prevalent causes of death globally. According to the WHO, cardiovascular diseases cause the deaths of 17.9 million people per day and are expected to cause approximately 25 million deaths by 2030. The increasing epidemiology of lifestyle, aided by the rising number of smokers globally, the growing incidence of obesity, and increasing dietary irregularities, is likely to propel market growth. A recent report by the United Nations (UN) in May 2023 suggests that there has been a 75% increase in the number of girls and 61% in the number of boys with obesity in Europe.

Market Concentration & Characteristics

The market for Active Pharmaceutical Ingredients (API) is rapidly changing, driven by advances in synthetic biology, biocatalysis, and continuous processing that are transforming API discovery and manufacture. The growing need for complex compounds, such as highly powerful active pharmaceutical ingredients (HPAPIs), nucleic acid medicines, and tailored cancer treatments, is driving investment in new process technologies and containment methods. AI-driven design and automation are also accelerating development plans and improving molecular accuracy.

M&A activity in the active pharmaceutical Ingredients market is medium, driven by strategic consolidation, capability enhancement, and the advancement of operational efficiency. Many pharmaceutical companies and contract manufacturers are seeking acquisitions to expand their product lines, increase manufacturing capacity, and gain expertise in high-growth sectors, such as biologics, highly potent active pharmaceutical ingredients (HPAPIs), and complex generics. Nonetheless, mergers and acquisitions are slowed due to regulatory scrutiny, high valuation premiums, and the technical difficulties associated with merging API manufacturing plants.

Regulation has a significant impact on the active pharmaceutical ingredients industry, as it influences production standards, quality requirements, and global trade dynamics. The FDA, EMA, and national health agencies enforce stringent standards for quality control, documentation, traceability, and compliance with Good Manufacturing Practices (GMP) throughout the API lifecycle. While these requirements are critical to ensuring patient safety, they also provide significant operational and financial challenges for manufacturers. The increase in regulatory audits and the push toward international standard harmonization, such as ICH Q7 and Q11, require significant investment in modern facilities, digital quality-management systems, and continuous monitoring technological advancements.

Type of Synthesis Insights

The synthetic segment captured the largest revenue share of 70.99% in 2025. The primary driver behind the synthetic API market is the strong demand for generic drugs, which significantly contributes to revenue for companies involved in synthetic and chemical API manufacturing. This creates substantial opportunities for Contract Development and Manufacturing Organizations (CDMOs) operating in this segment. The appeal of the synthetic API market is further heightened for CDMOs due to the growing trend of outsourcing, as companies seek to enhance profitability by lowering production costs. In October 2023, Cambrex announced the completion of its USD 38 million small molecule API manufacturing facility, effectively doubling the size of its operations and improving its capacity to attract new customers to meet their changing requirements.

Type of Manufacturer Insights

The captive APIs segment led the active pharmaceutical ingredients industry, accounting for the largest share of 50.58% in 2025. An increasing number of companies are investing in overcoming challenges and developing new chemical methods for in-house API production. This approach helps lower costs and minimize the risk of contamination. Advances in protein synthesis and artificial intelligence are expected to enhance development by providing greater control over the manufacturing process. Moreover, recent initiatives by major players show a strong inclination toward in-house production rather than outsourcing.

Type Insights

The innovative APIs segment held the largest share of the overall API market, accounting for 53.82% of revenue in 2025. This growth can be attributed to increased funding and favorable regulations for research and development facilities. A number of novel products are currently in the pipeline due to extensive research in this area, with many expected to launch in the near future. Moreover, growing support from regulatory agencies for the approval of new drugs is anticipated to enhance market growth further, reflecting a heightened focus by governments on healthcare and the pharmaceutical sector.

Regional Insights

The active pharmaceutical ingredients market in North America accounted for a 37.66% share in 2025, driven by the increasing prevalence of cardiovascular, genetic, and other chronic diseases, as well as growing research in the field of drug development. The presence of key players such as AbbVie Inc.; Curia; Pfizer Inc. (Pfizer Center One); Viatris Inc.; and Fresenius Kabi AG is positively influencing growth. Furthermore, there is an increasing number of innovators and Contract Development and Manufacturing Organizations (CDMOs) in the area, which improves the ability to develop and commercialize active pharmaceutical ingredients (APIs). For instance, in 2025, ESTEVE acquired CDMO Regis Technologies, increasing its presence and infrastructure in North America for small-molecule API development and manufacture. The above-mentioned drivers are driving the market growth.

Active Pharmaceutical Ingredients Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 287.12 billion |

|

Revenue forecast in 2033 |

USD 418.99 billion |

|

Growth rate |

CAGR of 5.55% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type of synthesis, type of manufacturer, type, application, type of drug, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; Spain; France; Italy; Russia; Hungary; Russia; Poland; Hungary; Sweden; Switzerland; Portugal; Greece; Japan; China; India; South Korea; Australia; Thailand; Vietnam; Indonesia; Malaysia; Taiwan; Philippines; Brazil; Mexico; Colombia; Peru; Chile; South Africa; Saudi Arabia; UAE; Kuwait; Egypt; Israel; Belarus; Algeria; Jordan; Iran |

|

Key companies profiled |

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; Cipla Inc.; AbbVie Inc.; Aurobindo Pharma; Sandoz International GmbH (Novartis AG); Viatris Inc.; Fresenius Kabi AG; STADA Arzneimittel AG |

|

Customization scope |

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |