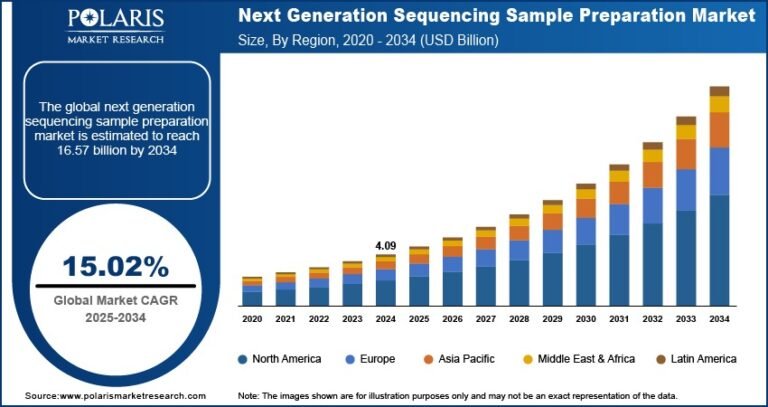

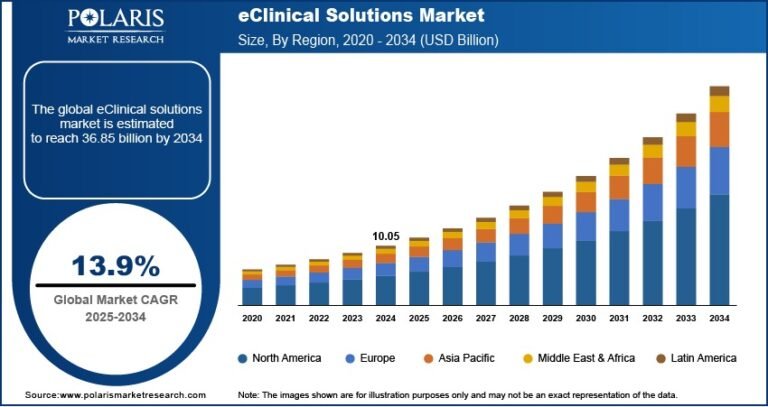

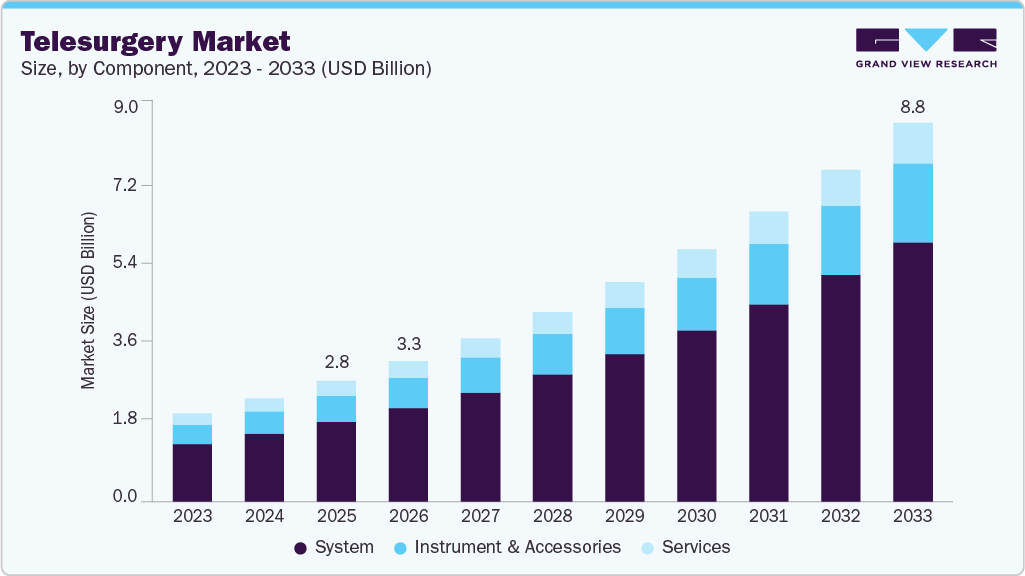

Telesurgery Market growing at a CAGR of 15.20% from 2026 to 2033

The global telesurgery market size was estimated at USD 2.82 billion in 2025 and is projected to reach USD 8.87 billion by 2033, growing at a CAGR of 15.20% from 2026 to 2033. The significant advancements in telecommunications and robotic surgery are driving the adoption of telesurgery.

Key Market Trends & Insights

- North America dominated the global telesurgery market with the largest revenue share of 51.27% in 2025.

- The telesurgery industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By component, the system segment led the market with the largest revenue share of 66.17% in 2025.

- By application, the general surgery segment accounted for the largest market revenue share in 2025.

- By end use, the hospitals segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.82 Billion

- 2033 Projected Market Size: USD 8.87 Billion

- CAGR (2026-2033): 15.20%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/telesurgery-market-report/request/rs1

Furthermore, the increasing collaboration between companies to establish a telesurgery center is fostering market growth. For instance, in December 2023, Iran and Indonesia agreed to open a robotic telesurgery center as a joint venture. The new center will be located at a hospital in Makassar, a port city in Indonesia. The collaboration involves Iran’s Sina Robotics Company, the Vice Presidency for Science, and Tehran University of Medical Sciences, as well as Indonesia’s Hasanuddin University, Indofarma Company, and the Ministry of Health.

The growing number of telesurgery clinical trials is expected to boost market growth. For instance, in October 2023, clinician-scientists from Singapore and Japan collaborated on an innovative telesurgery trial spanning over 5,000 km. In a sterile operating room in Nagoya, Japan, robotic arms are being used to perform a complex laparoscopic surgical procedure. Furthermore, AI plays a crucial role in advancing telesurgery by improving decision-making, predicting surgical outcomes, and optimizing procedural efficiency.

Moreover, machine learning algorithms can analyze large volumes of data to provide insights and recommendations, helping surgeons make better-informed decisions. AI-powered robotic systems also enable precise, consistent movements, reducing human error and improving patient outcomes. This technology assists the surgeon in planning and executing complex procedures with greater accuracy, thereby supplementing market growth.

The emergence of 5G technology is transforming the field of telesurgery by offering ultra-low latency and high-speed connectivity necessary for real-time surgical procedures. According to an article published in 2024 by Telefonaktiebolaget LM Ericsson, trials worldwide for telesurgery have confirmed that, in an optimal internet environment, the achieved latency is approximately 5 times the theoretically minimum possible delay. In a fully managed system with managed fiber and 5G, this figure is reduced to 2 times, resulting in significantly better performance. Thus, the reliable, instant communication enabled by 5G networks ensures that surgeons can conduct complex operations remotely with precision, reducing the risk of delays or disconnections. This advancement enables high-definition video streaming and real-time data transmission, both crucial for the complex nature of surgical procedures.

Market Concentration & Characteristics

The telesurgery industry shows a high degree of innovation. This innovation is driven by advancements in robotics, telecommunication technologies, and artificial intelligence. These technologies enable surgeons to conduct complex procedures with precision and control, even from remote locations. The incorporation of real-time imaging, haptic feedback, and improved visualization systems further enhances the accuracy and safety of surgical interventions. In July 2025, the Chinese University of Hong Kong, in collaboration with Renji Hospital and Imperial College London, successfully performed an intercontinental tele-robotic gastrectomy across 20,000 km using a locally developed surgical robotics platform.

The telesurgery industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for robots. Furthermore, increasing collaborations among market players will boost market growth. In July 2022, Soliton Systems in Japan, a global IT security and live streaming technology developer, completed a remote-surgery trial with KDDI and Riverfield, showcasing wireless tele-surgery.

Component Insights

The system segment led the market with the largest revenue share of 66.17% in 2025 and is projected to grow at the fastest CAGR during the forecast period. The growing adoption of telemedicine and remote healthcare services is propelling the telesurgery industry. Increasing funding for the development of advanced telesurgery robots is supplementing market growth. In September 2023, Virtual Incision, the startup preparing to launch a small surgical robot into space, announced that it had secured an additional USD 30 million in funding, building upon its previous USD 46 million series C financing. This round of funding will sustain the company’s activities until at least 2025 as it gets ready to bring to market the compact robotic system intended for abdominal surgery.

Application Insights

The general surgery segment led the market with the largest revenue share of 38.30% in 2025. The growing number of general surgeries across the globe is accelerating market growth. According to a report by the American College of Surgeons, 4 million abdominal operations are performed in the U.S. each year. Some of these operations may require hernia repair, with more than 400,000 ventral hernia repairs performed annually. In addition, the ongoing advancements in telecommunications and networking technologies are supplementing market growth. In December 2025, Zain Omantel International and Zain Kuwait set a Guinness World Record for remote robotic surgery, spanning 12,034 km. The ultra-low-latency network enabled surgeons to safely perform robotic procedures on a patient in Brazil, demonstrating the feasibility of global telesurgery and advanced digital healthcare collaboration.

The urological surgery segment is anticipated to register at the fastest CAGR over the forecast period. Increasing adoption of robots in urological surgeries is fueling segmental growth. In June 2025, Dr. Vipul Patel from AdventHealth in Orlando completed a telerobotic-assisted radical prostatectomy on a patient more than 7,000 miles away in Africa, representing the first human trial of this tele-robotic system. The surgery showcased the potential of remote robotic procedures to provide specialized care across international distances. As per the WHO report, bladder cancer ranks as the ninth most prevalent type of cancer globally. In 2022, over 600,000 individuals received a diagnosis of bladder cancer worldwide, and more than 220,000 people lost their lives to this disease. The rise in bladder cancer cases will drive greater demand for surgeries, thereby boosting market growth.

Telesurgery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 3.29 billion |

|

Revenue forecast in 2033 |

USD 8.87 billion |

|

Growth rate |

CAGR of 15.20% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast data |

2026 – 20303 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Intuitive Surgical; Sina Robotics & Medical Innovators Co.,Ltd; Asensus Surgical US, Inc.; SS Innovations International Inc.; RIVERFIELD Inc.; Siemens Healthcare; MicroPort; Sovato Health, Inc.; LIVSMED, INC; CMR Surgical Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |