eClinical Solutions Market growing at a CAGR of 15.07% from 2026 to 2033

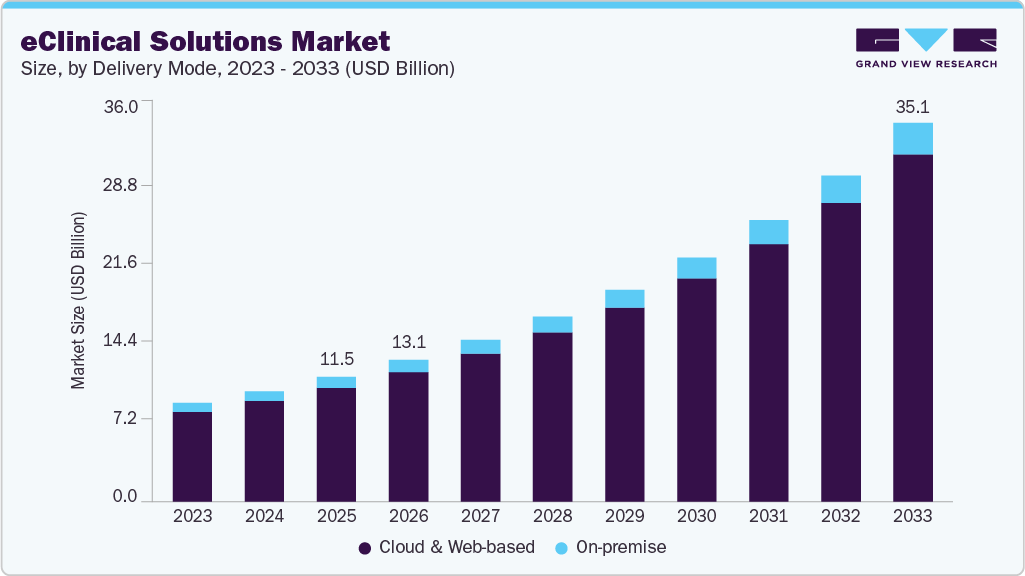

The global eClinical solutions market size was estimated at USD 11.53 billion in 2025 and is projected to reach USD 35.08 billion by 2033, growing at a CAGR of 15.07% from 2026 to 2033. Increasing research and development activities by biopharma and pharma companies is one of the key trends boosting market growth.

Key Market Trends & Insights

- The North America eClinical solutions industry dominated the global market and accounted for the largest revenue share of 48.56% in 2025.

- The eClinical solutions market in the U.S. held the largest share in 2025.

- Based on product, the CTMS segment dominated the market and accounted for the largest revenue share of 20.36% in 2025.

- Based on delivery mode, the web and cloud-based segment dominated the market in 2025.

- Based on end use, the CROs segment dominated the market and held the largest revenue share in 2025.

- Based on development phase, the Phase III segment dominated the market and accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.53 Billion

- 2033 Projected Market Size: USD 35.08 Billion

- CAGR (2026-2033): 15.07%

- North America: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/eclinical-solutions-market/request/rs1

Moreover, the growing incorporation of software solutions in clinical trials is projected to lead the market growth. The increasing outsourcing and externalization of clinical trials by the majority of the prominent pharmaceutical and biotechnological companies is presumed to be responsible for driving the market at an unprecedented rate throughout the forecast period.

The increasing outsourcing and externalization of clinical trials by the majority of the prominent pharmaceutical and biotechnological companies is presumed to be responsible for driving the market at an unprecedented rate throughout the forecast period. Drug development is of utmost importance as it enhances the capabilities in clinical data management, electronic data capture, data conversion, and standardization, as well as statistical programming and data reporting. The rising inclination of major pharmaceutical companies toward these services is also presumed to be a direct consequence of reduced demand for internal staff, enhanced cost-efficiency, efficient management of resources, and production of lucrative & unbiased results in clinical trials, which further widens the scope of growth.

The decentralization of clinical trials significantly increases the number of clinical trials. A July 2022 study by the Tufts CSDD, conducted in collaboration with biopharmaceutical companies and contract research organizations (CROs), examined the impact of decentralized clinical trials (DCTs) and hybrid trial models on sponsor-CRO collaborations. The research highlighted a notable increase in global drug trials incorporating DCT components between 2020 and 2022, with expectations for further growth in the years to come. Key challenges to implementing DCTs include inconsistencies in data standards and regulations, data privacy concerns, and technical validation requirements for health apps and wearable devices.

Furthermore, regulatory compliance and data security requirements are key drivers of growth in the eClinical solutions market. Clinical trials generate large volumes of sensitive patient and trial data, making adherence to regulations such as FDA 21 CFR Part 11, GDPR, HIPAA, and ICH-GCP essential. Sponsors and CROs increasingly rely on advanced eClinical platforms to ensure secure data capture, storage, and transfer, while maintaining audit trails, electronic signatures, and role-based access controls. The growing complexity of multi-country trials, coupled with stricter oversight by regulatory authorities, has accelerated the adoption of cloud-based, validated, and compliant solutions. By providing robust compliance frameworks and data protection mechanisms, eClinical technologies reduce regulatory risk, enhance trial integrity, and build stakeholder confidence, thereby fueling market growth..

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the eClinical solutions market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The industry is experiencing high innovation owing to the rapid evolution of digital health technologies and the growing demand for more efficient clinical trial processes. Numerous players introduce new AI-integrated products to optimize trial design, patient recruitment, and real-time monitoring. For instance, in March 2024, PhaseV announced that it would demonstrate AI/ML-powered clinical trial design and analysis capabilities at the CMO Summit 360°.

Product Insights

The CTMS segment dominated the market for eClinical solutions and accounted for the largest revenue share of 20.36% in 2025. The rapid growth of healthcare IT, along with a preference for decentralized clinical trials, initiatives by key industry players, and a rising number of clinical studies, is expected to fuel market growth. Government initiatives and investments by biotechnology and pharmaceutical firms are driving medical research activities. Combined with technological advancements, these factors are expected to propel market growth. For example, in October 2023, the Advanced Research Projects Agency for Health (ARPA-H), a U.S. Department of Health and Human Services (HHS) agency, announced plans to enhance the country’s ability to conduct clinical trials rapidly, safely, and equitably. This initiative aims to promote technological advancements and insights to establish a robust national clinical trial infrastructure, thereby fostering the adoption of CTMS and strengthening the market growth.

The ECOA segment is expected to be the fastest-growing segment during the forecast period, owing to the rising significance of high-quality clinical data. ECOA facilitates preservation of overall quality and is being increasingly incorporated in the measurement of patient-reported, clinician-reported, and observer-reported outcomes. The data capture process using eCOA platforms enhances the quality of information captured, streamlines data collection procedures, and facilitates effective data analysis.

End Use Insights

The CROs segment dominated the market and held the largest revenue share in 2025. The segment is projected to rise at a remarkable CAGR during the forecast period, owing to the growing inclination of pharmaceutical companies to reduce overall expenditure. The rising usage of eClinical solutions in research is further widening the scope of segment growth. The benefits associated with outsourcing clinical trials to CROs are a key factor in the segment’s heightened growth. These benefits include cost advantages, increased service efficiency, enhanced productivity, and a greater focus on core areas of development critical to a company’s growth.

eClinical Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 13.13 billion |

|

Revenue forecast in 2033 |

USD 35.08 billion |

|

Growth rate |

CAGR of 15.07% from 2026 to 2033 |

|

Historical data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2033 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, delivery mode, development phase, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; Sweden; Denmark; Japan; China; India; South Korea; Australia; New Zealand; Taiwan; Hong Kong; Singapore; Thailand; Vietnam; Brazil; Argentina; Chile; South Africa; Saudi Arabia; UAE; Qatar, Egypt |

|

Key companies profiled |

Datatrak International, Inc.; Oracle; Parexel International Corporation; Dassault Systèmes; Bioclinica; CRF Health; ERT Clinical; eClinicalWorks; IBM Watson Health; Anju Life Sciences Software; eClinical Solutions; Maxisit; IQVIA; Castor; Veeva Systems; RealTime Software Solutions, LLC; Medidata Solutions, Inc.; ICON, plc. Companies offering AI integrated eclinical Solutions Deep 6 AI (acquired by Tempus on March 12, 2025); Phesi; Curebase; Saama; Suvoda LLC (merged with Greenphire in April 2025); Cencora Pharmalex (acquired by AmerisourceBergen Corporation in January 2023); Clinion; Jeeva Clinical Trials Inc.; Trial Interactive by TransPerfect. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |