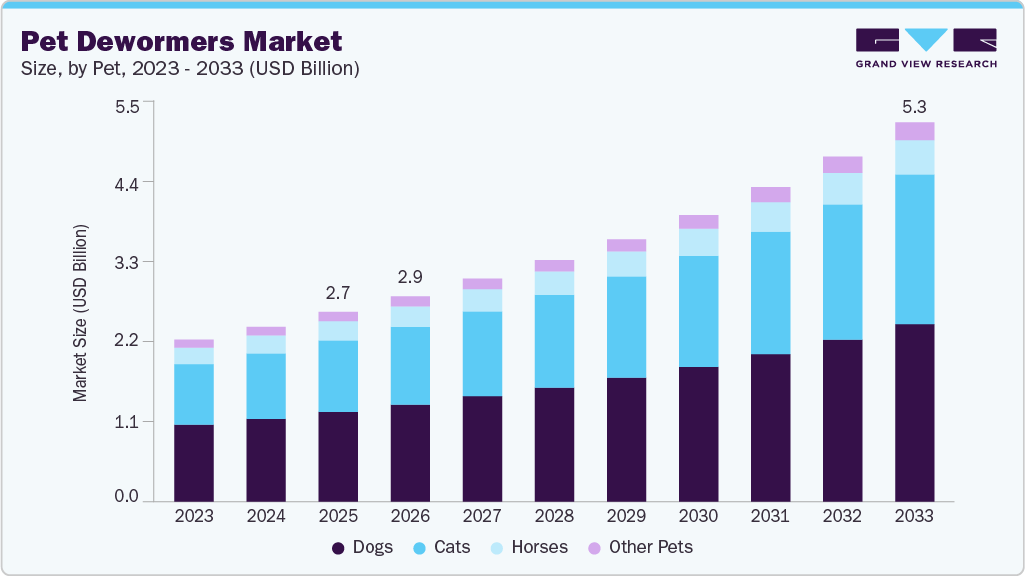

Pet Dewormers Market growing at a CAGR of 9.2% from 2026 to 2033

The global pet dewormers market size was estimated at USD 2.65 billion in 2025 and is projected to reach USD 5.32 billion by 2033, growing at a CAGR of 9.2% from 2026 to 2033. The market is experiencing growth driven by rising pet ownership, increasing awareness of zoonotic and gastrointestinal parasite risks, and growing adoption of preventive veterinary care.

Key Market Trends & Insights

- North America pet dewormers market held the largest revenue share of 35.19% in 2025.

- U.S. pet dewormers market dominated with largest revenue share in 2025.

- By pet, the dogs segment held the largest share of 47.49% in the market in 2025.

- By type, the prescription segment dominated the market with a revenue share of 64.23% in 2025.

- By route of administration, the oral segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.65 Billion

- 2033 Projected Market Size: USD 5.32 Billion

- CAGR (2026-2033): 9.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/pet-dewormers-market-report/request/rs1

Enhanced focus on pet health, humanization of pets, and availability of advanced, broad-spectrum deworming products further support market growth. The increasing global burden of parasite-borne diseases is driving demand for pet dewormers, as continuous parasite prevention becomes essential for pet health. According to 2024 Companion Animal Parasite Council (CAPC) data, heartworm prevalence is highest in Mississippi (1 in 15 dogs) and elevated across southern states, while 1 in 200 cats tested positive in high-risk areas such as Texas and Louisiana. Tick-borne diseases, including Lyme disease, affect 1 in 6 dogs in West Virginia, with anaplasmosis impacting 1 in 3 dogs in Maine and Vermont, and ehrlichiosis affecting 1 in 6 dogs in Arkansas. Flea exposure is widespread, affecting 1 in 4 cats and 1 in 7 dogs, making year-round preventive care crucial. The 2025 CAPC forecast highlights the Southeast as a heartworm epicenter, with northward spread along the Mississippi River and Atlantic coast, prompting veterinarians to recommend routine testing and year-round deworming even in traditionally low-risk regions. This has increased demand for broad-spectrum dewormers that combine heartworm, intestinal, and ectoparasite protection, with monthly or long-acting solutions such as Elanco’s Credelio Quattro supporting consistent preventive care and market growth.

In addition, tighter regulations on antiparasitic products are reshaping the pet dewormers market by emphasizing safety, resistance management, and veterinarian-led parasite control. For instance, in January 2024 legislation in parts of Europe mandates a physical veterinary examination before dispensing Prescription-Only Medicines-Veterinarian (POM-V), including most flea and worming treatments, limiting unsupervised repeat use and increasing demand for professional consultations. This shift favors premium, broad-spectrum, and combination dewormers that comply with guidelines, supporting higher per-pet expenditure and stable prescription-driven demand. Regulatory alignment with professional bodies such as AAEP and ESCCAP promotes diagnostic testing, record-keeping, and resistance monitoring, enhancing adherence and expanding associated veterinary services. Consequently, the market is moving toward a value- and compliance-focused growth model, ensuring long-term stability while addressing public health and drug-resistance concerns.

Market Concentration & Characteristics

The pet dewormers market is moderately concentrated, dominated by major global players such as Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, and Ceva Santé Animale, which leverage extensive product portfolios, strong R&D capabilities, and established veterinary and retail networks. These companies focus on broad-spectrum, combination, and innovative formulations to maintain market leadership. Regional and local players, particularly in emerging markets such as India and Latin America, compete through cost-effective products and localized distribution. Market concentration is reinforced by regulatory barriers, brand trust, and veterinary partnerships, favoring established firms while gradually enabling niche entrants in specialized segments.

The pet dewormers market demonstrates a high degree of innovation, driven by the development of broad-spectrum, combination, and long-acting formulations that target multiple internal and external parasites simultaneously. Companies are introducing palatable oral chewables, flavored liquids, topical gels, and medicated collars to improve compliance and ease of administration. Advances in preventive protocols, emergency regulatory approvals, and veterinary-guided diagnostics further support innovative product adoption and differentiation in the market.

Mergers and acquisitions in the pet dewormers market are moderate, primarily focused on portfolio expansion, geographic penetration, and acquisition of innovative technologies. Leading companies such as Zoetis, Elanco, and Merck Animal Health actively acquire smaller firms or niche product lines to enhance their broad-spectrum and combination dewormer offerings. M&A activities also target emerging markets and specialty segments, strengthening distribution networks and accelerating market growth.

Regulations significantly shape the pet dewormers market by enforcing safety, efficacy, and resistance management standards. Prescription-only requirements, mandatory veterinary examinations, and adherence to guidelines from bodies including AAEP and ESCCAP ensure controlled use of broad-spectrum and combination dewormers. Regulatory oversight limits unsupervised OTC sales, increases reliance on veterinary consultations, and encourages diagnostic testing and record-keeping. These measures enhance product compliance, promote responsible parasite control, and support long-term market stability while addressing public health and drug-resistance concerns.

Substitutes in the pet dewormers market include natural or herbal antiparasitic remedies, home-based preventive measures, and non-pharmaceutical interventions such as improved hygiene, regular grooming, and environmental parasite control. While these alternatives offer mild protection, they generally lack the efficacy, spectrum, and regulatory approval of conventional chemical dewormers. As a result, their impact is limited, and they mainly complement rather than replace veterinary-prescribed or OTC deworming products.

Regional expansion in the pet dewormers market is driven by rising pet ownership, urbanization, and growing awareness of zoonotic diseases in emerging markets such as India, Brazil, and parts of the Middle East & Africa. Leading companies such as Zoetis, Elanco, and Merck Animal Health are increasing distribution through veterinary clinics, retail chains, and e-commerce platforms to capture these high-growth regions. Tailored, cost-effective products and localized marketing strategies further support market penetration and sustained regional growth.

Pet Insights

The dogs segment accounted for the largest market share of 47.49% in 2025, due to higher parasite exposure, broader preventive care adoption, and rapid innovation in canine-specific parasiticides. Dogs face frequent contact with internal and external parasites through outdoor activities, social interactions, and environmental exposure, driving demand for routine deworming. Advanced combination products, such as Elanco’s Credelio Quattro launched in September 2025, offering broad isoxazoline protection against fleas, ticks, heartworm, and intestinal worms, and FDA-approved long-acting Bravecto Quantum injectable in July 2025, have strengthened canine preventive care. Moreover, dogs exhibit higher gastrointestinal parasite prevalence globally, ranging from under 10% to 85% in stray and shelter populations, including zoonotic species like Toxocara canis, Ancylostoma, and Echinococcus, further reinforcing frequent, broad-spectrum deworming and solidifying dogs as the largest revenue-generating segment in the market.

Pet Dewormers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 2.87 billion |

|

Revenue forecast in 2033 |

USD 5.32 billion |

|

Growth rate |

CAGR of 9.2% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Pet, route of administration, dosage form, type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Spain; Germany; Portugal; Romania; Slovakia; Czech Republic; Hungary; Poland; Italy; Ireland; UK; France; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait |

|

Key companies profiled |

Zoetis; Boehringer Ingelheim; Merck & Co., Inc.; Elanco Animal Health; Dechra Pharmaceuticals PLC; Virbac; Vetoquinol; Hester Biosciences Limited; Ceva Santé Animale; Intas Pharmaceuticals Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |