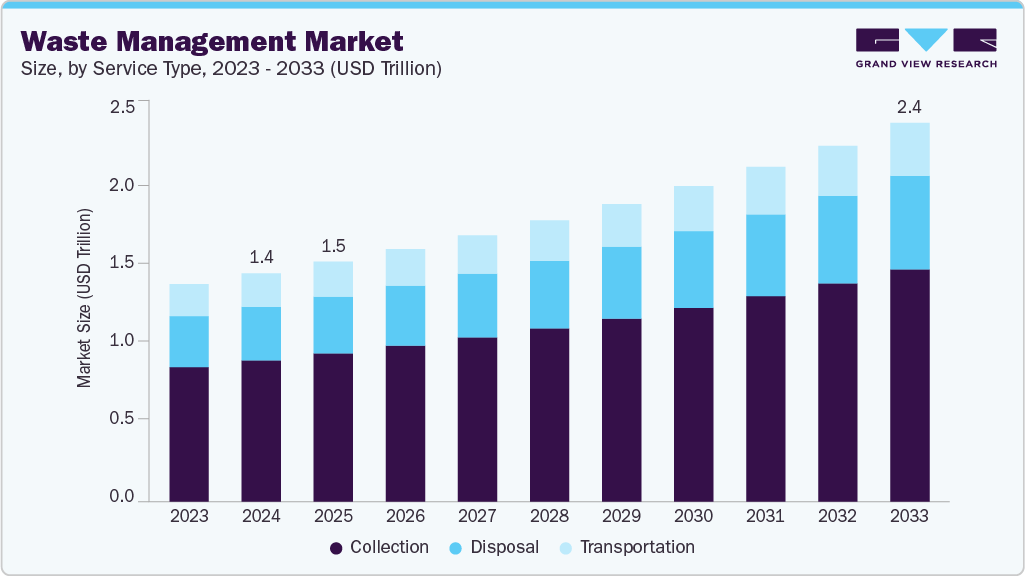

Waste Management Market growing at a CAGR of 6.0% from 2026 to 2033

The global waste management market size was estimated at USD 1,497.17 billion in 2025 and is projected to reach USD 2,365.14 billion by 2033, growing at a CAGR of 6.0% from 2026 to 2033. Rapid urbanization, population growth, and changing consumption patterns are the primary growth drivers.

Key Market Trends & Insights

- North America dominated the waste management market with the largest revenue share of 33.2% in 2025.

- The U.S. waste management industry dominates North America, driven by high waste generation and a well-developed service infrastructure.

- By service type, the disposal service segment is expected to grow at a considerable CAGR of 6.5% from 2026 to 2033 in terms of revenue.

- By waste type, the E-waste segment is expected to grow at a fastest CAGR of 8.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 1,497.17 Billion

- 2033 Projected Market Size: USD 2,365.14 Billion

- CAGR (2026-2033): 6.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/global-waste-management-market/request/rs1

Rising municipal solid waste volumes, higher use of packaged goods, and shorter product life cycles are pushing governments and private players to expand collection and processing capacity. Another key growth driver for the waste management industry is the expansion of the healthcare, industrial, and electronics sectors, which generate complex waste streams that require specialized treatment. Growth in medical facilities has increased demand for compliant medical waste handling, while industrialization is boosting volumes of hazardous and non-hazardous industrial waste. The rapid rise in electronic consumption is accelerating e-waste generation, creating opportunities for recycling and material recovery.

Market Concentration & Characteristics

The waste management market is moderately fragmented, with a mix of large multinational operators and a broad base of regional and local service providers. Major players tend to dominate long-term municipal contracts, hazardous waste treatment, and capital-intensive facilities such as landfills and waste-to-energy plants. However, collection and transportation services remain highly decentralized, especially in emerging economies, where small and mid-sized operators play a critical role.

The waste management industry is moving beyond basic collection and disposal toward technology-led and data-driven operations. Digital monitoring, automation, and advanced sorting systems are improving efficiency across the value chain. Large operators are investing heavily in innovation, as seen in initiatives by SUEZ, which focuses on digital solutions, circular economy models, and advanced recycling to manage complex waste streams. These developments are gradually reshaping the industry, although adoption remains uneven among smaller players.

Regulation has a strong and direct influence on industry operations, shaping how waste is collected, treated, and disposed of. Governments are enforcing stricter landfill norms, emissions limits, and recycling targets, which raise compliance costs but also create demand for organized services. Extended producer responsibility and medical waste rules are pushing more waste into formal channels. Regulatory stability often determines long-term investment in treatment infrastructure.

End user concentration is moderate, with demand spread across municipalities, healthcare facilities, industrial producers, and commercial establishments. Municipal bodies account for a large share of service contracts, typically through long-term agreements that provide revenue stability. Industrial and healthcare users add complexity through specialized waste streams and compliance needs. This diversified customer base helps balance demand but increases the need for customized services.

Drivers, Opportunities & Restraints

Rising urban populations and higher waste generation rates are the core drivers of the waste management market. Governments are increasing spending on organized collection, treatment, and disposal to meet environmental and public health goals. Stricter regulations on landfill usage and emissions are accelerating the shift toward recycling and waste-to-energy solutions. Growth in healthcare, industrial activity, and consumer electronics further adds to complex waste volumes.

Opportunities are expanding in advanced recycling, waste-to-energy projects, and formal e-waste processing. Digitalization of collection and transportation creates scope for cost reduction and service optimization. Public-private partnerships are opening long-term revenue streams, especially in municipal and industrial waste segments. Material recovery from plastics, metals, and electronics is improving profitability and circular economy adoption.

High capital investment for treatment facilities and waste-to-energy plants remains a key restraint. Regulatory compliance and permitting delays can slow project execution and raise operating costs. Informal waste handling in developing regions limits the growth of organized players. Volatility in recycled material prices also affects margins and investment decisions.

Waste Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 1,576.2 billion |

|

Revenue forecast in 2033 |

USD 2,365.14 billion |

|

Growth rate |

CAGR of 6.0% from 2026 to 2033 |

|

Historical data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, waste type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; UAE; South Africa. |

|

Key companies profiled |

WM Intellectual Property Holdings, L.L.C.; Suez; Valicor; Veolia; Waste Connections; Republic Services; Biffa; CLEAN HARBORS, INC.; Reworld; DAISEKI CO., Ltd.; Stericycle, Inc.; Casella Waste Systems, Inc.; CECO ENVIRONMENTAL; Cleanaway; GFL Environmental, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |