Healthcare Digital Signage Market growing at a CAGR of 13.6% from 2023 to 2030

The global healthcare digital signage market size was estimated at USD 5.82 billion in 2022 and is estimated at USD 15.21 billion in 2030, growing at a CAGR of 13.6% from 2023 to 2030. The growth is expected to be driven by the growth of the healthcare industry across the globe.

Key Market Trends & Insights

- North America accounted for the highest revenue share of 34.3% in 2022.

- The Asia Pacific region is anticipated to grow at the fastest CAGR of 14.3% from 2023 to 2030.

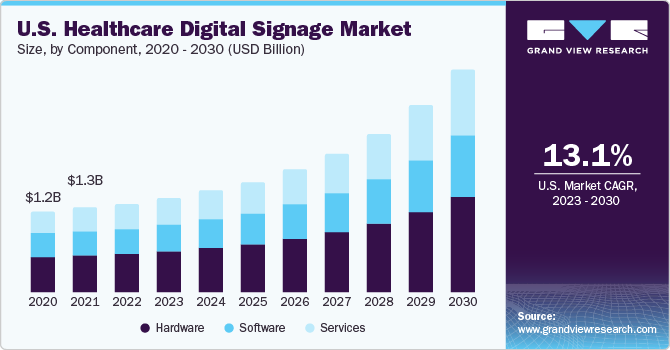

- Based on component, the hardware segment dominated with a revenue share of 44.7% in 2022.

- Based on display type, the LCD segment dominated with a revenue share of 44.3% in 2022.

- Based on type, the video-walls segment dominated the market with a revenue share of 23.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 5.82 Billion

- 2030 Projected Market Size: USD 15.21 Billion

- CAGR (2023-2030): 13.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/healthcare-digital-signage-market-report/request/rs1

As per a study conducted by Delloite, the aggregate count of healthcare investment transactions between the United States and global markets reached its zenith in 2018, amounting to 196 deals with a collective worth of USD 26.1 billion. These facilities require effective communication tools to disseminate information, educate patients, and enhance the overall patient experience. Digital signage provides a dynamic and engaging platform for delivering important messages and information within healthcare facilities.

Furthermore, with the growth of the industry, there is a greater need for efficient and effective communication between healthcare providers and patients. Digital signage can be used to display important announcements, directions, wait times, and other relevant information, improving communication and reducing confusion for patients. Additionally, Digital signage can contribute to this by creating a welcoming and informative environment for patients. It can display personalized messages, educational content, and entertainment options, making the waiting areas more engaging and reducing perceived wait times.

Digital signage can help reduce hallway congestion by providing a clear and efficient way to communicate important information. Instead of relying on traditional methods like paper signs or verbal communication, digital signage can display real-time updates, directions, and announcements, allowing staff, patients, and visitors to quickly and easily access the information they need. This can help prevent overcrowding in hallways as people can find the information they need without gathering in one area. Such benefits associated with digital signage are propelling the adoption within the hospital industry.

Component Insights

Based on component, the market is classified into hardware, software, and services segments. The hardware segment dominated with a revenue share of 44.7% in 2022. The segment is anticipated to be driven by the growing demand for remote management and maintenance within the healthcare industry. The hardware focuses on developing displays that can be remotely managed and monitored, reducing the need for on-site maintenance and troubleshooting. This remote management capability ensures that displays are always up-to-date, minimizing downtime and improving the overall efficiency of digital signage systems.

Healthcare businesses often require assistance implementing and integrating healthcare digital signage systems into their infrastructure. Service providers offer expertise in system configuration, data migration, and integration with other business systems, such as ERP or CRM. This support ensures smooth implementation and minimizes disruptions to healthcare operations. Additionally, they provide insights, best practices, and industry expertise to improve efficiency, reduce costs, and enhance patient experience. The services segment is anticipated to grow at the fastest CAGR of 15.0% from 2023 to 2030.

Display Type Insights

Based on display type, the market is classified into LCD, LED, and OLED segments. The LCD segment dominated with a revenue share of 44.3% in 2022. LCDs are relatively cost-effective compared to other display technologies, such as LED or OLED. This makes them a popular choice for healthcare facilities that require multiple displays across various locations within their premises. The cost-effectiveness of LCDs allows healthcare providers to implement digital signage solutions within their budget constraints. LCDs have a long lifespan and are known for their reliability. This is crucial in healthcare environments where displays may be subjected to constant use, handling, and cleaning. The durability and reliability of LCDs ensure that they can withstand the demands of the healthcare industry and provide consistent performance over time.

Healthcare Digital Signage Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 6.23 billion |

|

Revenue forecast in 2030 |

USD 15.21 billion |

|

Growth rate |

CAGR of 13.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 – 2021 |

|

Forecast period |

2023 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Component, display type, type, location, display size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico;United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Panasonic; LG Electronics; Philips; Samsung Electronics; Sony; Sharp Electronics; Daktronics; Elo Touch Solutions; Cisco Systems; Keywest Technology |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |