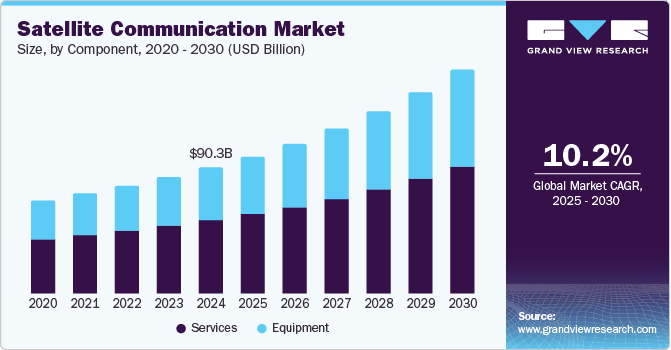

OLED Market growing at a CAGR of 19.4% from 2024 to 2030

The global OLED Market size was estimated at USD 45.95 billion in 2023 and is projected to reach USD 152.83 billion by 2030, growing at a CAGR of 19.4% from 2024 to 2030. The market represents a significant sector in consumer electronics and display technology, providing advanced display solutions for various applications.

Key Market Trends & Insights

- The Asia Pacific OLED market dominated the global industry in 2023 accounting for the largest revenue share at 34.9%.

- The OLED Market in China held the largest share of 22.5% in 2023.

- By product, the OLED display segment dominated the market and accounted for the largest revenue share of 73.2% in 2023.

- By technology, the AMOLED segment dominated the target market and accounted for the largest revenue share of 78.2% in 2023.

- By panel type, the rigid panel type segment held the largest share of 45.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 45.95 Billion

- 2030 Projected Market Size: USD 152.83 Billion

- CAGR (2024-2030): 19.4%

- Asia Pacific: Largest market in 2023

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/oled-market-report/request/rs1

The organic light-emitting diode (OLED) technology involves the use of organic compounds that emit light in response to an electric current, enabling the creation of high-quality, energy-efficient displays with superior contrast ratios and vibrant colors. This technology is widely adopted in various consumer electronics applications, such as smartphones, tablets, televisions, and wearable devices, as well as in automotive displays and lighting solutions.

The market growth is driven by factors, such as high demand for high-resolution displays, advancements in flexible & foldable screen technology, adoption of smart devices, and the need for energy-efficient & environmentally friendly display options. In addition, continuous innovation in OLED materials and manufacturing processes is expected to accelerate market growth further, enhancing both the performance and affordability of OLED display products. The rapid adoption of OLED displays in smartphones has been a key driver in the market growth. Smartphone manufacturers are increasingly turning to OLED technology due to its numerous advantages over traditional LCD screens, such as higher contrast ratios, faster response times, and better color reproduction. OLED displays also offer thinner and more flexible designs, allowing for innovative smartphone form factors and improved durability.

Furthermore, there is a high demand for better viewing experiences, particularly from smartphone and television consumers. Consumers expect high-quality displays that deliver vibrant colors, sharp images, and smooth motion. OLED technology meets these expectations by offering superior picture quality and an immersive viewing experience. The deep blacks and rich colors produced by OLED displays make content come alive, whether it’s watching movies, playing games, or browsing photos. The demand for better viewing experiences is further fueled by the increasing popularity of high-resolution content, such as 4K and HDR video. OLED displays are well-suited to showcase these formats, providing crisp detail, enhanced contrast, and vivid colors that elevate the viewing experience to new heights.

Market Concentration & Characteristics

The degree of innovation in the OLED market is high. Manufacturers continually introduce advancements, such as flexible, transparent, and foldable OLED displays to meet evolving consumer demands for sleeker, more adaptable devices. Research efforts focus on enhancing color accuracy, brightness, and energy efficiency, resulting in vibrant displays with deeper blacks and extended battery life. Beyond traditional applications, OLEDs find use in lighting and wearable electronics, showcasing the market’s innovative trajectory. Integration of AI further drives innovation, enhancing picture clarity, color refinement, and audio quality for immersive viewing experiences. Gaming-focused OLED TVs feature high refresh rates, NVIDIA G-SYNC certification, and AMD FreeSync compatibility, ensuring smooth gameplay. AI-powered personalization and accessibility enhancements cater to diverse consumer preferences, highlighting the market’s commitment to innovation. For instance, in May 2024, LG Electronics introduced its latest lineup of AI-powered televisions featuring OLED and QNED technology, ranging from 43-inches to 97-inches. These TVs boast advanced AI features for improved picture quality and sound, gaming innovations, personalized user experiences, and enhanced accessibility and connectivity options, catering to a wide range of consumers. Thus, the market continues to evolve with ongoing technological advancements and AI integration, shaping the future of display technology.

The market experiences a high level of product launches, with manufacturers constantly introducing new and innovative offerings to meet consumer demand. These launches often showcase advancements in display technology, such as improved picture quality, enhanced brightness, and increased resolution. In addition, manufacturers frequently unveil new form factors, including flexible, foldable, and transparent OLED displays, expanding the range of applications for OLED technology. Product launches in the market also focus on incorporating cutting-edge features like AI integration, advanced sound processing, and gaming-specific enhancements to cater to diverse consumer needs and preferences. Major players in the industry regularly announce updates to their product lineups, introducing models with larger screen sizes, sleeker designs, and enhanced functionality. The competitive nature of the target market drives continuous innovation, prompting manufacturers to strive for excellence in product development and launch.

OLED Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 52.84 billion |

|

Revenue forecast in 2030 |

USD 152.83 billion |

|

Growth rate |

CAGR of 19.4% from 2024 to 2030 |

|

Actual data |

2017 – 2023 |

|

Forecast period |

2024 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, panel type, display size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Taiwan; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Samsung Electronics; LG Electronics; Sony Corp.; AU Optronics Corp.; BOE Display; IPG Automotive; Robert Bosch GmbH; TDK Corp.; Rit Display; Visionox; eMagin Corp.; Universal Display Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |